Net effective rents: Where the rubber meets the road

Effective negotiations for an office lease require a thorough understanding of the underlying economics of the transaction. Great deals are not only found but also negotiated.

There are several factors that can impact the terms an office tenant and his broker can negotiate such as:

- The tenant’s attractiveness to the landlord and negotiation leverage

- Size and creditworthiness of the tenant

- Market conditions and the buildings position within the marketplace

- Timing and positioning of the negotiations

- The overall negotiation skills of the participants involved

Having the financial skills to measure the impact of various economic components on the value of the lease and to quantify the landlord’s effective rental rate is a valuable tool.

By viewing the lease from the landlord’s perspective, you can relatively simply benchmark the landlord’s projected return and measure the impact of various changes in financial components of the lease on the landlord’s bottom line. In essence, the landlord’s “effective rental rate” is the net profit level from the lease before the building’s debt payments expressed on a square foot basis.

Anatomy of the effective rental rate

Understanding how landlords pro forma their buildings is important. They have to project their effective rental rates. This is what is left over to service the debt on the building and provide a return to the building investors. To determine their projected effective rent structure, they look at:

- Market rental rates for comparable buildings: What can they charge?

- Operating costs: What does it cost to operate the building?

- Transaction costs: Tenant improvements, commissions, free rent

In simple terms, it is a calculation of all the projected inflows and outflows of cash from leasing and operations. They project vacancy periods for unoccupied space, but they basically target an effective rent structure that forms a basis for leasing decisions.

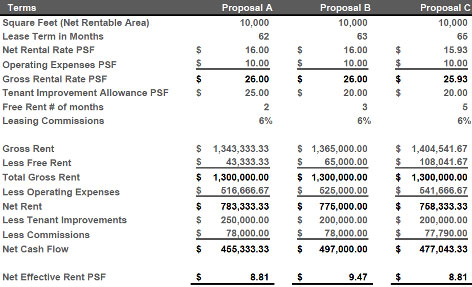

For illustration purposes, below I present the calculation of the landlord’s net effective rent for three sets of leasing terms without using discounted cash flow analysis to take into consideration the time value of money based on the timing of cash flows. In practice, we use discounted cash flow models, which is an even more thorough analysis.

(CoyDavidson.com)

To put this calculation into the context of a negotiation, let’s assume Proposal A is the landlord’s initial proposal. You will notice a proposed tenant improvement allowance of $25.00 per square foot. After some preliminary space planning and construction pricing, you determine you can reasonably expect to renovate the space to fit your needs at the cost of $20.00 per square foot. Your broker goes back to the leasing agent and proposes the terms outlined in Proposal C. However, the landlord responds to your offer with the terms outlined in Proposal B. The analysis tells me the landlord has not given me equal monetary value for giving up $5.00 per square foot in tenant improvement allowance, and there is still money on the table. Therefore, negotiations continue.

Comparing effective rental rates among various proposals and to other transactions in the building is an excellent indicator of achievable terms. Rarely do two lease transactions, even with identical rental rates, yield the same return to the landlord.

Effective rental rates are where the rubber meets the road. By utilizing this analysis, you can more closely pinpoint the landlord’s bottom line and prevent leaving money on the negotiation table.

Coy Davidson is Senior Vice President of Colliers International in Houston. He publishes The Tenant Advisor blog.

Coy Davidson

Coy Davidson

Colliers Insights Team

Colliers Insights Team

Beth Young

Beth Young