Even though the recession officially ended in June 2009, it hasn’t felt like much of recovery in the U.S. economy or office market — until recently. On the economic front, total employment didn’t return to its prerecession peak until nearly five years into the recovery, and real GDP growth has been slow and choppy. Office vacancy rates have remained stubbornly high due to relatively weak job creation as well as companies’ backfilling space emptied during the recession before leasing additional space. Also, firms across industries are allocating less space per employee, a long-term trend that has contributed to a slower recovery relative to previous cycles.

Plus: The surging U.S. dollar: Friend or foe? | CPI has declined, and so has your rent

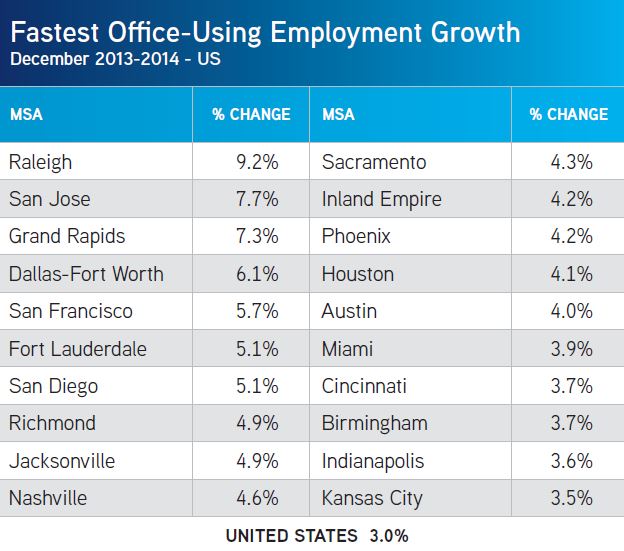

However, both the economy and office market turned the corner in 2014 and are positioned for further improvement in 2015. The U.S. added more than 3 million jobs during the year – remarkably, the first time this has happened since 1999. Moreover, growth is no longer confined to a handful of sectors, specifically tech and energy. In 2014, every sector added jobs, even the long-lagging government sector. Federal government employment continues to shrink, but state and local governments are finally hiring again, buoyed by improving tax receipts.

(Colliers International)

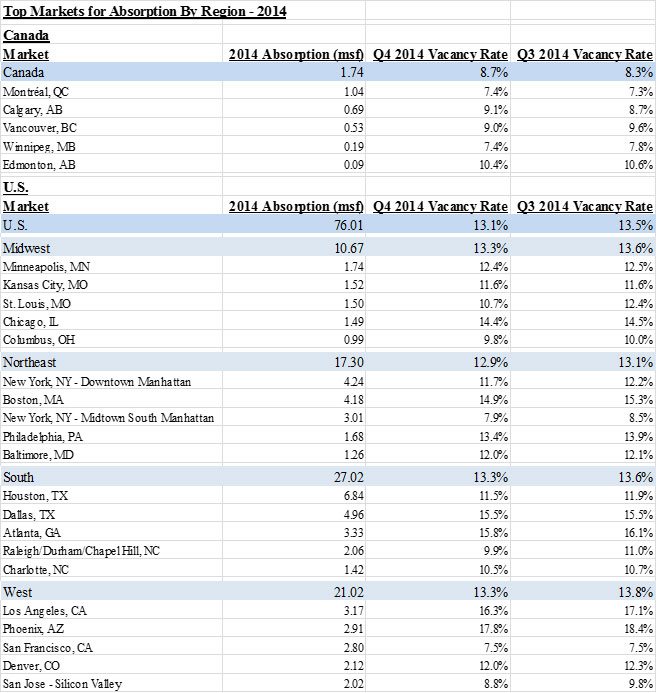

Likewise, many more cities are benefiting from economic growth than a few years ago. More than half of the metro areas that Colliers tracks have recovered all of the office-using jobs lost during the recession. Also, lagging housing-bust markets including Fort Lauderdale, San Diego and Jacksonville were among the fastest-growing metropolitan areas for office-using jobs in 2014.

Another reason for optimism is that developers just aren’t building that much new space outside of the strongest markets and submarkets. Yes, total construction activity has been creeping up, but nearly two-thirds of the office space under way is in just 10 markets — places like San Francisco, San Jose and Seattle, where tech tenant demand has been robust. Given the precipitous drop in oil prices, one office market for greatest concern is Houston, home to 18 percent of office space construction underway in the U.S. markets tracked by Colliers. Reflecting how concentrated construction activity is, these top 10 markets account for less than 30 percent of existing U.S. office inventory. Markets that have been recovering more slowly — places like Orange County, Miami, Las Vegas and Tampa — have little to no office space under construction. In Los Angeles and Phoenix, which have high vacancy rates overall, most construction is happening in the strongest submarkets — places like West Los Angeles and Tempe — in response to tenant demand. Overall, developers and lenders remain cautious and prudent, limiting the risk of overbuilding at this point in the cycle.

(Colliers International)

So what does all of this mean for 2015? In short, our office market outlook is the strongest that it’s been since before the recession. The combination of stronger job growth and limited, targeted construction activity bodes well for the market this year. Yes, tenants across virtually all sectors continue to become more efficient, doing more with less space as their leases come up for renewal. But as hiring activity increases further, firms will need more space to house additional workers, even if it’s in spaces with fewer square feet per employee than a decade ago. Overall, the U.S. office market is in the “sweet spot” in terms of supply-and-demand fundamentals, and these should result in additional occupancy gains and rent growth, a steady increase in development activity, and greater domestic and foreign investor interest in office properties in 2015 – in places beyond gateway markets like New York and San Francisco.

For more data and analysis, check out the latest North American Office Market Outlook report from Colliers International.

Colliers Insights Team

Colliers Insights Team