- Nationally, 870,000 multifamily units are under construction.

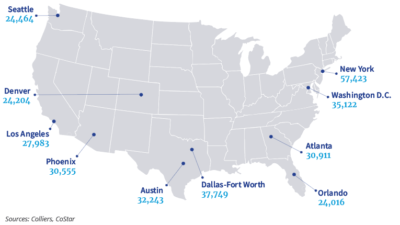

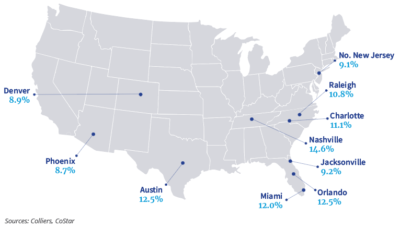

- The top 10 markets for total units underway vary compared to those with the highest percentage of inventory under development.

- New York, which has the largest inventory in the country, currently has the most units under development.

- Smaller markets lead for percentage of inventory underway. For markets with at least 100,000 units of existing inventory, Nashville ranks first in percentage of inventory growth.

- Strong leasing trends mean these levels of development are not expected to cause fundamentals to collapse.

Numerous reports discuss the lack of affordable housing options across the U.S. being a concern. While today’s robust construction pipeline will not resolve decades of underdevelopment, some relief is on the horizon. Nationally, a new generation of multifamily units are under construction, totaling approximately 870,000 units or about 5% of national inventory, per data from CoStar.

Top 10 Markets by Total Units Underway

This year’s overall performance has led to attractive valuations and continued acquisitions. Blackstone, for one, has been on a buying spree this year, acquiring American Campus Communities, PS Business Parks, Preferred Apartment Communities, and Resource REIT. In June, Prologis said it will acquire Duke Realty in one of the largest REIT deals on record. Green Street estimates that REITs are trading at an average 10% discount to net asset value, making these owners prime acquisition targets. Keep an eye on further mergers and acquisitions and take private deals, boosting investment sales.

Top 10 Markets by % of Inventory Underway

The markets with the highest percentage of inventory underway tend to be those with a smaller unit base (such as The Villages, FL, and Punta Gorda, FL). For example, El Paso, TX has an existing inventory of nearly 45,000 units with another 10,000 under development, accounting for a 22.6% increase. Using this metric, markets with at least 100,000 units of existing inventory make up a different top 10 and include: Nashville, Orlando, Austin, Miami, Charlotte, Raleigh, Jacksonville, Northern New Jersey, Denver, and Phoenix. Rapid unit absorption coupled with high housing costs, elevated mortgage rates, and economic concerns suggest the growing pipeline will not be overwhelming.

Download the report.

Aaron Jodka

Aaron Jodka