Adaptation is the secret to success.

Multifamily has been on a bull run in recent years, sending occupancies and rents to record levels. However, recent geopolitical events, high inflation, and interest rate hikes have spun multifamily into a new state of uncertainty.

The market is changing rapidly. It’s important to understand the challenges facing multifamily today so you can adapt your strategies and prepare for the future. Positioning for success early can also help you take advantage of opportunities that still exist, and will emerge, in the market.

Let’s take a closer look at what got us here.

1. Inflation reached record levels in June.

We’ve all felt the sting of inflation in recent months. Nationwide, consumers are paying more for everyday goods and services like groceries and gas, which topped $5 per gallon in many states.

Stimulus distributed in 2020 and 2021 gave a much-needed boost to the economy, but also fueled inflation. Increased spending and consumer demands, paired with factory closures and supply chain issues, pushed inflation to a 40-year high this summer.

According to the U.S. Bureau of Labor Statistics, the inflation rate from June 2021 to June 2022 peaked at 9.1%. Since then, rates have trended down slowly, landing at 7.7% in October 2022 over the previous year. Compare this to the annual 2-3% increase in a typical year.

2. Interest rates spiked.

Something had to be done to counter inflation, and the Fed responded emphatically – though some could argue their reaction was slow and didn’t consider pent-up demand from the pandemic. Still, Forbes reported four consecutive 75 basis point rate hikes this year, shooting rates up by three full percentage points.

The question looming is at what point will the Fed stop increasing rates? According to Bankrate.com, Bloomberg, and others, Fed officials are divided. Some are calling for additional hikes – setting the terminal rate between 4.75-5% – while others suggest rates could top 5% in 2023. Whatever the peak, based on recent commentary from Chairman Powell, it appears the Fed will be taking a more conservative approach to rate hikes moving forward.

What does this mean for multifamily?

As the cost of capital increases, fewer multifamily investments make financial sense. Many institutional investors are sitting on the sidelines taking a “wait and see” approach. Data from Real Capital Analytics shows a decrease by more than 50% in sales volume in October 2022 compared to October 2021.

Interest rate hikes also pose a serious threat to investors with uncapped bridge loans or variable rates. While recent record rent growth cushioned this threat, rent growth has since declined and no longer protects against rate increases, which have jumped from 2.4-7% in some cases.

3. Expenses are consuming profits.

As if this wasn’t enough, expenses are surging. High insurance premiums and increased wages are squeezing NOIs and putting constraints on multifamily development.

Insurance

Weather-related disasters like Hurricane Ian have prompted steep increases in insurance premiums.

Insurers hit hard with losses are passing the burden to property owners. Premiums for multifamily have increased as much as 40-50% in numerous properties since 2021 and, in some markets, rates have nearly tripled.

Savvy investors have responded with loss prevention strategies to help to secure competitive rates. Showing that a property is proactively taking preventative measures against risk could be the deciding factor in securing a rate that pencils. It’s best to be prepared.

Wages

High inflation and a tight labor market have put upward pressure on wages. Developers have had to increase compensation and strengthen retention strategies just to stay competitive. The NAHB’s latest multifamily market survey revealed that multifamily developers are paying employees nearly 12% more this year than last.

Financial constraints are putting development projects at risk. Due to a nationwide housing shortage, any pullback in construction will further restrict affordability.

Rental rate growth is in it for the long haul.

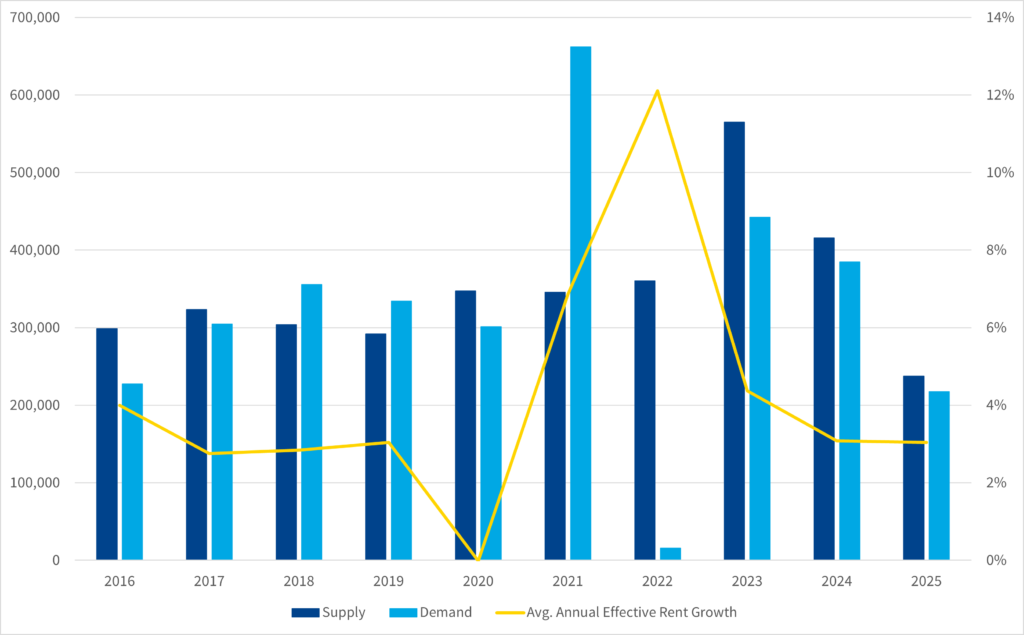

Rental rate growth has dipped recently but is still outperforming pre-pandemic levels. A surge in demand in 2021 helped spike rents higher in 2022. As demand fell, rental rates followed, declining in the third quarter of this year.

Axiometrics projects rental growth to settle back to historical averages over the next two years.

Opportunities exist for buyers and sellers.

As you rethink strategy and prepare for the future, it’s important to stay current on valuations. Understanding market nuances will help you seize the right opportunities. And there’s still plenty of opportunity in the market today for both buyers and sellers.

Let’s start with buyers.

Loan assumptions – particularly assets with attractive debt – offer prime investment conditions for buyers.

More opportunity will also be found in distressed assets. We’re likely to see these assets hit the market as investors with variable-rate debt face loan defaults and foreclosures in the coming months.

Sellers, on the other hand, can cash in on 1031 exchange buyers seeking replacement properties. Given the fundamental need for housing, multifamily assets will always be an investor favorite.

There may also be significant opportunity for sellers from investment groups with captive funds. These groups not only have the capital to deploy, but they are also under pressure to place it or return it to investors.

Multifamily will always be essential.

Multifamily living is an attractive option for many Americans. Forty-four million households currently rely on rental housing, according to a Harvard University rental housing report. Occupancies are strong, and near all-time highs.

There’s a clear need for multifamily housing that isn’t going away. With huge sums of capital just waiting to be deployed and a pipeline of new supply projected over the next two years, the multifamily market can expect a strong return to activity. It’s just a matter of when.

Will Mathews

Will Mathews

Aaron Jodka

Aaron Jodka