Key Takeaways:

- The U.S. office vacancy rate increased marginally in Q2 2022.

- Net absorption was positive for the third time in the past four quarters.

- Asking rents are mostly holding firm, but generous concessions are on offer.

- Sublease space is at record levels.

- Supply-side risks are limited with speculative construction subdued.

- Office occupancy is increasing, but the return to the office has slowed.

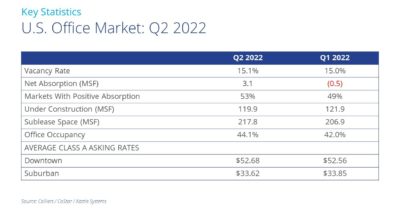

Vacancy: The U.S. office vacancy rate stands at 15.1%, an increase of 10 basis points in the second quarter. However, vacancy is still comfortably below the record peak of 16.3%, seen at the height of the Global Financial Crisis.

Net Absorption: National office absorption totaled 3.1 million square feet in Q2 2022 and has been positive in three of the past four quarters starting in Q3 2021. This marks a significant turnaround from the prior four quarters when cumulative net absorption was negative 141.8 million square feet.

Flight to Quality: Tenants continue to show a clear preference for the best quality space. Class A absorption in Q2 2022 totaled 5.6 million square feet, while the combined amount for Class B and C space was negative 2.5 million square feet.

Suburban Markets Lead: Suburban vacancy is below CBD levels for the first time on record. The suburbs posted 3.9 million square feet of net absorption in Q2 2022, compared to negative 760,000 square feet in CBD markets.

Sublease Space: There is a record 217.8 million square feet of sublease space available across the U.S. office market, significantly higher than the prior peak of 143.3 million square feet seen in Q2 2009.

Construction: Development activity continues to slow. Currently 119.9 million square feet are underway, which is down 27% from this cycle’s peak of 164 million square feet, seen in Q3 2020.

Rents: Asking rates are, by and large, holding firm. Tenant improvement allowances of $100 per square foot or more plus 12 to 15 months of rent abatement are available in several major markets when a tenant signs a new 10-year lease on Class A space.

Return to the Office: While employees are returning to the office, occupancy levels, as tracked across 10 leading metros, rose at a slower pace in Q2 2022 to 44.1%.

Outlook

Some degree of remote working is here to stay, but we are still awaiting clarity on the adoption of hybrid working and how many days per week people will be required to be in the office. It will take time for firms to recast their property strategies and decide how much space will be needed going forward, plus where it should be located.

U.S. National Research

U.S. National Research

Gary Gottlieb

Gary Gottlieb Darren Lemmon

Darren Lemmon Phil Breidenbach

Phil Breidenbach Marianne Skorupski

Marianne Skorupski Michael Lirtzman

Michael Lirtzman

Aaron Jodka

Aaron Jodka