- Millennials, or Generation Y, are the largest demographic in today’s workforce.

- Millennials also have the second highest birth rate in American history, following the Baby Boomers.

- Although generally perceived as a smaller group, Generation Z, sometimes called Zoomers, still represents a significant demographic cohort.

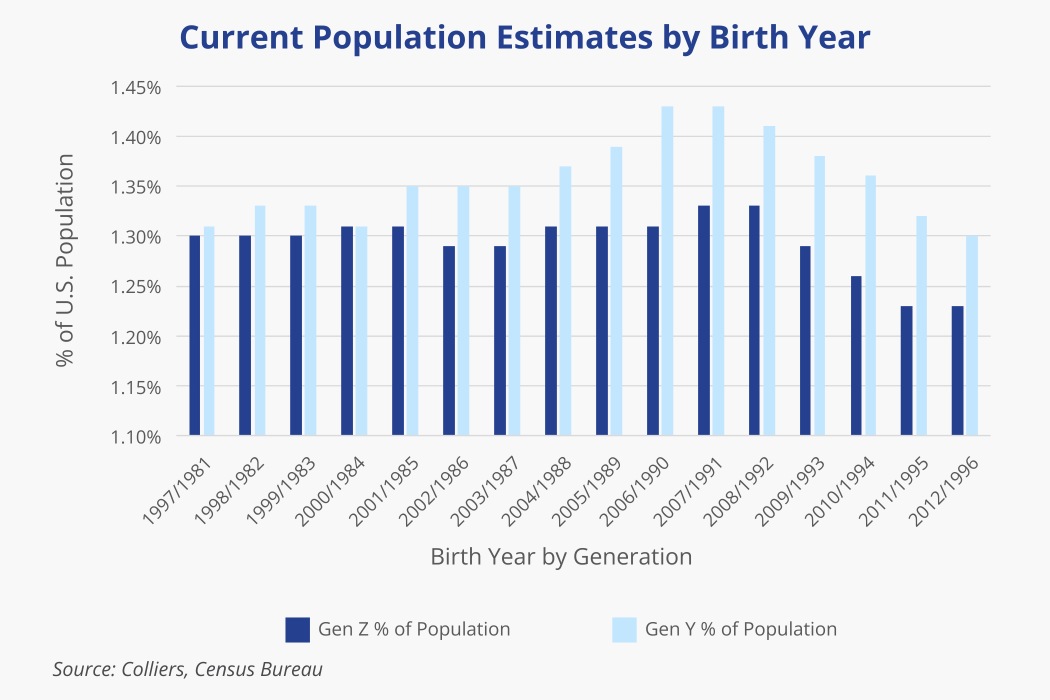

- Gen Y and Gen Z may be closer in size than statistics have shown, which could have implications for various asset classes.

- Multifamily could potentially benefit the most from this.

There’s an adage that demography is destiny, and there is certainly truth to this. We can calculate population growth by analyzing birth and death rates, household formation, average household size, and the median age of marriage and having children.

Based on generally accepted generational spans, Gen Y, or Millennials, total around 73.1 million people born between 1981 and 1996, or about 21.7% of the U.S. population. They are currently the largest demographic in today’s workforce and have captured headlines and investor attention for years. Real estate investors have been particularly interested in this group, constructing new apartments in urban areas and targeting their substantial retail spending power.

Gen Z is considered the smaller demographic cohort. There is still some debate on the exact end date of this generation, but to make comparisons consistent, we are using the birth years of 1997-2012. This group makes up an estimated 69.6 million people, about 20.7% of the population. Gen Z’s smaller size has had a ripple effect on the economy, resulting in lower college enrollment, concerns about future real estate demand, and the need for property redevelopment.

Aaron Jodka

Aaron Jodka

A surge in demand across asset classes, particularly multifamily and industrial, could bolster a recovery in fundamentals and investment sales activity.

However, what if Gen Y and Gen Z are closer in numbers than we thought? The Congressional Budget Office recently released population estimates out to 2054, noting that immigration has been much higher than initially predicted. The Brookings Institution estimates that 2023 net immigration totaled 3.3 million people, compared to its previous projection of 1 million. Faster population growth has been a trend for several years and is predicted to continue in 2024, suggesting future population estimates could, and likely will, change. Historically, immigrants to the U.S. are older, per Migrationpolicy.org, with fewer young children than the population overall. Whether recent immigration rates match those statistics remains to be seen.

With more people comes an increased need for housing, consumer goods, and jobs. A surge in demand across asset classes, particularly multifamily and industrial, could bolster a recovery in fundamentals and investment sales activity. In addition, different generations tend to have distinct spending habits, providing valuable insight into the future of retail. Understanding these potential demographic shifts can help investors make better-informed decisions and unlock new investment opportunities.