In 1906, Vilfredo Pareto observed that 80 percent of Italy’s land was owned by 20 percent of its population. Eventually this observation was memorialized as the Pareto principle or, more commonly, the “80-20 rule” because of its near universal application to describe many phenomena, such as where 80 percent of a country’s wealth is held by 20 percent of its citizens, where 80 percent of a company’s sales come from 20 percent of its customers, where 80 percent of Internet page views are on 20 percent of websites and so forth. Of course, the ratio isn’t always 80-20, but it is always lopsided such that the data highlight, as Pareto put it, the “predictable imbalance” or the “vital few and the trivial many.”

Plus: Closer look at GSA’s Lease Turnover analysis | CPI has declined, and so has your rent

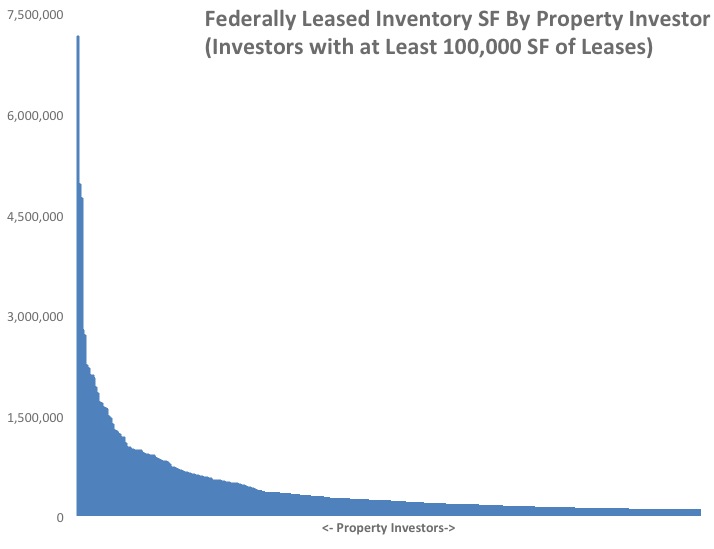

Clearly this is true in federal property ownership. In the graph below, we took 3,848 owners of federal property and graphed the square footage of federal leases they hold in their respective inventories. When we set each of these 3,848 narrow columns cheek by jowl, an area chart in the classic power law shape emerges. Simply put, the power law shape is one that has a very tall spiked “head” at the left side and a long “tail” trailing to the right.

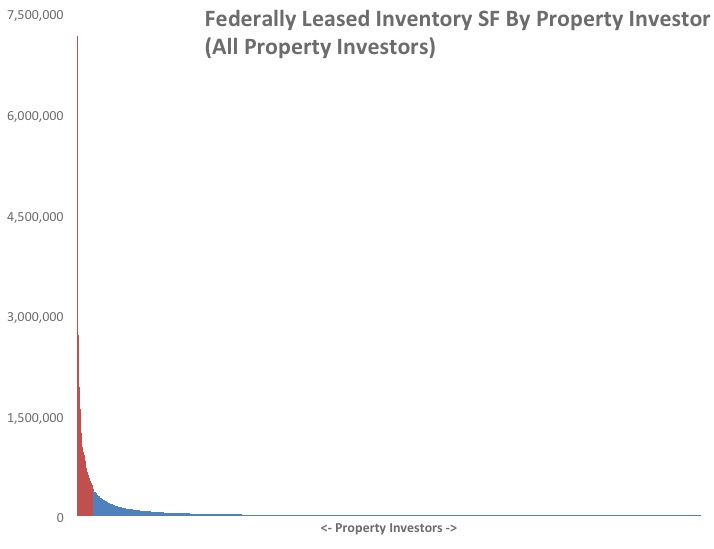

This is the same graph shown at the top of this article except that it is “zoomed out” to show all 3,848 property owners. The 98 property owners shown in red own as much federally leased real estate as all other owners combined. Note that the “tail” to this graph is very long and very, very thin. Two-thirds of property owners hold less than 20,000 SF of federal leases.

Also: Will the rise of megacities be our finest hour? | Six attributes that make a great workplace

This is the Pareto principle at work: the 98 largest owners (just 2.6 percent of all federal property owners*) control as much federally leased real estate as all other owners combined. Even Pareto would find that astonishing.

Astonishing, yes. But what does it mean? Well, a few things:

1. Federal real estate ownership is substantially aggregated. The 10 largest federal property owners hold almost 16 percent of all federally leased properties. These, the “vital few,” will by and large remain a pretty small group. The reason for this is that new fund investors are inevitably focused on entering the federal sector through purchases of long-term leased properties. Yet, those investments are increasingly scarce because the new lease-construct projects, which generate the longest initial lease terms, have largely dried up, and each year the remaining term of those projects burns off. Instead, much leasing right now is of the short term, “kick the can” variety. This creates a barrier to entry for new investors who need to lead with long-term leased investments. It is also creating some growth in the head of the trend where many of those investors have already generated portfolios substantial enough that they are able to speculate a bit on more plentiful shorter-term leased investments.

2. For the rest of the pack, catching up to the ever spikier head is also complicated by the fact that the tail is so thin. If you were the 99th largest property owner and wanted to become the largest, you’d have to buy the portfolios of the next 20 property owners (numbers 100 through 119). Of course, that is unlikely, and those portfolios may not be appealing. Aggregating a substantial inventory requires real work, and it favors investors who devote substantial resources to buying properties, often one at a time. It demands sustained focus because there are few shortcuts to the head of the pack.

3. Pareto noted that the 80-20 distribution evolves in large part because the “rich get richer.” This is true in the federal property sector as well, partly for the reasons outlined above and also because the restricted flow of new investors with solid track records provides the lead investors with a marked advantage. In a sector where pricing tends to cluster tightly for stable assets, larger investors’ track records often tip deals their way. Further, among off-market transactions, the reliability of execution offered by the larger investors provides them with one of the precious few seats at the negotiating table. This may not be fair or even rational, given the number of eager buyers out there, yet it is a dynamic that often prevails in the clubby federal sector.

The Pareto principle is here to stay. And as portfolios at the “head” of the power law curve continue to get larger the capital supporting them becomes more institutional. In some respects, this has been good for the sector because it has improved pricing overall. But for sellers, the message is this: There are plenty of qualified buyers out on that long, long tail.

Don’t ignore them.

* We track most owners of federal property of all kinds in the United States. But we centered this analysis largely on a 215 million SF tranche that includes all GSA-leased building owners, along with a slug of properties leased by agencies with statutory or delegated authority. Among the properties we did not include are U.S. Postal Service properties, VA medical facilities and most of the facilities leased “subject to annual appropriations.” However, had we included these, the Paretian distribution and all of this article’s conclusions would have remained very much the same.

Kurt Stout is the national leader of Colliers International’s Government Solutions practice group, which provides government real estate services to private investors and federal agencies. He also writes about federal real estate on his Capitol Markets team blog. You can contact Kurt by email or on Twitter.

Colliers Insights Team

Colliers Insights Team