The U.S. economy continued to inch back towards pre-pandemic levels during the first quarter. The accelerated rate of vaccine distribution, the distribution of fiscal stimulus packages and the static level of daily new cases of COVID-19 encouraged economic growth as pent-up demand resulted in increased brick-and-mortar sales and overall consumer sentiment. With consumer spending plunging for services yet rising for durable goods, this further positions the industrial sector to benefit from shifting trends following the pandemic. While not completely out of the woods yet, we can finally see the light at the end of the tunnel in hopes of a return to some semblance of normalcy in the coming months.

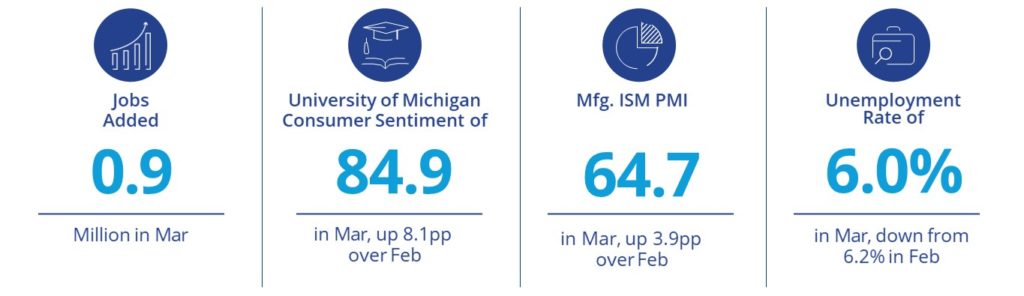

March economic indicators were positive, providing optimism for further economic expansion. According to the Bureau of Labor Statistics, the economy added another 916,000 jobs in March, to edge the employment rate down to 6.0%, down significantly from its April 2020 peak, yet still 2.5 percentage points higher than its pre-pandemic level in February of 2020. Job growth in March was widespread, with the largest job gains occurring in leisure and hospitality (+280,000), education services (+190,000), construction (+110,000) and professional and business services (+66,000). Other sectors directly impacting the industrial market also showed positive momentum as job gains were also seen in manufacturing (+53,000), transportation and warehousing (+48,000) and wholesale trade (+24,000).

In March, consumer sentiment also rose month-over-month, reaching its highest level in 12 months, largely due to the pandemic relief payments received in January. According to the University of Michigan Consumer Sentiment Index, most consumers reported hearing of recent gains in the national economy, mainly net job gains, and the data clearly point toward robust increases in consumer spending during the year ahead. Consumer sentiment measured 84.9 in March, up considerably from 76.8 in February.

As the forces driving economic recovery expand, Americans continued to drive retail spending. U.S. retail sales surged 9.8% month-over-month in March as federal stimulus checks and easing public health measures led to a strong first quarter finish. The increase marks the best growth since May 2020 and the second strongest single-month performance on record since 1992. The critical bar and restaurant industry saw a 13.4% surge, thanks to relaxed restrictions in many parts of the country. Sporting goods spending was the highest percentage gainer at 23.5%, followed by clothing and accessories at 18.3% and motor vehicle parts and dealers at 15.1%. These retail figures should encourage demand for warehouse distribution space in the coming months, as all signs point to higher consumer willingness to spend, given the continued growth of e-commerce. According to the U.S. Department of Commerce, e-commerce accounted for a total of 14% of retail sales in 2020, up from 11% in the previous year.

Manufacturing production continues to grow at a faster rate than expected, with the output growing for the 10th consecutive month. The Institute for Supply Chain Management’s Production Manufacturing Index (PMI) registered 64.7 in March, up 3.9 percentage points from February’s reading of 60.8. Wide-scale shortages of some critical basic materials, and their overall rising costs, could slow the production growth rate soon. Yet, the strength of the manufacturing sector is not expected to contract. Persistent demand will keep production pipelines full and manufacturing industries operating at maximum capacity for the duration of the year.

Overall, these economic readings point to a strong recovery in market fundamentals that impact industrial real estate. Continued growth in e-commerce, brick-and-mortar sales (especially bars and restaurants) should fuel the sector in the months to come and translate demand for industrial space into new leasing activity and continued robust construction. With low vacancy in many industrial markets, new builds will continue to surge to meet occupiers’ industrial space needs.

U.S. National Research

U.S. National Research

Chris Zlocki

Chris Zlocki

Adam Schindler

Adam Schindler