- May volume totals remain low.

- However, recent months have seen solid upward volume revisions.

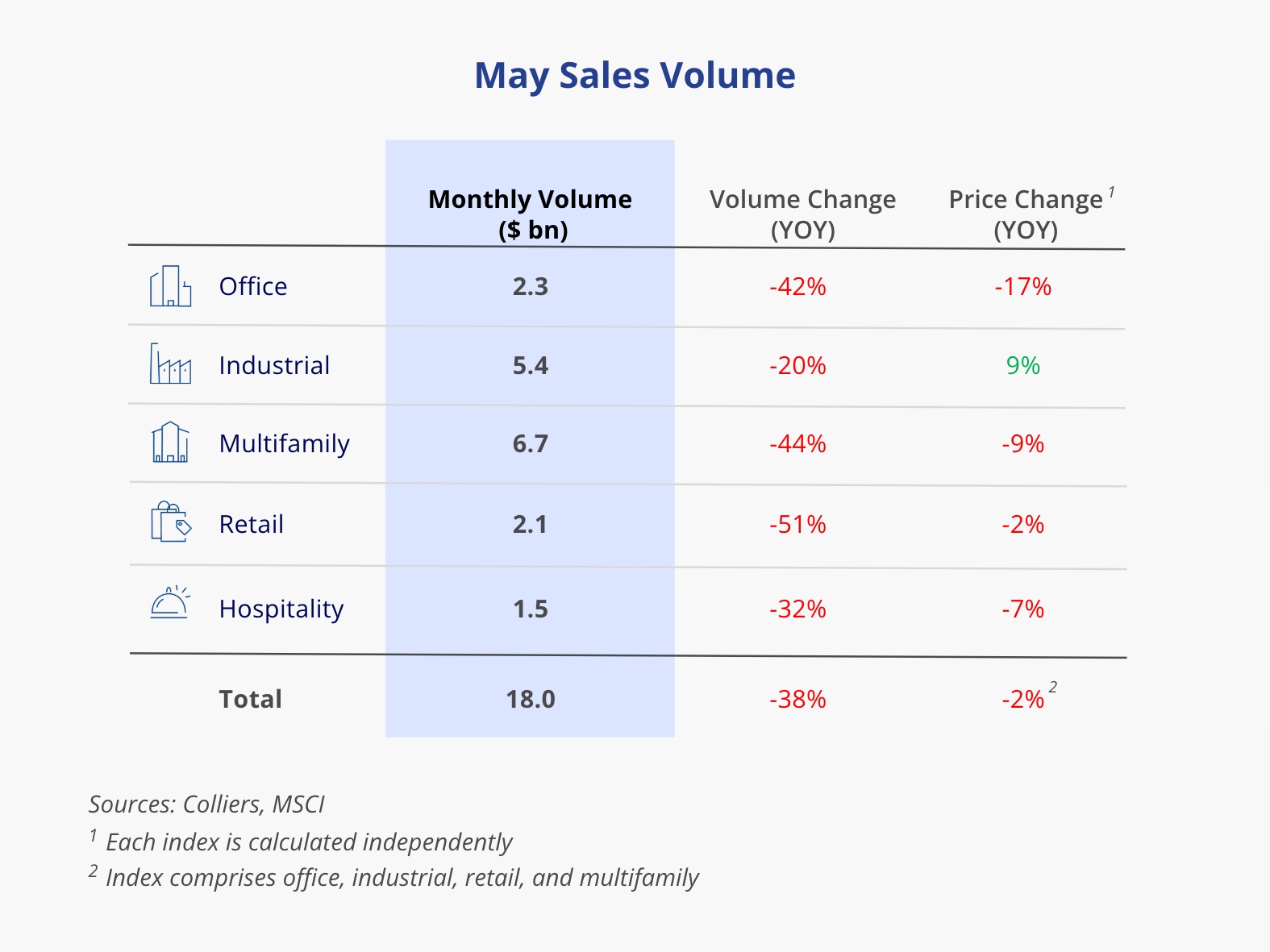

- Volume is down 38% compared to last year, marking a reversal from the single-digit, year-over-year declines seen in March and April.

- Industrial and multifamily posted month-over-month sales increases.

- Portfolio activity and properties on the market indicate a thawing of conditions and an expectation for stronger months ahead.

Aaron Jodka

Aaron Jodka

Portfolio activity and properties on the market indicate a thawing of conditions and an expectation for stronger months ahead.

Office

Office sales volume pulled back in May, with $2.3 billion transacting and the fewest individual asset trades this year. Volume is off 42% from last May, continuing the broad volatility of monthly activity in 2024.

The three largest deals of the month took place in the Bay Area. Pleasanton Corporate Commons, occupied by 10x Genomics, traded for $151.8 million, or $514/SF, at a 7% cap rate. In addition, Sunnyvale Park Place traded for $100.5 million, or $233/SF, with 60% occupancy. In San Francisco, 1455 Market Street traded for $96.9 million, or $96/SF.

Industrial

Sales volume increased month-over-month, with $5.4 billion in trading activity. Portfolio activity ramped up as Prologis sold a 4.1 million SF portfolio in Minnesota to Exeter, and Blackstone traded two portfolios to Terreno Realty and DRA Advisors.

This increased portfolio activity is a strong sign of improving liquidity in the industrial market. However, the month’s largest deal was NVIDIA’s acquisition of San Tomas Technology Park in Santa Clara, CA, for $374.3 million, or $599/SF.

Multifamily

With $6.7 billion in volume, multifamily sales activity picked up in May, although it still represents a 44% decline from one year ago. Multifamily has consistently remained the most liquid asset class, and recent portfolio activity offers promising signs of a rebound.

The highlight of the month was Brookfield Asset Management acquiring a 7,300-unit portfolio from Starwood Capital. It traded at an estimated purchase price of $1.6 billion, or $212,000/unit.

Retail

May represented a slow sales month for retail. A reported 173 properties traded, the lowest monthly activity since July 2010. In total, $2.1 billion transacted, a 51% decline from one year prior and the lowest figure year-to-date.

The luxury segment of the market continues to remain red-hot. In the month’s largest deal, TZ Capital acquired 680 Madison Avenue in Manhattan for $180 million, or $5,391/SF. Tenants include Tom Ford, Brioni, Oscar de la Renta, Morgenthal Frederics, and Missoni.

Hospitality

Similar to other asset classes, hospitality sales activity was restrained in May. MSCI reported 71 assets traded for $1.5 billion, a 32% decline in volume from last year and the lowest number of trades since August 2020.

One large transaction, the sale of the 705-room Biltmore Resort & Spa in Phoenix, was the main driver of volume. A joint venture between Henderson Park and Pyramid Global Hospitality acquired the property from Blackstone for $705 million, or $1 million/room. It will remain branded as a Waldorf Astoria Resort.