Last month, the Colliers Logistics & Transportation Solutions (L&T) Group hosted a conference in Charleston, South Carolina. The three-day event was a convergence of industrial leaders, and explored the latest emerging markets, supply chain trends and more. Here’s a summary of the key learnings and insights from the presentations, sessions and panels that took place.

Alleviating Port Congestion is Top Priority

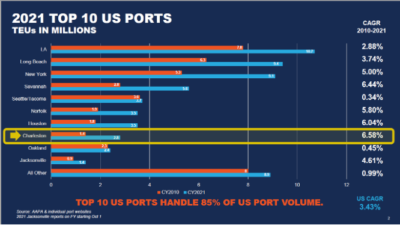

South Carolina Ports Authority (SCPA) has invested more than $2 billion in recent years to enhance port infrastructure as bigger ships and larger amounts of cargo arrive at the Port of Charleston, which is the fastest growing U.S. port and is ranked at 8th in the top 10 U.S. ports in terms of volume.

Barbara Melvin CEO effective July 1, SCPA, discussed new strategies to address import congestion at the country’s largest ports. The shift to ecommerce and steady consumer demand has pushed volume projections higher than expected. Currently, there are zero ships anchored outside of Charleston, but keep in mind there is one million TEU of imports in transit or stuck on the water, representing 3% of annual U.S. imports (30 million TEU).

Inland waterways and inland ports are increasingly vital in moving cargo quickly, especially for retailers that are working to keep up with ecommerce demands. Utilizing smaller vessels to move through rivers and lakes has been one solution to the congestion at the top ocean ports.

In addition, all U.S. ports have been working through the country’s chassis shortage. SPCA has opened its own pool with 11,000 chassis to help with fluidity. This crucial piece of equipment is difficult to get because they are manufactured overseas, and the shortage intensely affects the output of port-dependent industries.

Key Economic Indicators to Watch

The supply chain is a series of ripple effects. Understanding how one event or shift will impact the next is key to minimizing disruptions. KC Conway, Principal and Co-founder of Red Shoe Economics, explored various economic markers and how they are affecting the industry.

The labor market remains tight in the industrial and manufacturing sectors, with 11.5 million open jobs. This is especially impacting the trucking industry as trucking wages keep going up, Walmart is offering up to $110,00 a year, and will continue to get more competitive as big retailers gear up for back-to-school and holiday shopping.

The South saw more than 10% increase in population, specifically along the I-85 corridor. Taxes are affecting population migration as well as the 10 lowest-ranked states in the 2022 State business tax climate index were California, New York, and New Jersey. He predicts inland ports and strong rail connectivity will remake the supply chain and reconfigure the supply chain to move from South to North rather than West to East.

Additionally, increased industrial development is seeing the NIMBY Principle come into effect in more markets like the Inland Empire. The region is nearing a breaking point as it’s running out of space, but residents are pushing back against the encroachment into their neighborhoods.

Consumer confidence is hitting a decades-long low and will continue to be burdened with rising prices.

New build prices have doubled in the last five years due to the price of materials, a cost that will get passed down to consumers. On a global scale, Conway noted one third of the normal wheat production was not planted in Russia, so prices will likely increase by 20% when it hits the shelves.

What’s Next for the Sector?

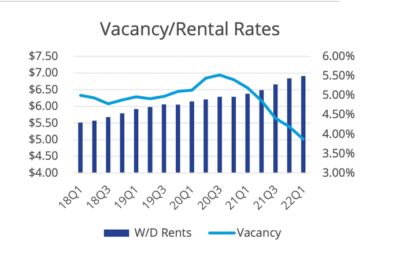

2022 is looking like a banner year for industrial development, according to Amanda Ortiz, Colliers National Director of Industrial Research. She reports that rents will keep increasing at record pace as the breakneck speed of the market will continue.

This highly competitive market is pushing demand into secondary markets. In response, 3PLs are expected to expand at a higher rate in efforts to expand their distribution footprint into these new and emerging markets, including Salt Lake City, Las Vegas and Charleston.

As vacancy remains low and developable land grows in scarcity, Ortiz expects multi-story facilities and tear-down/re-developments to rise. Some examples of these tear-down/redevelopment projects include old shopping centers, revamping existing industrial, etc. There is such insatiable demand that developers, as well as users are willing to get creative.

Brewster Smith, Colliers Senior Vice President, Supply Chain Solutions, presented his insight into what’s next for manufacturing. Specifically, he foresees an increase in Midwest manufacturing hubs as dependence on container ports decrease. He noted the public sector is making new investments in manufacturing that will encourage companies to reshore their manufacturing operations.

Questions? Reach out to Chloe Heiligenstein.

Colliers Insights Team

Colliers Insights Team

Craig Hurvitz

Craig Hurvitz

Aaron Jodka

Aaron Jodka