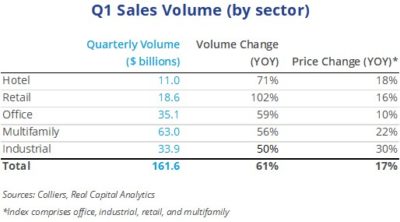

- $161.6 billion traded in Q1, setting a new all-time high.

- Cap rates continue to compress, and prices are still on the rise.

- Office is back ahead of industrial volume year-to-date.

- Industrial pricing has soared 30.1% over the past 12 months.

- Year-over-year volume is up at least 50% across all asset types.

Sales volume did not disappoint in the first quarter, setting a new record, as has been common in recent quarters. A total of $161.6 billion in sales volume bested the previous first quarter high-water mark of $150 billion in 2007 (when Blackstone bought Equity Office Properties). Over the past four quarters, volume reached $861.7 billion, a pace likely to face some headwinds in the months ahead. With interest rates rising, persistent inflation, and geopolitical risks at the forefront, a slowdown would not be a surprise. However, capital is still on the sidelines searching for real estate, so 2022 is due to be another strong year overall.

Office

At $35.1 billion in volume, office sales are ahead of industrial sales year-to-date. This is the typical rank-order of the past — industrial has been running ahead of office sales only in recent quarters. Pricing is up 10.3% year-over-year, with the strongest gains in the suburbs and non-major markets. The surge in life science is a factor. The Manhattan office market made a big return in Q1, with the sale of One Manhattan West (a partial-interest sale, valuing the asset at nearly $2.9 billion) and a three-property portfolio from Silverstein Properties to Extell for $931 million. Other top deals took place in Culver City, CA; Phoenix; and Atlanta.

Industrial

Once late-Q1 deals are accounted for, this is likely to be the strongest first quarter start for industrial on record. RCA reported $33.9 billion in industrial sales volume in Q1, just shy of the $34.5 billion Q1 record in 2019. Price appreciation over the past 12 months is north of 30%, the strongest of all asset classes. Most property types cooled down in Q1, while industrial prices escalated by 6.5% in the quarter. March had several headline deals, but no massive portfolios sold. CyrusOne sold a four-property portfolio in Houston to DataBank for $670 million, part of a continuing push by investors into the data center space.

Multifamily

At $63 billion in Q1, multifamily continues to set the top pace for sales volume, a new high-water mark 55% higher than the previous Q1 record in 2020. Cap rates continue to compress, with RCA’s hedonic series averaging 4.4%. But price appreciation is slowing, gaining 4.2% on the quarter and 22.4% on the year. Deals continue to come fast and furious, though early signs of re-trades are emerging. In the largest deal of the month, Black Spruce Properties along with Orbach Group acquired American Copper in Manhattan for $837 million, or $1.1 million per unit.

Retail

Retail volume, off to its strongest start since 2017, totaled $18.6 billion in the quarter, more than double than at the start of 2021. Cap rates continue to fall, though pricing stalled in Q1. While pricing is up 16.3% over the past 12 months, quarterly gains were just 0.4%. The U.S. consumer remains strong, with wage gains and low unemployment. However, persistent inflation is showing signs of weighing on discretionary spending, which may cause retail investment to stall. In the largest deal in March, EDENS purchased an eight-property portfolio in California and Washington, totaling 1.2 million square feet, for an estimated $577 million.

Hotel

At $11 billion, hotel posted one of the strongest Q1 totals on record. The last time volume was stronger was at the start of 2015. Fundamentals have rebounded soundly in many markets, and with the return to offices driving business travel, the outlook remains optimistic. However, elevated fuel costs may curb some spending on travel. Hotel pricing is up 17.8% year-over-year, and as with other asset types, Q1 pricing slowed. In the largest deal of the month, the brand-new W Hotel (built in 2021) in Nashville, with 346 rooms, sold to Xenia for $266 million, or nearly $770,000 per room.

Download the report.

Aaron Jodka

Aaron Jodka