- In 2022, a combination of factors caused cross-border investment in the U.S. to fall to the lowest level since 2012.

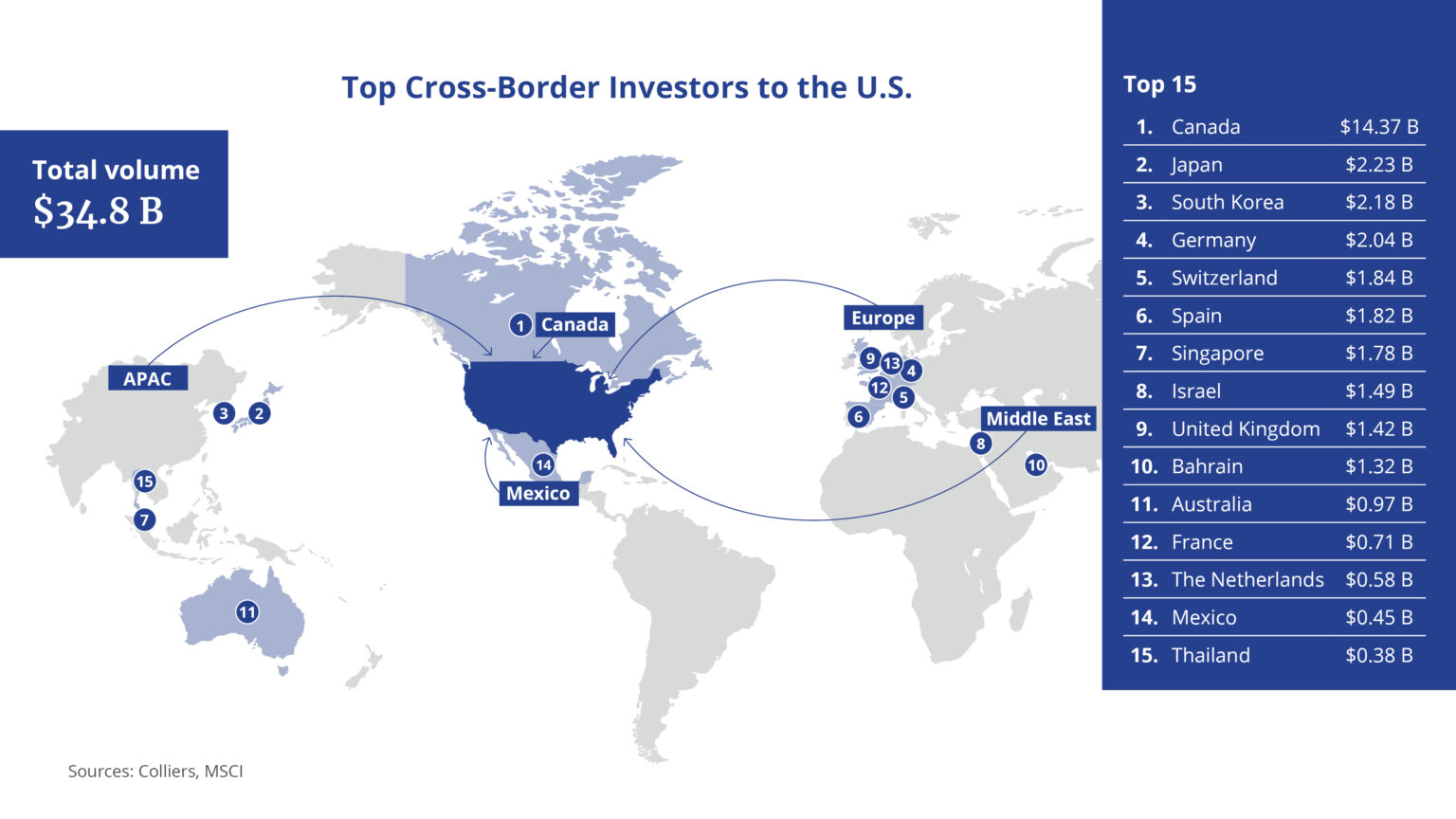

- A total of $34.8 billion of foreign capital came to the U.S., a 53% decline from 2021.

- Net acquisitions, taking purchases and sales into consideration, were -$12 billion, the strongest figures in MSCI’s data series.

- The start of 2023 shows signs of a reversal, thanks to GIC partnering on the privatization of STORE Capital Corporation in a deal valued at $15 billion.

- A recent Association for International Real Estate Investors (AFIRE) survey showed U.S. allocations are up 6% on the year.

Cross-border capital flows fell sharply last year. While the overall market was down 13% from a record-high 2021, foreign investment fell more than three times as far, down 53%. Elevated inflation, rising interest rates, a strong dollar, and geopolitical strains all combined to reduce direct cross-border investment in U.S. commercial real estate in 2022. All major investment regions were net sellers last year, outside of Europe, which was slightly positive. In total, foreign investors decreased their holdings by $12 billion on the year, the largest such disposition in MSCI’s data series.

Will this continue? If Q1 is a guide, it won’t. GIC and Oak Street took STORE Capital Corporation private, driving billions in total activity. Relative to 2022, this single transaction more than quadrupled sales volume from Singapore. Other major international buyers included GPIF (Japan), Credit Suisse (Switzerland), Brookfield Asset Management (Canada), Hyundai Motor (South Korea), and Investcorp (Bahrain). Initial estimates for Q1 cross-border investment total $15.5 billion, with a net acquisition of $11.7 billion.

Cap rates in the U.S. have escalated more rapidly than in other regions of the globe, although some European markets are close, making U.S. real estate more attractive. At the same time, foreign currencies are appreciating relative to the U.S. dollar, resulting in more affordable real estate. In addition, REITs have been battered, transforming them into attractive acquisition targets for sovereign wealth and international capital sources.

Aaron Jodka

Aaron Jodka