- The U.S. dollar is the strongest it’s been since 2000.

- As a result, it is more expensive for international investors to acquire U.S. assets.

- On the flip side, overseas real estate is more affordable for U.S.-based investors.

- Inflationary pressure, geopolitical turmoil, and Fed action have investors focused on the U.S. dollar.

- U.S. real estate is still attractive for many reasons, demographics chief among them, but investors with an international capital strategy could look to buying opportunities elsewhere.

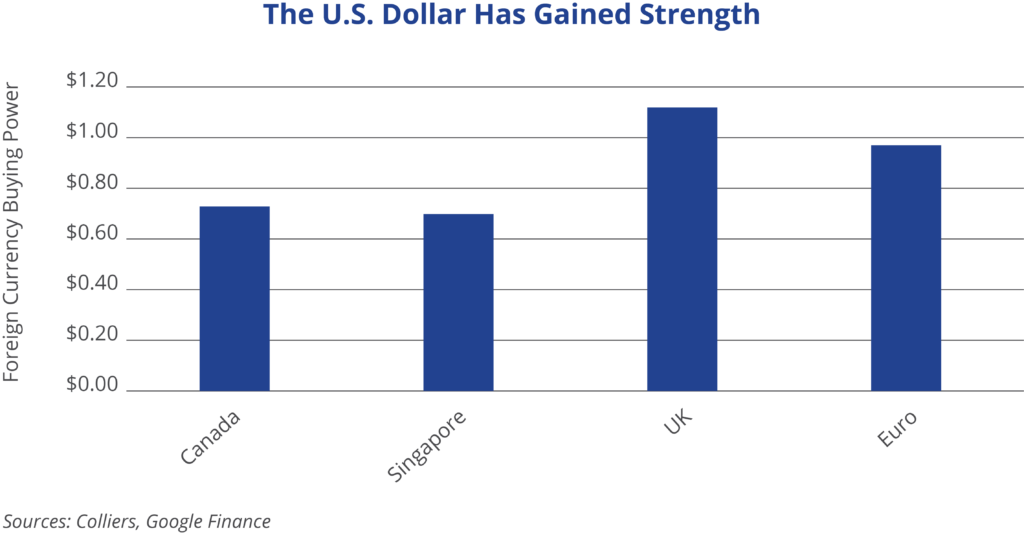

The U.S. dollar has appreciated markedly compared to worldwide currencies in 2022. The IMF notes that through mid-October, the dollar has gained 22% against the yen and 13% on the euro. Similarly, other currencies have less buying power in the states, making commercial real estate more expensive for cross-border investors. In recent years, the share of cross-border capital acquiring U.S. real estate has declined to around 8%, down from roughly double that in 2015-16. That acquisition rate has slid further in 2022. The largest overseas buyers of U.S. real estate include Canada, Singapore, the U.K., and other European countries. However, this means overseas real estate is on sale for U.S. buyers.

Cap rates are higher in the U.S. than in major global markets. The dollar’s stronger buying power helps to offset that. Inflation has not hit Japan and China to the same extent as in other countries, and the dollar is expected to remain strong in the near term. Consensus Economics expects foreign currency appreciation in the 12 months ahead, suggesting relative value may be strongest sooner rather than later for U.S. acquisitions overseas.

Even in a recessionary environment, U.S. Treasuries are seen as a safe harbor investment, increasing capital flows to the U.S. dollar. The Federal Reserve is expected to raise its overnight lending rate by an additional 50-75 basis points through the end of 2022, with possible further increases in early 2023. This is stressing financial policies worldwide and weakening foreign currencies. The Federal Reserve notes that about 50% of cross-border loans, international debt securities, and trade invoices are U.S. dollar-denominated. As inflation remains embedded in the U.S. economy, the Fed’s top priority is returning to price stability. U.S. investors can take advantage of today’s strong dollar by acquiring assets overseas.

Aaron Jodka

Aaron Jodka