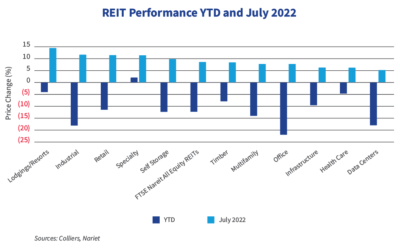

- July had the strongest monthly performance for REITs in 2022.

- This follows a record setting, full-year 2021 performance.

- Lodging/resorts, industrial, and retail led the charge in July. No sector posted declines that month.

- Green Street estimates that REITs are trading on average at a 10% discount to net asset value.

- REITs are an attractive acquisition target for private equity and other REITs.

REITs posted their strongest monthly performance of 2022 in July. Year-to-date, the FTSE Nariet All Equity REIT index is down, as are the broader stock indices. In July, lodging/resorts posted the strongest performance, gaining 14.44%, followed by industrial (11.63%) and retail (11.44%). Specialty (11.37%) and self storage round out the top five, while multifamily (7.69%) and office (7.63%) showed more mutual gains. No sectors posted losses in the month. Two subsectors: specialty, which includes properties such as casinos and movie theatres, and freestanding retail have posted year-to-date gains.

This year’s overall performance has led to attractive valuations and continued acquisitions. Blackstone, for one, has been on a buying spree this year, acquiring American Campus Communities, PS Business Parks, Preferred Apartment Communities, and Resource REIT. In June, Prologis said it will acquire Duke Realty in one of the largest REIT deals on record. Green Street estimates that REITs are trading at an average 10% discount to net asset value, making these owners prime acquisition targets. Keep an eye on further mergers and acquisitions and take private deals, boosting investment sales.

Download the report.

Aaron Jodka

Aaron Jodka