Companies are beginning to prepare for the recent Financial Accounting Standards Board (FASB) decision to alter the way leases are accounted for on financial statements. It has been my experience that most tenants are aware of the changes, yet they don’t fully understand how this changes their processes. Not only will organizations need to change their lease accounting practices, but they will now be faced with questions regarding strategy and implementation to lower the risk of noncompliance. Understanding why the changes have been made, when compliance is required, what the changes are, and how best to prepare will ensure a seamless transition.

Why is FASB changing their current reporting guidelines?

The Financial Accounting Standards Board, in conjunction with the International Accounting Standards Board (IASB), decided in November of 2015 to move forward with the new accounting guidelines. The new guidelines were put into place with the intention of increasing transparency and comparability within organizations that lease assets. The new standards will make it much easier for investors and lenders to determine the extended financial obligations of companies when providing capital.

When is compliance necessary?

Those who adapt and prepare for the changes as early as possible will not only avoid non-compliance fees, but will save additional time and money spent reviewing statements and manually changing reports one-line item at a time. FASB has allowed organizations to adopt the standards as early as possible to help prepare for looming changes.

How are leases classified under the new standard?

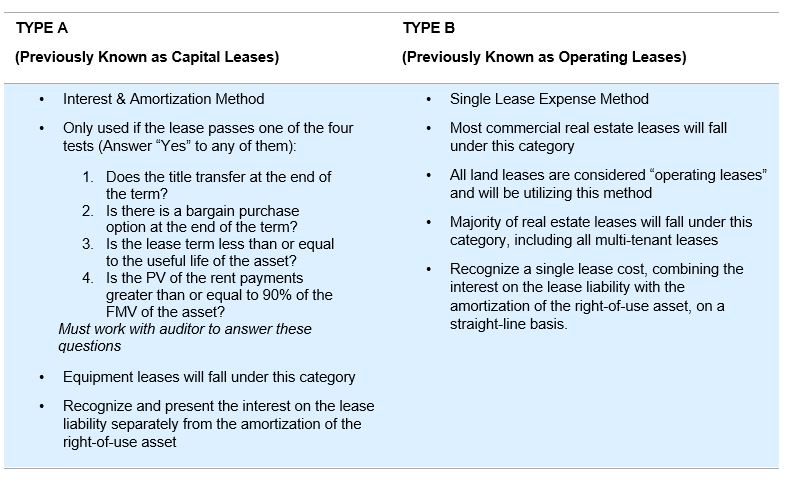

FASB has kept the dual model role that they currently use, separately classifying operating leases from capital leases. There have been some slight modifications, in which they are now referring to them as Type A and Type B leases. For both models, the lessee recognizes the right-of-use asset and a lease liability, initially measured at the present value of lease payments. You must report them separately (as A or B) on your balance sheets to differentiate between an owned facility and a leased facility. Here is a simple clarification on both:

It is important to note that the capitalization method will affect your company’s profitability. It will reduce the company’s return on assets and asset turnover. Because it is also a liability, it affects your liabilities to equities ratio. This all affects what creditors and investors use to evaluate your company and will definitely affect your borrowing rate (discount rate). It will not affect your debt ratio, as the FASB has decided not to classify operating lease liability as debt, therefore not impacting your loan covenants that limit the debt incurred.

How will this affect your existing and new lease negotiations?

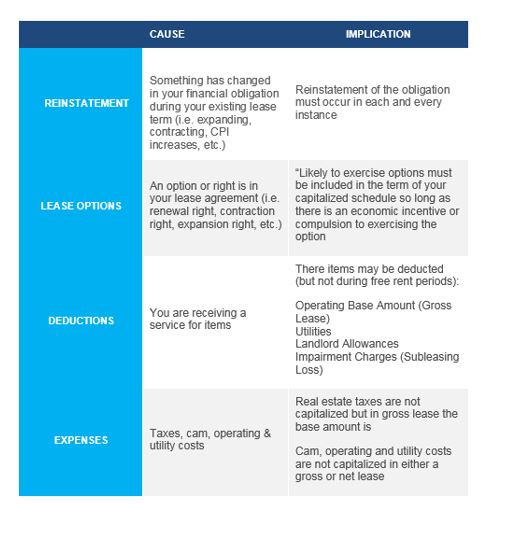

Any leases that expire prior to 2019 will not be held to the new standard. Likewise, any new or existing leases that do not go beyond a 12-month term will not need to be reported. There are many caveats to the new standards, especially related to underwriting Type B leases. A few of those changes and their implications are:

How do you prepare for these changes?

- Evaluate your existing real estate portfolio: Leverage your real estate provider relationship to provide abstraction services, highlighting all significant economic incentives, rights and options. If you have a large portfolio it is best to consider lease administration services, which your real estate provider can provide.

- Consider renegotiating leases now: It doesn’t matter if your leases are up for renewal or not. Landlords are always willing to extend a term if it is in their best interest. Making sure your leases are set for the new standards now will eliminate headaches later.

- Identify the right team to help transition to the new standards: Work with your auditors, accountants and real estate providers to help ease the transition. Understanding what your auditors will be looking for will help you to understand what processes need to be in place.

- Dual Reporting: Begin with a sample set of leases and run the financials with both the existing standards as well as the new ones to determine how much of financial spread there is. This will also help you to determine which leases should be renegotiated prior to the audit period.

Stephanie Bujwit joined Colliers International as a financial analyst with the Office Advisory Group in August 2010. Stephanie consults with clients to optimize their real estate planning, acquisition and disposition strategies by developing comprehensive financial models and conducting market research and mark-to-market analysis. Her work often involves evaluation of real estate alternatives, conducting cost-effective analysis and developing strategies and tactics for lease negotiation, and supporting transaction management and other real estate demands.

Colliers Insights Team

Colliers Insights Team

Aaron Jodka

Aaron Jodka

Amber Merrigan

Amber Merrigan

Andrew Steele

Andrew Steele