Highlights

- Higher borrowing costs have the industry looking to loan maturities and refinancing challenges in the future.

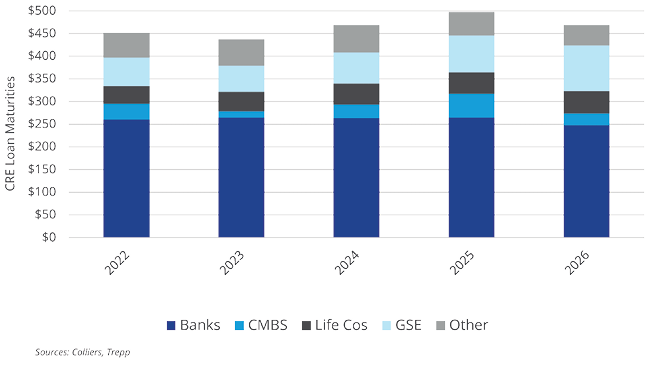

- Based on data from Trepp and the Mortgage Bankers Association, there is no Wall of Maturities in the near term. Instead, maturity levels are consistent.

- Multifamily loans, as a share of non-bank maturities, will trend upward through 2026.

- Uninvested capital remains near record levels, with opportunistic strategies having the largest share, per Preqin.

During the Great Financial Crisis, there was concern over a wall of CRE maturities, particularly on the CMBS side. In an era of low interest rates, this largely worked itself out, as kicking the can allowed underwater deals to recover. With today’s interest rate environment very different, it’s worth exploring CRE maturities in the years ahead. There does not appear to be a wall this time around. Using data and estimates from Trepp, loan maturities from 2023 through 2026 are relatively consistent, peaking in 2025 at nearly $500 billion. This doesn’t mean investors won’t face distress or challenges. Still, there isn’t a single year that the market will be holding its breath.

GSE maturities will expand each year over that time. For non-bank maturities, Mortgage Bankers Association data shows that multifamily maturities will make up an increasing share of the total. In 2026, more than half of all non-bank maturities will be for multifamily product. This trend bears watching, as a larger share of maturities could create investment and recapitalization opportunities. Many funds in the market today are raising debt capital, and rightly so. Debt strategies have been popular this year, as uninvested capital at year-end 2021 has decreased 20% through mid-October, per data from Preqin. Meanwhile, opportunistic funds have never had more capital to deploy. Investors know deals are on the horizon and are busy preparing for them.

Aaron Jodka

Aaron Jodka