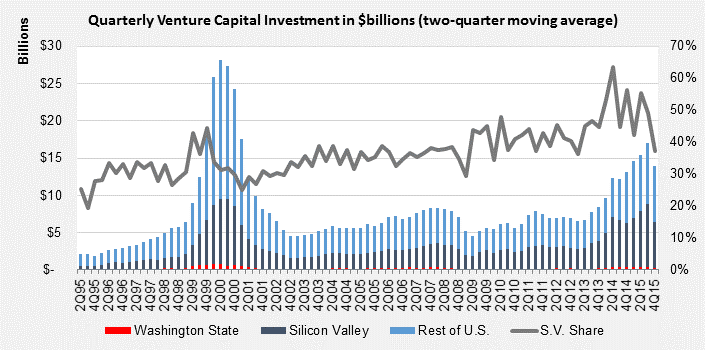

Are we starting to feel some tremors in the once-unshakeable San Francisco Bay Area tech market, or are we seeing a healthy recalibration? Figures from PwC/NVCA MoneyTree based on data from a Thomson Reuters report show that while venture capital funding in the San Francisco Bay Area was up 7.5% year-over-year in 2015, there was a sharp 47.2% decrease from the third to fourth quarter. In fact, the $4.3 billion total in the fourth quarter was the lowest figure in two years. The number of deals (264) was also down about 25% from the previous quarter and year.

Plus: From ashes to opportunity: the 8 mile view on the Detroit Market | Wall Street slides: less worrying than they seem

Even unicorns (in the parlance of tech, a unicorn is a start-up company valued at over $1 billion) are feeling the pain. In a 2015 year-end report by law firm Fenwick & West, the use of IPO protection terms that provided investors not only with downside protection, but also a premium on the unicorn price, increased compared to their prior survey. The average premium was 60% of the unicorn price. The sharp decline in tech stock prices earlier this year have only exacerbated the concern.

Also: Keeping score on connectivity in commercial real estate | Will technology replace commerial real estate brokerage?

The aggressive valuations investors had pinned on many startups are being reevaluated and portfolios are being culled. Many investors are now pressing startups to retool their business or shut down – which is in many ways a positive business decision that contrasts the “keep throwing money at anything that has a prefix of e- or a suffix of .com” approach of the late 1990s. In addition, although the Bay Area’s share of total venture capital has fallen recently, it still remains above its long-term average – and dwarfs all other regions.

Source: PwC/NVCA MoneyTree Report, Data: Thomson Reuters

Greater scrutiny by investors and positive tech employment forecasts signal that we are not in a bubble and there is still plenty of room for expansion in the sector. The State of California Employment Development Department projections out to 2022 forecast 1,868 annual openings due to growth for computer occupations in the San Francisco-Redwood City-South San Francisco metro area and 2,835 annual openings for the San Jose-Sunnyvale-Santa Clara MSA. The unemployment rate in San Francisco County has been stable at 3.3% from December 2015-February 2016 while Santa Clara County’s unemployment rate ended February at 3.8%, nearly unchanged from 3.7% in January.

While asking rent growth for office space is expected to moderate from its record pace over the last couple of years, there is no indication there will be a collapse in the market. With vacancy rates under 1% in many key submarkets in the Peninsula, there would need to be a flood of heavily discounted sublease space hitting the market to move the needle to the point of serious concern. Currently, vacant sublease space in San Francisco represents under 1% of total office inventory (0.7%) – a long way from the 5.1% during the bust at the beginning of the 2000s.

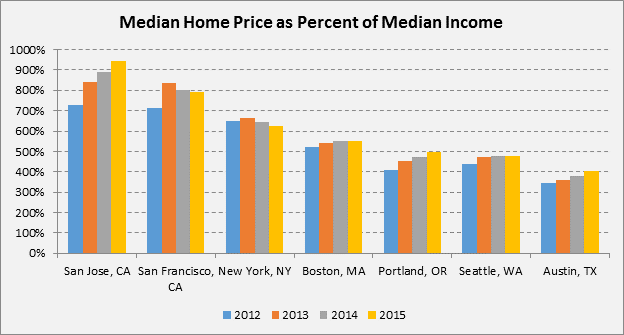

One issue of real concern is the issue of housing affordability in the Bay Area. The median home price as a percent of median income has pushed to between nearly 800% and 1000% in San Jose and San Francisco. While tech firms have been and will continue to pay top dollar for office space in locations that give them access to their desired workforce, the location of that workforce may begin shifting away from San Francisco and the Silicon Valley if affordability pushes them elsewhere. Should the labor pool depart for more affordable markets, the firms will follow – and realize a cost savings on rent themselves.

Source: National Association of Realtors, Moody’s, Colliers International

That being said, there is still substantial strength in the sector fueling these markets, as we have not seen developers shelving projects that are underway and office asking rents continue to lead the country. It is worth monitoring over the next few months – in the unlikely event that the pull-back in venture capital investment accelerates, office development slows and sublease space starts hitting the market at significant discounts, then it may be time to dust off the life jackets. Though we’ve seen a number of recent articles racing to be the first to proclaim that the end is nigh, it is generally better to be correct than to be first.

Colliers Insights Team

Colliers Insights Team

Aaron Jodka

Aaron Jodka

Amber Merrigan

Amber Merrigan

Andrew Steele

Andrew Steele