Jamie Dimon, CEO of JPMorgan Chase, recently said: “We are in a new world order where interest rates are likely to be higher for longer.”

In this five-part series, I’m looking at the largest forces shaping the future of commercial real estate. Part One explored shifting demographics, Part Two looked at the AI revolution, and this installment will analyze the impact of the new higher-for-longer interest rate environment.

The convergence of the rising cost of capital and cap rates, as well as the cascading capital allocation constraints for corporations, creates an intricate interplay in the evaluation of owning vs. leasing real estate and broader organizational investments, requiring a nuanced approach.

Disparity Between Cost of Capital and Cap Rates

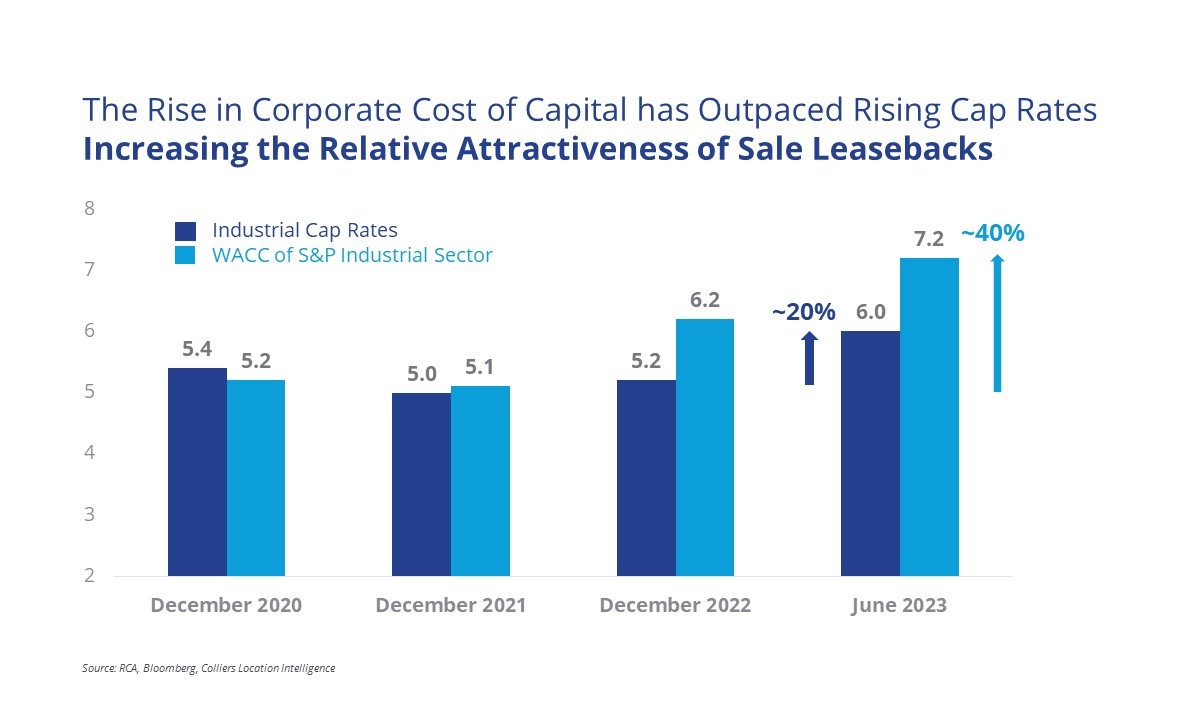

The persistent “higher for longer” headlines spotlighting this trend have unveiled an intriguing development. The escalation in corporate capital costs has notably outpaced the concurrent rise in cap rates, setting the stage for tactical financial arbitrage and thus increasing the attractiveness of sale-leasebacks for many organizations.

Cap rates and the weighted average cost of capital (WACC) for the S&P industrial sector were nearly identical in December 2021. However, while cap rates have increased materially since (+20%), the WACC of the S&P industrial sector has effectively grown at twice that rate (+40%) creating a tactical opportunity to leverage sale-leasebacks to enhance enterprise value.

Seizing Emerging Opportunities for Value Creation

As an example of why this makes sale-leaseback transactions more attractive, consider the scenario of owning a $100 building: in 2021, the cost of capital for that $100 was $5.10, while currently, the market demands $7.20.

Today, the owner could sell the building, free up the $100, and take the $7.20 the market would otherwise be charging them for that capital and pay their $6 rent—resulting in an incremental $1.20 in value creation. This opportunity has surfaced in several of my recent discussions with notable entities including Fortune 1000 and private equity companies.

What adds further weight to this opportunity is not just the swiftness of these changes but also the void in the market for applying the proper analytical framework to the own vs. lease analysis. This analysis is far more complex than simply comparing a company’s cost of capital to cap rates.

Developing a Quantitatively Defensible Own vs. Lease Assessment

Neil Dutta, the Head of Economics for Renaissance Macro Research, aptly emphasizes that “nobody wants to talk about nuance, but the nuance is usually where the answer is.”

There is a great deal of important nuance in developing the proper analytical framework for evaluating own vs. lease decisions. A mistake we often see clients make is using the weighted average cost of capital as the discount rate in both the own and lease scenarios. Because the risk profiles of owning real estate versus leasing real estate and freeing up that capital to invest in the average capital project of an organization are not equivalent, the required rate of return (discount rate) should not be the same in both scenarios.

In addition to varied discount rates, there are a host of considerations that must be accounted for, such as internal factors including the tax rate, expected occupancy timeline, opportunity costs, and phase in the company life cycle. Building characteristics like level of specialization, and market considerations such as liquidity, supply constraints, forecasted availability, and expected rental rate growth are also components of a quantitatively defensible own vs. lease analysis.

Thus, a comprehensive evaluation of market dynamics, asset characteristics, opportunities, risks, and strategic priorities is critical to making an informed lease vs. own decision amidst a dynamic market landscape where this higher-for-longer interest rate environment is expected to persist.

Bret Swango, CFA

Bret Swango, CFA

Mike Spears

Mike Spears Greig Lagomarsino

Greig Lagomarsino Peter Danna

Peter Danna Christopher Sheehan

Christopher Sheehan

Matt Gannon

Matt Gannon Craig Hurvitz

Craig Hurvitz

Anjee Solanki

Anjee Solanki