The property sector and the economy overall have benefited greatly from the Fed’s expansionary monetary policies. But the deep wounds from the Great Recession are largely healed, and it’s time to venture out from sick bay and resume normal life on the outside.

Perhaps you heard: The Fed declined to move on interest rates last week — again. Cause for celebration? I’m not so sure — despite the undeniable benefits of low interest rates for the real estate sectors.

Real estate assets and property investors especially have clearly gained both directly and indirectly from the Fed’s accommodative monetary policies since 2009. Directly, because the Fed’s policy of holding short-term interest rates near zero has enhanced the relative attractiveness of property investment and minimized debt costs for acquisition. And indirectly, because property demand has grown — if not quite surged — as the economy slowly, slowly recovered, juiced by the low interest rates and so-called quantitative easing. And more indirectly, because Fed policies attendant to Dodd-Frank legislation reduced construction lending by banks, thereby limiting new supply on the market with all this additional demand being funneled into existing buildings. Finally, even more indirectly, the superior risk-adjusted returns commanded in the property sector over the past half decade have helped legitimize real estate as an appropriate alternative investment class for institutional investors, again bolstered by the anemic returns being offered by traditional investment assets due to the Fed’s artificially low interest rates.

The combination of growing demand and limited supply, all while holding down returns of competing asset classes, has been just the recipe for exceptionally strong real estate investment returns since 2009, even if property performance — rent growth and occupancy levels — have been relatively weak by historical standards for expansion periods. Apartments were the first to recover as the mortgage crisis forced many households out of their homes and into rentals, at just the same time that changing demographic and consumer preferences favored multifamily rentals. For the other sectors, however, this expansion has been more of a slog. The industrial sector is just now getting back to prior peak levels — some seven years after the prior peak — while office and retail sectors may not reach their prior peaks before the next recession begins.

Nonetheless, these have been banner years for property returns, with the five-year returns as measured by NCREIF among the highest ever recorded. One reason for the strong returns even when property fundamentals have been weak? We’re seeing more of a “winners-versus-losers” dichotomy in this recovery, where the rising tide is not necessarily lifting all boats, and the quality of institutionally-owned properties properties tends to be higher than average. These better assets are capturing a disproportionate share of tenant demand, lifting their income returns. But the bigger reason for the strong investment performance is that investors are flooding into the property sector, driving up prices and augmenting returns.

No doubt, it has felt good. But we’ve been in this easy-money mode for so long that we forget just how unusual it is, both for its duration and extent.

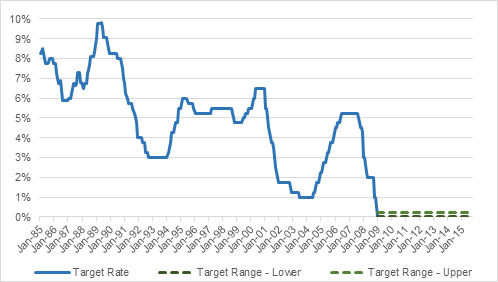

The Fed actually began its accommodative monetary policy way back in September 2007 — a full year before the Lehman collapse — dropping the Federal Funds Target Rate by 50 basis points to 4.75 percent, followed by two more 25 basis-point drops in late 2007, before an unprecedented 125 basis-point drop in January 2008 — and then four more drops until the rate effectively hit 0 percent in December. The Fed replaced the Federal Funds Target Rate with the Federal Funds Target Range, with specified lower and upper limits, in December 2008. So, technically there is now a range of 0 percent to 0.25 percent. For perspective, the Fed had gone down to 1 percent only once, for the year starting July 2003. And typically the Fed holds interest rates low for only 12 to 18 months. This time, the Fed has held the target rate at effectively 0 percent for 82 months and counting (see chart below). Our near-zero inflation rate is only a small part of the explanation.

(Federal Reserve Bank)

So, this is uncharted territory on many levels, and we’ve perhaps gotten too used to the drug that was supposed to help us get through the sickness, to change metaphors. But now we need to wean ourselves off the medication. The economy is certainly strong enough to support higher interest rates and has met the ever-expanding checklist of metrics the Fed is said to consider. But mostly, it’s just time to get back to a more normal state of economic affairs.

And yet, the markets fret about this rate hike. The consternation is not about the impact of this one rate hike, of course. The expected 25 basis-point hike by itself could hardly alter many investment decisions beyond the narrow world of bond and currency traders. And, of course, the Fed’s target rate directly affects only rates for depository institutions. The change in rates ultimately charged to consumers and business borrowers varies considerably and typically is less.

Rather, investors are alarmed by what this move portends for future rate hikes. Rate increases are supposed to be like cockroaches: There’s never just one. When the Fed last initiated rate hikes in June 2004, the initial 25 basis-point hike was followed by 16 more identical hikes for a total of 425 basis points over the course of two years, as the Fed’s target rate rose from 1.00 percent to 5.25 percent, where it remained for more than a year. That tightening cycle was extreme. On average, the Fed raises rates between 250 and 300 basis points once they start down that path.

But there’s ample reason to believe that this time is different, in terms of both pace and near-term magnitude. The Fed has made it abundantly clear — at least by the notoriously opaque standards of “Fed speak” — that they intend future hikes in this cycle to be very gradual and data-dependent. And with inflation probably the Fed’s weakest indicator, there’s little evidence of that the economy is overheating overall. So, there’s little reason for a very restrictive tightening cycle.

Then why raise at all? Beyond the fact that the economy has largely met the metrics outlined by the Fed, including job growth, unemployment and economic growth, several additional reasons stand out for why the Fed should move now.

First, it’s better to move early than late. As with pain management, it’s easier to prevent pain than alleviate it. There seems little risk of a rate hike causing the economy to stall at this point, certainly not with the modest 25 basis-point hike thought to be under consideration.

Second, despite the lack of general inflation, there is growing evidence of asset bubbles for equities and hard assets like real estate. The prudent course is to nip those bubbles in the bud rather than wait until it’s sky high. Moreover, the markets expect the move. So, pricing already largely reflects anticipated rising interest rates. Waiting further is only introducing more uncertainly.

Finally and perhaps most importantly, the Fed needs to put some arrows back in its quiver so that it has ammunition to fight the next recession. Yes, I believe this expansion still has a bit more road to run. Still, there’s no doubt that this growth cycle is getting old by historical standards, and the Fed must be ready to fight the next inevitable downturn.

And the justification for waiting? More data? The biggest shortfall among the Fed’s metrics has been the anemic wage growth, but jobs markets have tightened sufficiently in recent months that wage gains seem all but inevitable. Fears of triggering a debt crisis in other countries? Maintaining economic strength in foreign countries is well beyond the Fed’s twin mandates to ensure maximum employment and stable prices, except to the extent that it impacts the U.S. economy. And weakness in emerging economies cannot be reasonably expected to undercut our recovery given trade’s small share of our economy.

So pick your metaphor: Rip off that Band-Aid. Take back the crutches. Start weaning off the medication. We’re ready to start the process of normalizing monetary conditions.

Maybe next month.

Colliers Insights Team

Colliers Insights Team

Anjee Solanki

Anjee Solanki