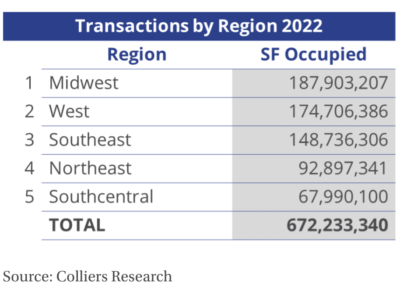

Despite widespread speculation that the U.S. industrial market would see signs of cooling, occupier activity in bulk industrial space (tenant size larger than 100,000 square feet) outperformed 2021 transactions at the end of the year. Transaction volume increased 16.2% year-over-year and totaled more than 672.2 million square feet.

Nearly 2,300 industrial (warehouse, manufacturing, and flex) new leases, renewals, and user sales were transacted throughout the year, compared to 2,000 a year ago. Additionally, the average transaction size for bulk space increased in 2022 to 293,700 square feet, slightly over the average size of 290,300 square feet in 2021.

Record deliveries throughout the year contributed to solid transaction volume as occupier requirements continue to lean towards shiny and new. Higher ceiling heights, heavy power, generous parking, increased building amenities, and a greater focus on ESG are attracting tenants to newly built facilities.

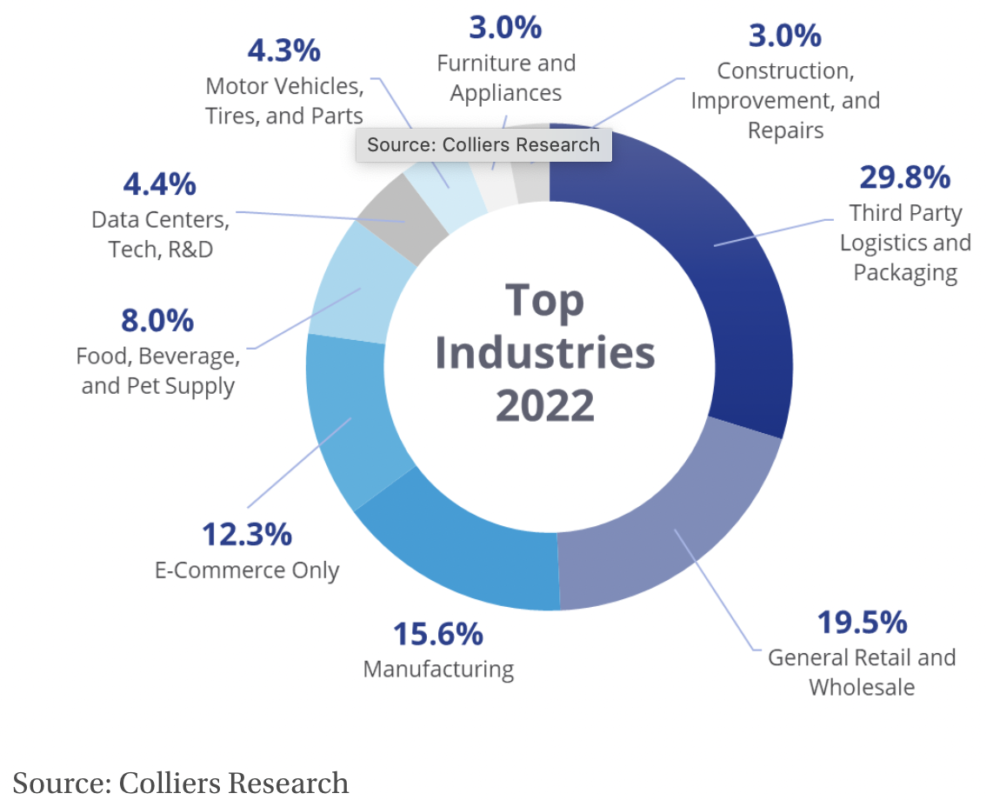

Third-party logistics and packaging companies (3PLs) remained the top occupier of bulk industrial space at year-end, and even increased their year-over-year market share from 28.1% in 2021 to 29.8% at the close of 2022. 3PL providers, who offer outsourced logistics and warehousing services for retailers and wholesalers, oftentimes provide cost savings for users and supply labor for fulfillment, which can be difficult to find. While 3PLs were the top overall occupier, the data centers/tech/R&D industry increased its market share by 56.6% year-over-year and transacted 29.9 million square feet in 2022. E-commerce, the former darling of bulk activity, experienced the most significant decline year-over-year as its market share fell 36.6%. Amazon’s resolve to reduce its real estate footprint early in the year certainly contributed to the industry’s sharp decline.

Despite the diminishing presence of the e-commerce industry, Amazon remained the largest occupant of bulk space in the U.S. in 2022. While Amazon may have pulled back in some markets, they remain in expansion mode in others. In fact, of the 15 facilities under construction that are larger than two million square feet, Amazon is set to occupy nine of those facilities totaling more than 30 million square feet. Additionally, to capture a portion of Amazon’s market share, Walmart increased its occupancies 43.7% year-over-year, with transactions totaling 13.7 million square feet.

Transactions in the Midwest accounted for 28.4% of all bulk occupier activity, followed by the West region with 27.4%. The Southcentral market was the least active at the end of the year, accounting for just 8.4% of transactions signed. The Inland Empire is considered the premier big-box market in Southern California and helped push the West region into the second spot. It continues to attract large distributors, warehousers, e-commerce companies, and logistics firms seeking to consolidate their operations into large, state-of-the-art facilities. As a result, the market maintains one of the lowest vacancies in the country and transacted much of the bulk space in new facilities.

The robust activity experienced in 2022 highlights the pent-up demand that has existed since the start of the global pandemic. Occupiers are still seeking space in tight industrial markets to remain as close as possible to their largest consumer bases. More than 647 million square feet remained under construction at the end of the year, and nearly 180 of those facilities are larger than one million square feet. In addition, an increase in manufacturing development is expected in 2023, as evidenced by the eight facilities larger than one million square feet under construction – many for automotive companies, including General Motors, Nikola Motor Company, and Ford Motor Company. Record levels of industrial product under construction will continue to offer modern options for bulk occupiers in the coming quarters.

Company Type Description:

Construction, Improvement and Home Repair – Warehousing and distribution of materials used in residential and commercial construction, improvements and repair, could contain some e-commerce components.

Data Centers, Tech and R&D – The use of industrial space for data centers and non-pharmaceutical R&D purposes.

E-Commerce Only – Warehousing and distribution of product that is ordered online and shipped directly to the end consumer only.

Food, Beverage and Pet Supply – Manufacturing, warehousing and/or distribution of food and beverage related products. Could contain some e-commerce or manufacturing components.

Furniture and Appliances – Warehousing and distribution of retail and/or wholesale furniture and appliance products. Could contain some e-commerce and or manufacturing components.

General Retail and Wholesale – The warehousing and distribution or retail and/or wholesale products not listed in any of the other categories. Could contain some e-commerce or manufacturing components.

Manufacturing – Industrial space used for manufacturing and/or storage of raw materials and equipment used in the manufacturing of non-automobile related products.

Motor Vehicles, Tires and Parts – The warehousing, manufacturing and/or distribution of motor vehicles, tires, and related parts and materials.

Third-Party Logistics and Packaging – Third-party logistics (3PL) and packaging of a wide variety of products, could contain some e-commerce components.

U.S. National Research

U.S. National Research

Craig Hurvitz

Craig Hurvitz

Lauren Pace

Lauren Pace Ronna Larsen

Ronna Larsen

Tom Golarz

Tom Golarz Michael Golarz

Michael Golarz