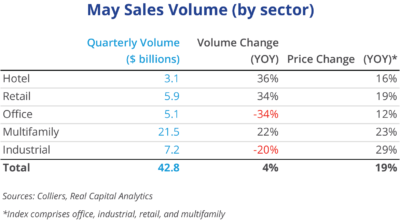

- Aggregate volume is up slightly (4%) from last year, but transactions are harder to complete today.

- Pricing is still up year-over-year but on the ground, retrades are becoming commonplace. Transactional data points do not yet show meaningful changes to cap rates.

- The immediate driver to repricing and slowing trade volume is the cost escalation of debt financing.

- Multifamily, retail, and hotel all posted annual volume increases. Office and industrial were down year-over-year.

- Near-record capital yet to be deployed is still waiting in the wings.

Office

At $5.1 billion, monthly office volume was down 34% from last May and is the lowest monthly showing since February 2021. Major deals were few and far between, with just six topping $100 million. The largest transaction was the Madison Centre in Seattle which was acquired by Boston Properties. Sold by Schnitzer West and Barings, the 761,000 SF property traded for $730 million. Other major deals closed in Manhattan, Charlotte, suburban Chicago, Queens, and Atlanta. While several large properties are active in the market, it’s not clear yet if they will close.

Industrial

Industrial sales volume was 20% lower than one year ago. Some of the largest trades were for data centers (Cloud Plaza in Sterling, VA, a Google-occupied facility), and life science (One Patriots Park in Bedford, MA). California properties were the top sales targets in the month, including a five-property portfolio of Amazon facilities in Bakersfield, Inland Empire, and San Diego for an estimate of more than $250 million ($405 per square foot), and 6th & Alameda Wholesale Distribution Center in Los Angeles for $240 million, or $835 per square foot. The Los Angeles property is to be repositioned as film studio space.

Multifamily

Multifamily continues to lead the pace in the broader real estate market with $21.5 billion in volume, half of all monthly sales volume. Multifamily volume is up slightly month-to-month and is 22% higher than year-ago figures. Several portfolios closed in May, led by SREIT’s $2.4 billion 32-property acquisition of 8,344 units, predominantly in the Southeast and Texas. Meanwhile, Clarion Partners, along with Blackfin Real Estate Investors, acquired a 3,564-unit 12-property portfolio in the Southeast for nearly $900 million.

Retail

Retail is on a roll with volume of $5.9 billion in May, topping office, a rare occurrence. The largest trade was a nine-property grocery-anchored portfolio in Massachusetts and Rhode Island sold to TA Realty and Wilder Companies for $390 million. In Yonkers, Nuveen, North American Properties, and Taconic Investment Partners acquired the leasehold of the 1.2-million-square-foot Ridge Hill for $219.5 million. In total, seven deals topped $100 million in the month.

Hotel

Hotel volume, up 36% on the year, rebounded from an April sales lull. Hotel’s strong fundamentals are attracting buyers’ attention. The largest deal was the leasehold acquisition of 1100 Pennsylvania Ave NW in Washington, D.C., a Trump International Hotel to be rebranded as a Waldorf Astoria. The 263-room property sold for $375 million. The 251-room Austin Block 21 in Austin, TX and 119-room Inn on Fifth in Naples, FL, also topped the $1 million-per-room price point in May.

Download the report.

Aaron Jodka

Aaron Jodka