- Market participants are adjusting their expectations because of rising interest rates.

- Assumable debt transactions are attractive and accretive.

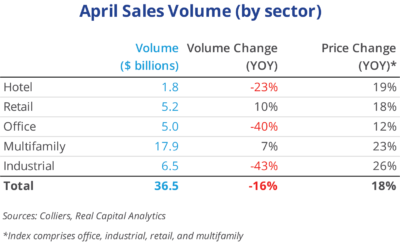

- Overall volume of $36.5 billion is down 16% from April 2021.

- Cap rates have yet to move in aggregate, though buyers are repricing many assets by 25–50 basis points or more (depending on the asset and weighted-average lease term).

- Unsurprisingly, multifamily continues to lead overall investment sales.

Office

Office volume hit $5 billion in April, a 40% decrease from one year ago. March-to-April volume drop-off (excluding 2020) in recent years averages 26%. In 2022 it was 69%, suggesting an impact from rising interest rates. Large sales in San Francisco and Washington, D.C., in April, indicated a continued recovery in some of the nation’s core office markets. Other deals in growth markets such as Nashville and Boca Raton also drove volume.

Industrial

Industrial volume of $6.5 billion is a slowdown from recent months, because no major portfolios drove sales. Industrial’s strong rent growth prospects appeal to investors, and large capital allocations to industrial should keep sales volume strong. Highlighting the value of infill logistics properties as well as the lure of Amazon, a two-property asset sale in Brooklyn, fully leased to Amazon, sold for $228.4 million, or $1,120 per square foot.

Multifamily

Multifamily remains the clear-cut sales volume leader, getting a kick-start from Camden Property Trust’s $2.1 billion buyout of partner Teacher Retirement System of Texas. The portfolio consists of 22 properties and 7,241 units. With overall volume at $17.9 billion in April, the largest deals of the month continued the trend of investors seeking growth markets in the Southeast and Southwest. New York City was also on the list for major transactions for the month.

Retail

April sales volume was $5.2 billion, a 10% increase over the same month in 2021, the strongest of all asset types. Retail investors are taking on more risk, and two of the largest deals involved buyers planning a renovation. These properties include Eden’s Plaza in Wilmette, IL (WS Development is the new owner), and Nut Tree Center in Vacaville, CA (sold to a Tower Investments joint venture with Richard Teske).

Hotel

Hotel volume eased, as no major chain went private this month. New York City hotels continue to garner attention, with the Sheraton New York Hotel & Tower, Fifty NYC, Shelburne NYC, Gardens NYC, and The Benjamin (among others) trading, at prices well below 2020 levels (on a price-per-room basis). Leisure travel is back in a big way, suggesting that hotel trading will continue to be strong.

Download the report.

Aaron Jodka

Aaron Jodka