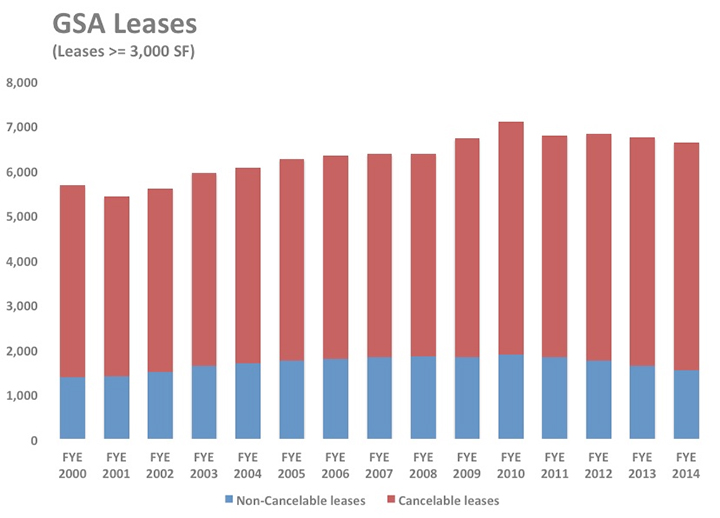

Despite increasing congressional pressure to improve the number of long, firm-term leases, GSA and its tenant agencies have proven that they are not yet serious about weaning themselves from their addiction to termination rights. As measured from the leasing peak in 2010 (note that some of the leases in that year are due to short-term Census leases), the number of cancelable leases remains nearly unchanged. Yet, during that same five-year period, the number of non-cancelable leases (at least 3,000 RSF*) has declined by a little more than 18 percent. The net result is that GSA has been executing a smaller proportion of non-cancelable leases in an inventory that is also shrinking.

Plus: What is scoring? | GSA occupancy of new buildings has dwindled

That unfortunate trend would be mitigated if the leases that were executed achieved longer firm terms. Alas, they are not. In fairness, I have not studied this in detail, but the back-of-the-envelope analysis is as follows: Currently, in the entire United States there are only 129 leases that have remaining non-cancelable terms of 10 years or more. Given that the pileup of GSA lease expirations is such that the agency is executing approximately 1,100* lease actions annually, it is pretty easy to conclude that the process is yielding an exceedingly low volume of long firm-term leases.

Also: New steps for downsizing federal real estate | How open-plan office spaces can fail

The data in the graph above tracks these figures through the end of the 2014 fiscal year (Sept. 30, 2014). So, the trend could potentially improve when we revisit it again at the end of fiscal 2015. Certainly, congressional intervention has ramped up substantially in this past year, and we would expect that to have some influence on federal leasing. Yet, so far this fiscal year (looking at the data available through May 2015), we see only a very slight, half percentage point improvement in the ratio of non-cancelable to cancelable leases.

As we’ve discovered in our recent study of lease expiration dates, there is some “seasonality” to GSA leasing. So, we will revisit this again at the end of the year to determine conclusively if Congress is having any influence over GSA’s leasing activities or if the agency is merely paying lip-service to its legislative branch colleagues.

* Throughout this article we base our analysis on GSA leases that are at least 3,000 RSF in order to improve the focus on traditional leases, eliminating many TSA on-airport leases, storage leases, parking leases and other esoteric leases.

Kurt Stout is the national leader of Colliers International’s Government Solutions practice group, which provides government real estate services to private investors and federal agencies. He also writes about federal real estate on his Capitol Markets team blog. You can contact Kurt by email or on Twitter.

Colliers Insights Team

Colliers Insights Team

Coy Davidson

Coy Davidson

Beth Young

Beth Young

David Abraham

David Abraham