Authors:

Monty Turner, Colliers Site Selection and Economic Incentives Practice Group Leader

Don Moss, Colliers Industrial Service and Economic Incentives Practice Group

In the landscape of incentives, 2023 marked an intriguing chapter characterized by shifts in investment patterns and job creation dynamics. In this new blog series, professionals can gain valuable insights into the state of economic development and anticipate the trajectory for 2024 based on 2023 data and trends. We will also cover regional and industry trends in the upcoming blog posts.

Key Highlights of 2023 Incentives

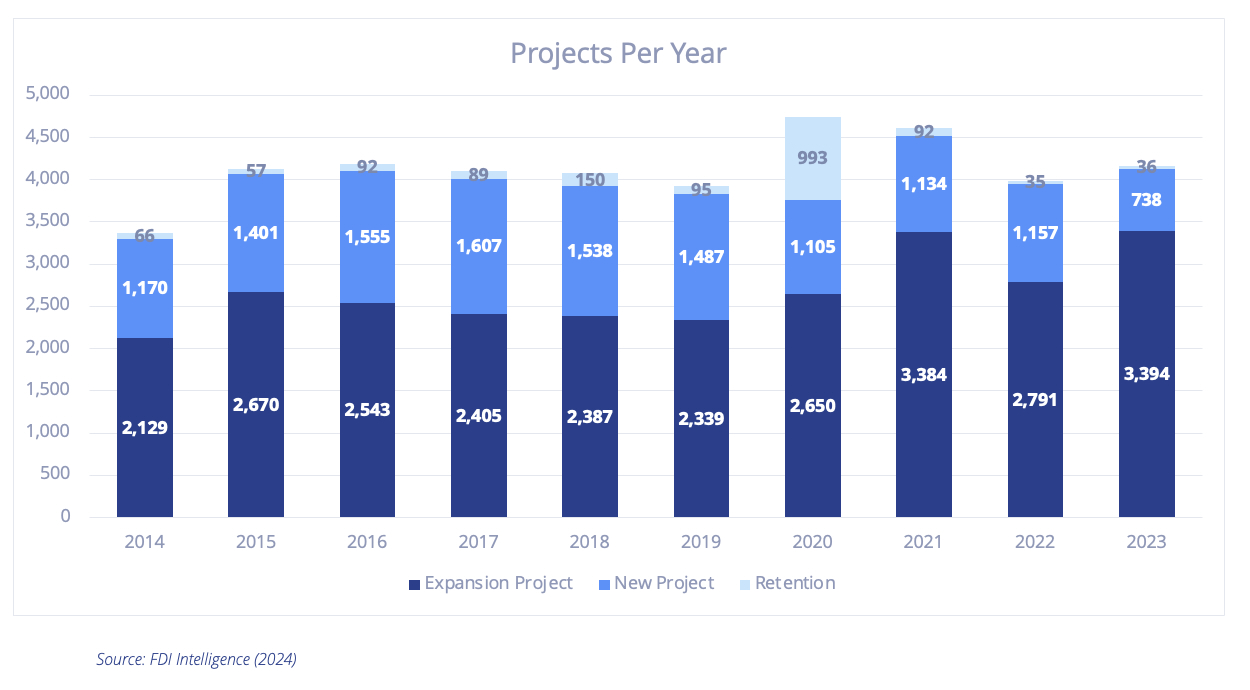

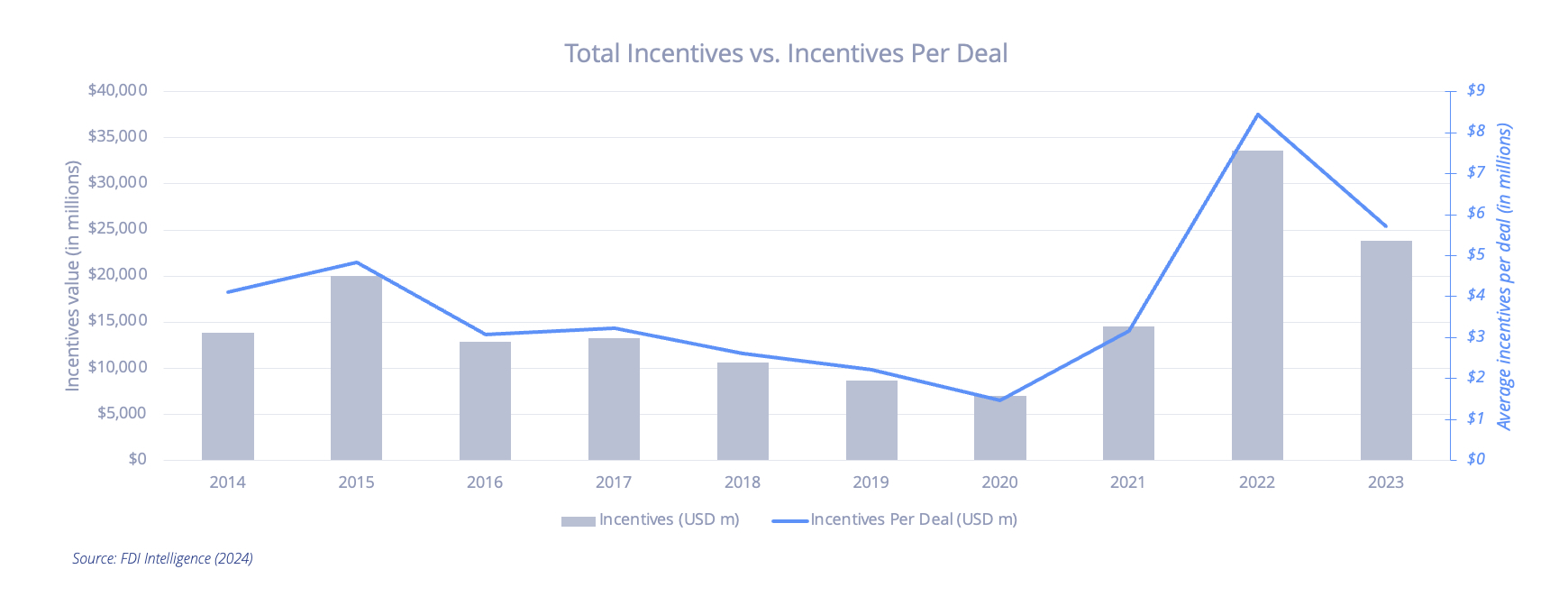

Despite a slight increase in total projects compared to the previous year, figures remained below the peaks observed in 2020 and 2021. There was a remarkable surge in expansion projects, reaching unprecedented levels in the past decade, with 4,168 total incentive deals recorded, and 738 new projects initiated, showcasing sustained commitment to investing in fresh ventures. The cumulative value of these incentives stands at $23.84 billion, providing substantial financial support to businesses.

New projects continue to see the majority of incentives having received on average $20 million in incentives per deal, reflecting the desire at the local, state, and federal levels to support business development activities. Comparatively, expansion projects were able to secure roughly $2.5 million per project. Moreover, these incentives facilitated the creation of around 433,000 new jobs, with an average incentive of approximately $50,221 per new job. Additionally, over 170 different incentive programs were utilized, reflecting a diverse array of approaches employed to encourage business activities.

Trends in 2023

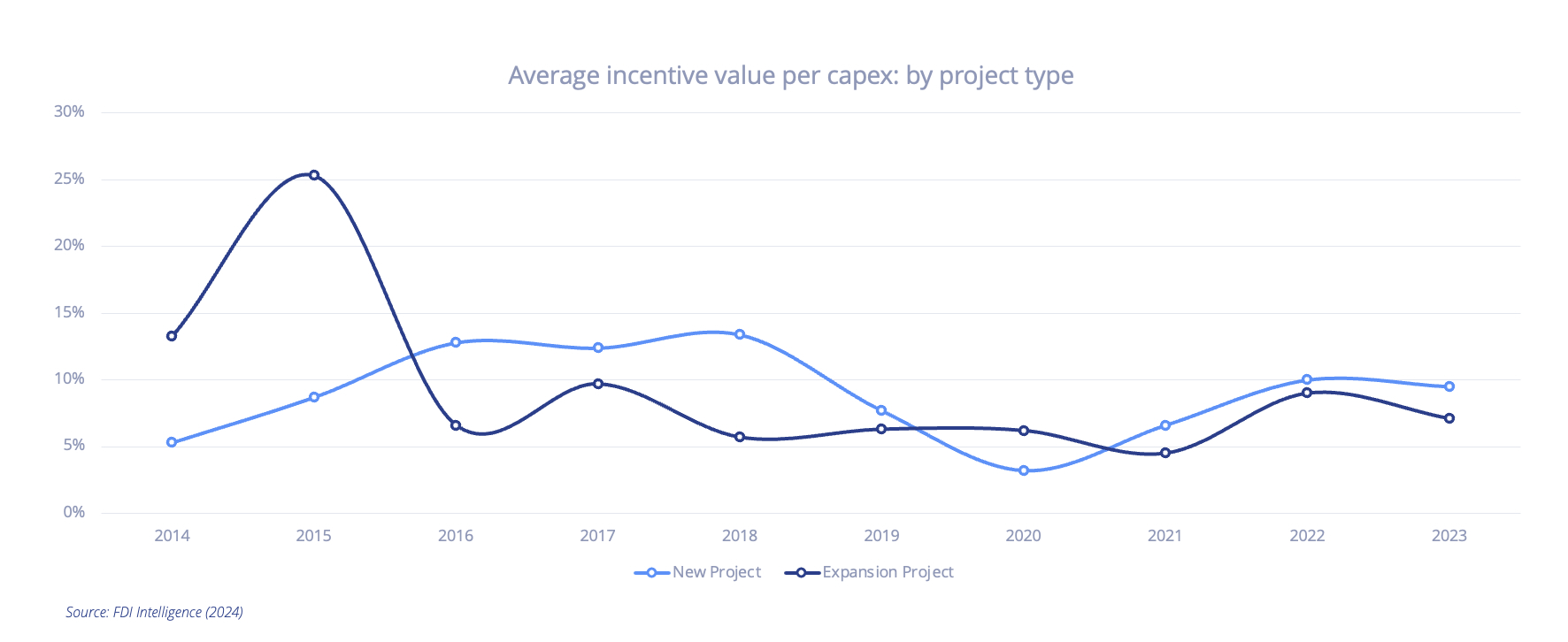

Although ranking as the second-highest year for total incentive value and average incentives per deal in the past decade, there has been a notable downward trend in new job creation since 2021. Nonetheless, 2023 witnessed the second-highest dollar value per new job, down slightly from a ten-year high in 2022, marking a sustained desire to support job growth and economic investment. We anticipate this trend will continue as companies seek to onshore operations or “friendshore” supply chains with geopolitical allies. Moreover, the average incentives value per capital expenditure for new projects remained stable at just under 10% in 2023, signaling consistent support for emerging ventures amidst the fluctuating economic landscape.

Anticipated Trends for 2024:

As we head into the second quarter of 2024, here are several key trends that are poised to shape the landscape this year:

- Manufacturing investment is expected to remain robust.

- Projects backed by proven technologies and strong balance sheets are likely to thrive, whereas speculative ventures relying heavily on federal funding may face challenges.

- Continued constraints on suitable land for mid- and large-scale projects are anticipated, especially for projects with robust utility and infrastructure needs. Electricity remains an increasingly scarce resource.

- States will take a larger role in development with funding geared towards site readiness.

- Availability of skilled labor remains a large factor in a location decision.

- The rise of Artificial Intelligence will continue to impact operations, workforce requirements, space and site utilization, and energy usage.

- The forthcoming 2024 election is expected to influence decision-making, particularly for projects reliant on federal support, amid a broader trend towards onshoring or nearshoring to mitigate geopolitical risks.

The landscape of business incentives is ever evolving, shaped by economic forces, regulatory environments, the geopolitical climate, and election cycles. As we reflect on the trends witnessed in 2023 and project forward to 2024, it’s evident that businesses navigating this terrain must remain adaptable and strategic in their decision-making processes. By staying attuned to emerging trends and leveraging available incentives, organizations can position themselves for sustainable growth and resilience in an increasingly complex global landscape.

Monty Turner

Monty Turner

Patrich Jett

Patrich Jett

Patrick Duffy

Patrick Duffy

Anjee Solanki

Anjee Solanki