Family is coming to stay at your house in three days. That DIY project in the kitchen is still not done. And suddenly, at 11 p.m., you decide to go shopping online to find the perfect kitchen sink. Now, to wait a few days for delivery. But think again: The next day, you simply show up at your local Home Depot, pick up your selected sink and bring it home to install before the in-laws arrive.

Plus: Airport retail comes of age | Retailers go high-end and outlet

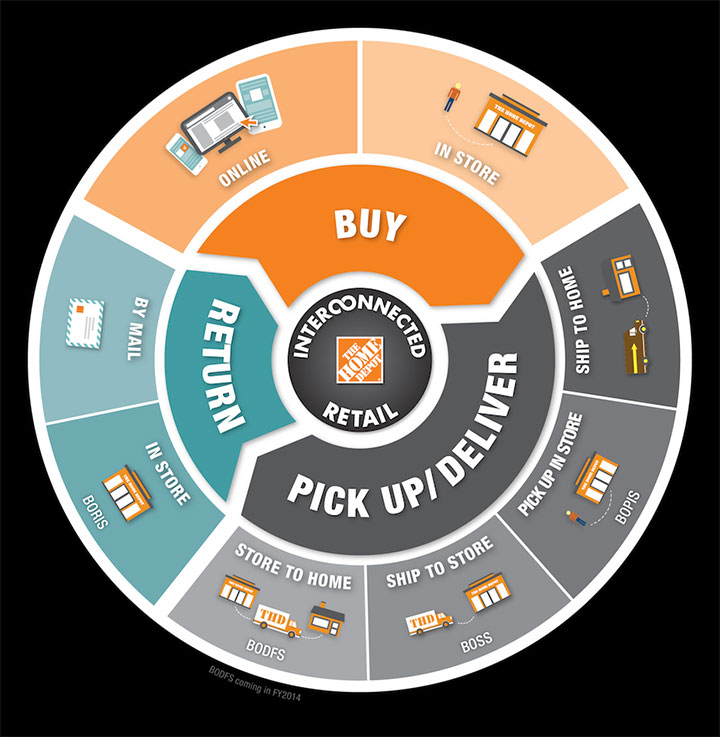

Home Depot is a prime example of a company that is successfully blending its online presence with its brick-and-mortar stores, setting an example for other retailers to follow in a trend that is known as omni-channel retailing: meeting customers online, on mobile devices and in stores.

Also: Getting smarter about wearable tech | Largest shopping malls in the world

It is a trend that goes both ways: While traditional brick-and-mortar stores like Home Depot beef up interconnectivity with online shopping, e-commerce-only retailers (such as Amazon, Warby Parker, Birchbox and Bonobos) are adding brick-and-mortar outlets to further expand the shopping experience.

Home Depot: Quick to adapt

Home Depot is tilting its investments toward interconnected retail and technology and is shifting its advertising dollars to online channels. Like many other companies, it has had to adapt to customers’ changing whims. Today’s tech-savvy shoppers are conditioned to expect choice, personalization and convenience, and companies are starting to deliver as technology changes retail at a rapid pace. Brick-and-mortar retailers like Home Depot have had to adjust to face the threat of e-commerce competitors and to accommodate online shoppers with an interconnected retail strategy. After a slow start, other traditional brick-and-mortar retailers are finally getting into the game.

The most sophisticated brick-and-mortar retailers are investing heavily in shaping the online shopping experience. They’re using e-commerce as a supplement to get customers back into the store. While Target, Kohl’s, JCPenney and other big retailers are struggling, one of Home Depot’s biggest sales drivers is e-commerce. Home Depot uses its stores as distribution centers for shoppers to pick up online orders locally. And once a customer is in the store, he or she will ultimately purchase a second item.

(Builtfromscratch.Homedepot.com)

Omni-channel retailing is producing results for other retailers, too. One statistic they all pay attention to? Slow-loading websites, overly complicated check-out processes and difficulty with mobile purchases cause 30 percent of shoppers to abandon a purchase midstream.

The positive statistics from omni-channel retailing, according to ICSC:

- Omni-channel customers tend to shop more frequently and spend 3.5 times more than single-channel shoppers.

- In-store conversion rates are four times higher than online-only conversion rates.

- For online sales with in-store pick-up and return, retailers can expect a net sale of 107 percent.

- Omni-channel shoppers shop more than those who shop exclusively online or exclusively in-store.

- Conversion rates at brick-and-mortar stores are higher than for online-only sites (20 percent vs. 4.8 percent).

These promising statistics explain why ecommerce-only companies are beginning to invest in brick-and-mortar channels to grow their brands.

Online-only companies open boutiques

Formerly online-only companies like Warby Parker, Birchbox and Bonobos are all opening brick-and-mortar boutiques to increase brand awareness. “We hit a big turning point. We realized offline really works,” said Bonobos co-founder Andy Dunn.

Bonobos raised $55 million last year to give its customers a chance to “try it on before you buy” at one of their Guideshops. A Bonobos customer can make an appointment for a personalized fitting. Shop assistants become more like personal stylists, and orders are taken with iPads and shipped directly to the customers’ homes. Bonobos claims that in-store sales are nearly double the average online purchase. Bonobos is able to build an ever-closer connection with its customers through the integrated service proposition.

(Retail-Week.com)

“We’ve learned that brick-and-mortar isn’t going away, but it is evolving into something more exciting,” said Dunn. “Customer reaction to the model has been overwhelming,”

Rumors started circulating earlier this year that the granddaddy of e-commerce companies, Amazon.com, would be expanding its brick-and-mortar presence. Amazon has experimented with pop-up kiosks and vending machines. Now, Amazon is considering acquiring some of RadioShack‘s stores after the company files for bankruptcy. And in breaking news, Amazon opened its first brick-and-mortar store at Purdue University with a co-branded website. The “Amazon Campus” brick-and-mortar option gives students a quick, inexpensive way to pick up textbook rentals and other products. Amazon plans to open similar stores at the University of Massachusetts and the University of California, Davis.

(Purdue.edu)

Whether it’s the kitchen sink, fancy pants or a college textbook you want, retailers are making it as easy as possible to find them. You’ll get personalized service, maybe an extra discount, and you might just pick up a “few more items” on your way to checkout. Or, you might choose some new outfits and hop off, bag-free, to your dinner engagement and get those clothes delivered right to your door. Whatever way you want to shop, retailers are more than happy to accommodate.

Anjee continues to be an insatiable collector of all things retail. She’s a student of culture living next door to future shoppers, whose fleeting trends constantly change the retail landscape … driving retailers, landlords and developers crazy!

Anjee Solanki

Anjee Solanki

Ron Zappile

Ron Zappile