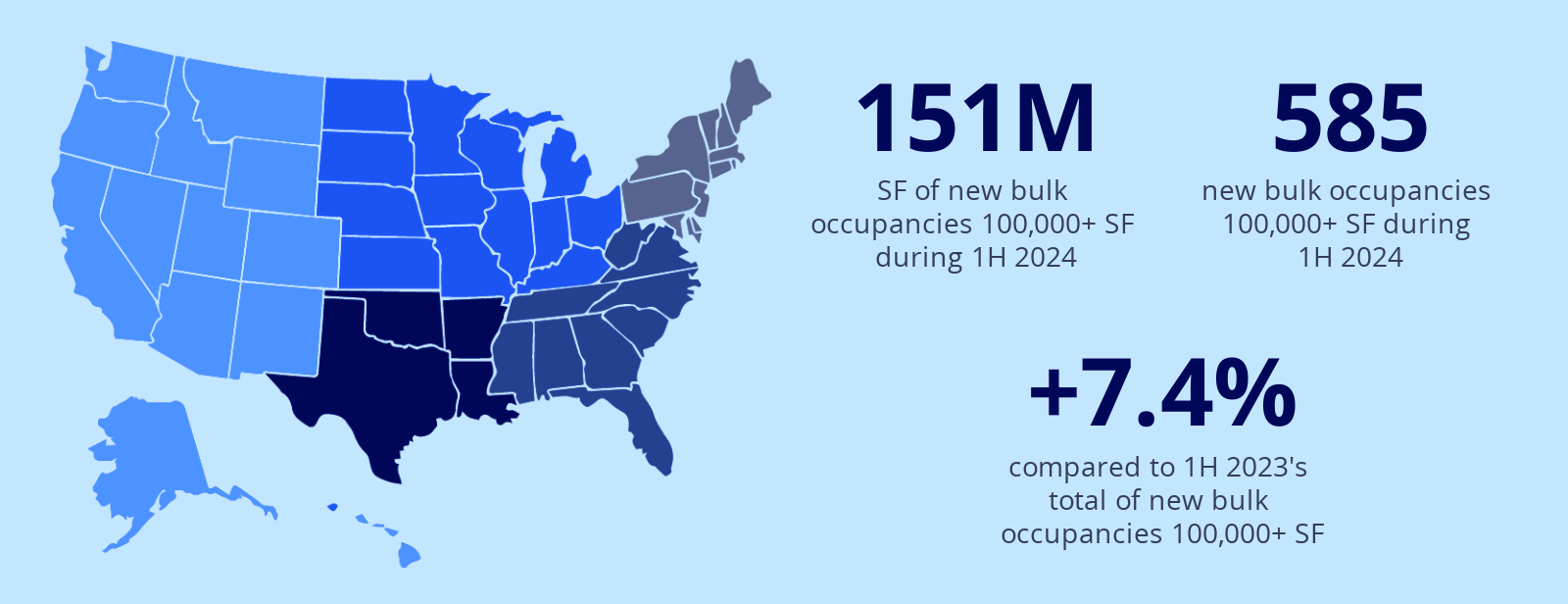

Industrial tenant occupancies picked up during the first half of 2024, particularly in bulk space 100,000 SF or greater. New bulk occupancies totaled 151 million SF, a 7.4% increase compared to the first half of 2023. Tenants took occupancy on 585 new leases and user sales 100,000 SF or greater during the first half of 2024, compared to 484 during the first half of 2023. Following a sharp decrease between 2022 and 2023 when new bulk occupancies fell by nearly 50%, the year-over-year increase recorded during the first half of 2024 is encouraging and suggests that industrial demand has bottomed and started to slowly build back. Despite the uptick, the average transaction size for new bulk occupancies decreased to 257,804 SF during the first half of 2024, down from 289,840 SF during 2023 — new occupancies are smaller in size, but greater in quantity.

A bump in new leasing activity during the first half of 2024 will lead to another increase in bulk occupancies during the second half of the year. At the same time, new supply as measured by construction completions has started to fall, totaling 243 million SF during the first six months of 2024 compared to 607 million SF during all four quarters of 2023. The total space under construction dropped to 343 million SF by mid-year, a 52% decrease compared to the peak of 711 million SF at the end of 2022. This figure is expected to drop below 300 million SF by the end of the year to levels consistent with the pace of construction prior to the pandemic.

As new supply continues to fall over the coming quarters and demand builds back, the two indicators are expected to approach equilibrium by early next year, when vacancy rates in most markets will peak and begin to fall again. Vacancy has climbed into the double digits in some markets where too much space has been delivered, and vacancy will take longer to return to historical averages in these markets compared to others where new supply has been more constrained.

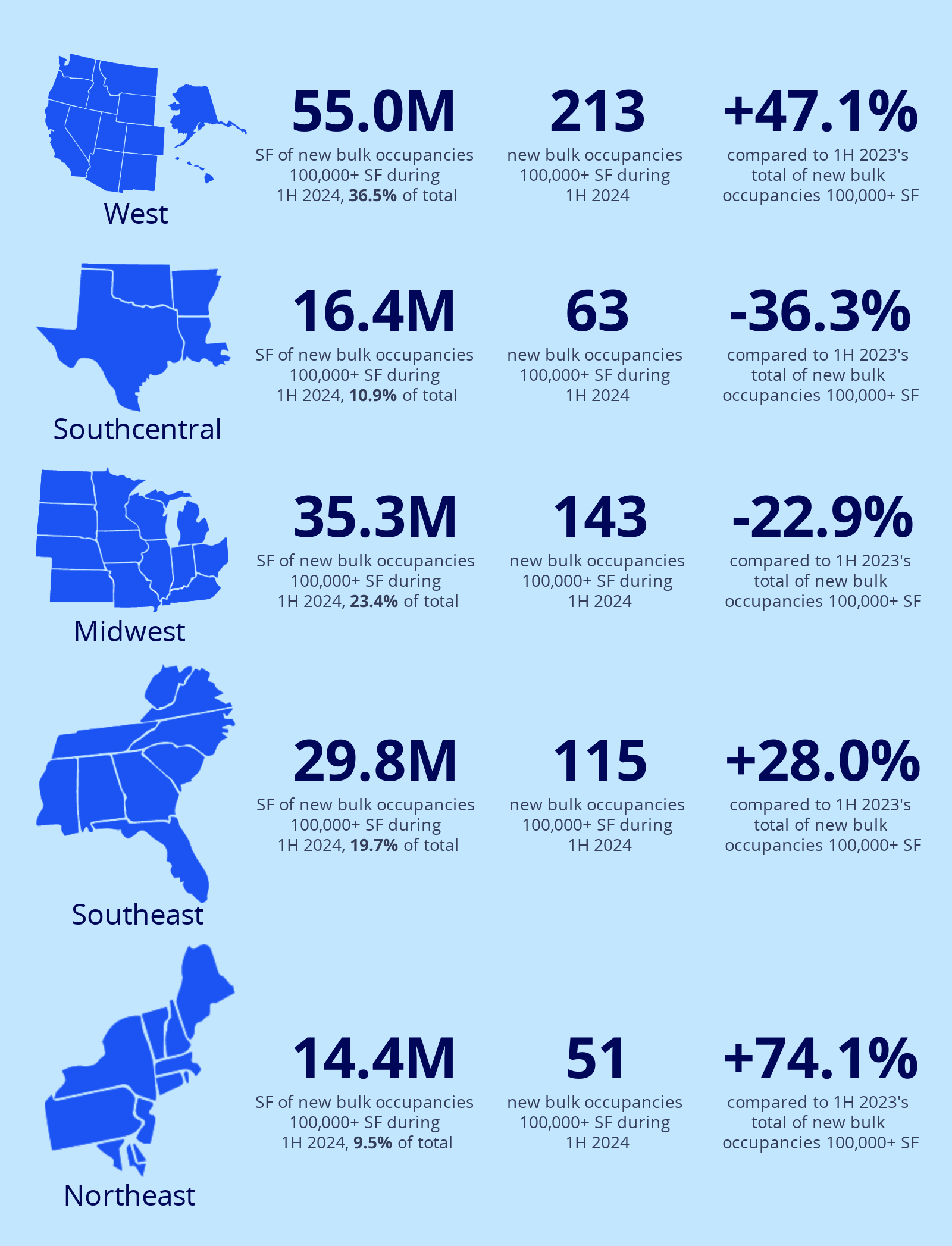

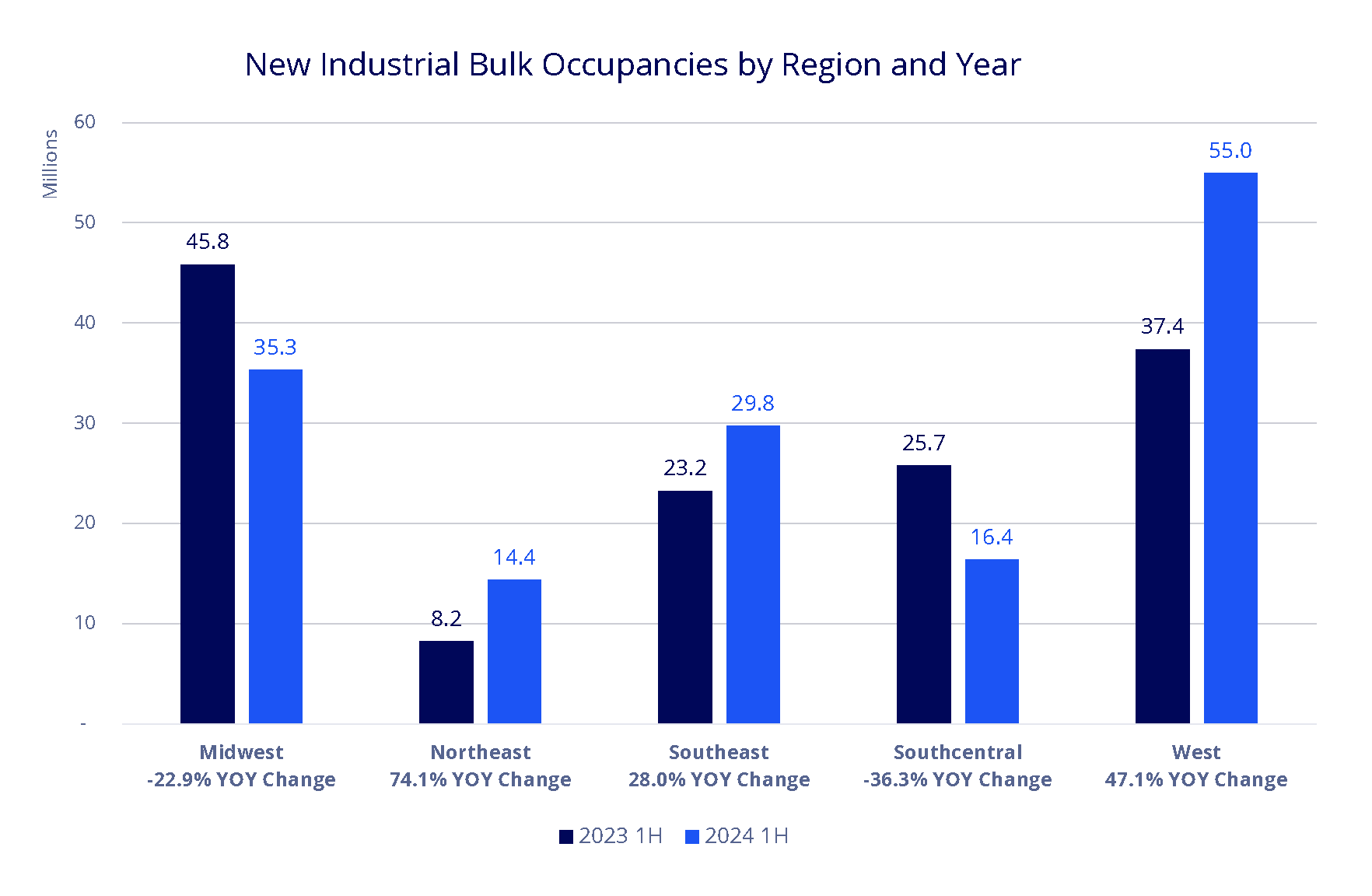

The greatest number of new bulk occupancies during the first half of 2024 occurred in the West region, where 213 tenants took occupancy in 100,000 SF or more, totaling 55 million SF. This figure was up 47% compared to the first half of 2023. The largest year-over-year increase in bulk occupancies was in the Northeast region, where they totaled 14.4 million SF, up 74%. Bulk occupancies in the Southeast region increased by 28% year-over-year during the first half, while they decreased in both the Midwest and Southcentral regions.

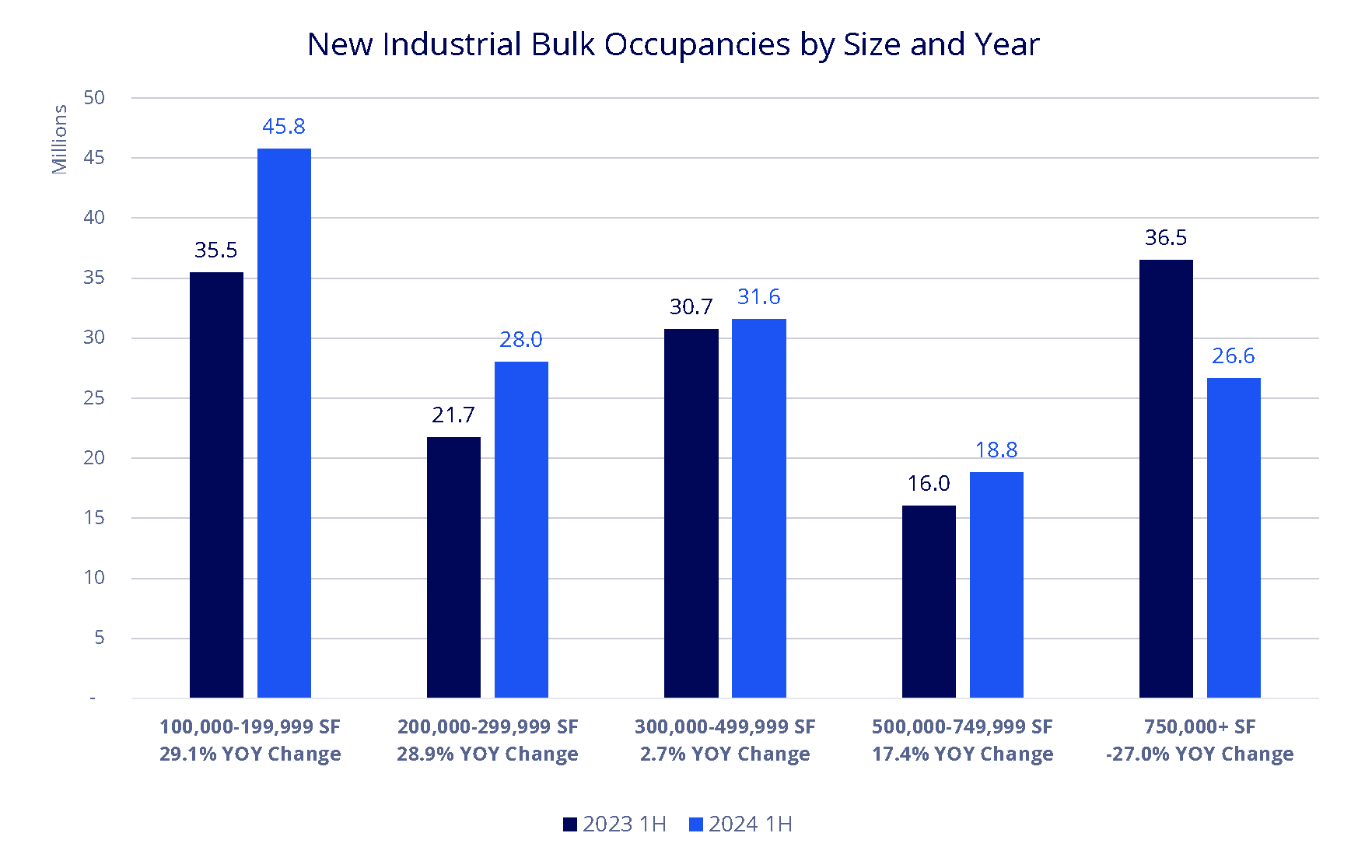

Bulk occupancies greater than 100,000 SF increased in all size segments during the first half of 2024 except for new occupancies 750,000 SF or greater, which decreased by 27% compared to the first half of 2023. The largest increase occurred in new occupancies between 100,000 SF and 199,999 SF, which were up 29% compared to same time last year. As tenants take occupancy of recently-lease space during the second half of 2024, bulk occupancies will increase again, particularly in the smaller size segments.

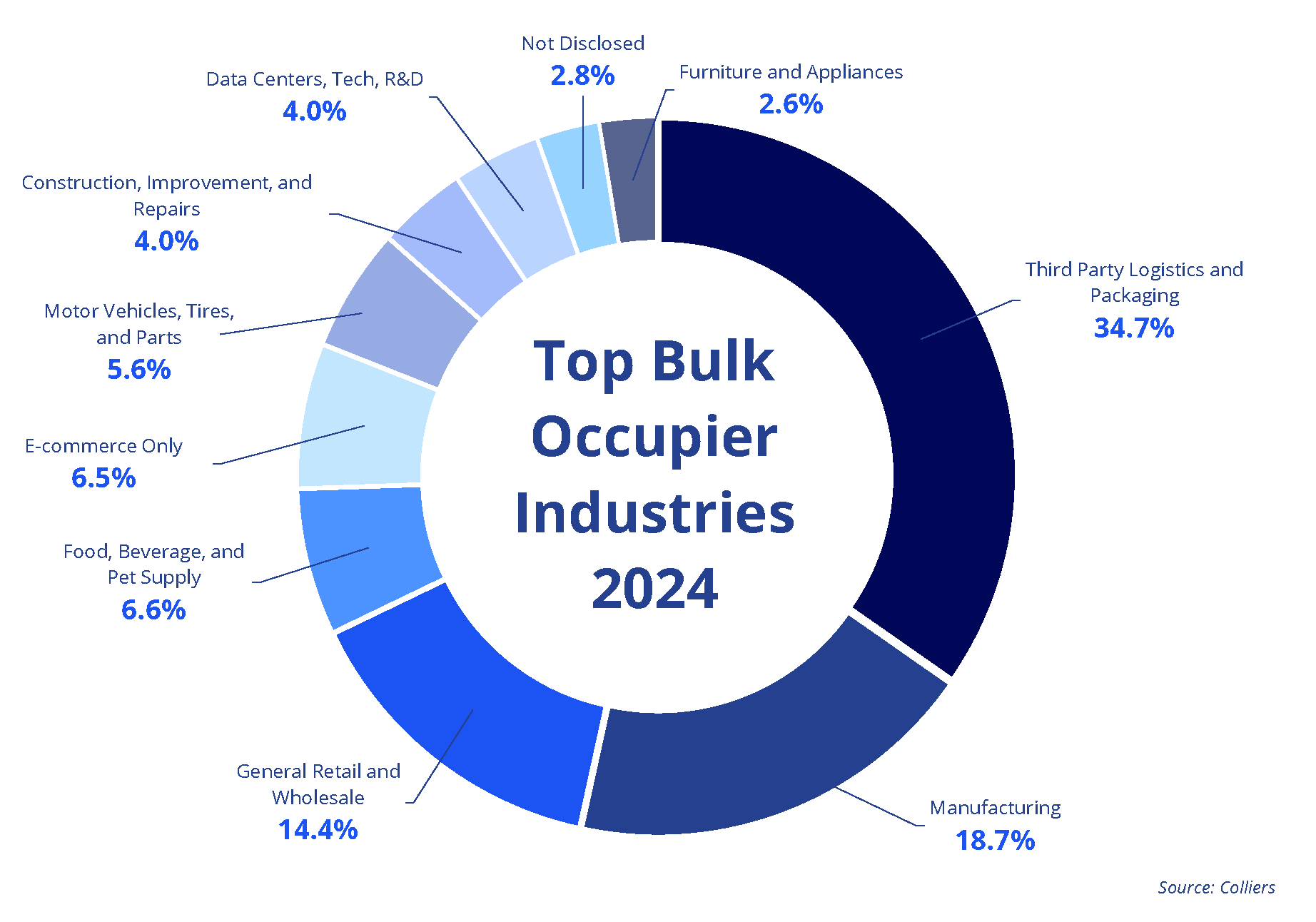

In line with the past few years, third-party logistics providers (3PLs) and packaging companies represented the greatest percentage of new bulk occupancies during the first half of 2024, at 34.7%. Demand from these industries is expected to wane over the coming quarters, as many 3PLs had leased space speculatively during the recent surge in demand, and new leasing activity from these types of users has dropped off as the 3PLs try to secure clients to utilize the space. Manufacturing occupancies increased year-over-year to 18.7%, the highest percentage this industry has represented during the recent cycle. Additional demand from manufacturing users is anticipated through the end of 2024 and into 2025 as several large, advanced manufacturing projects including semiconductor and electric vehicle battery facilities projects deliver. While e-commerce users represented only 6.5% of bulk occupancies during the first half of 2024, this figure is expected to increase over the coming quarters as Amazon recently made a new push, leasing dozens of distribution buildings nationwide 700,000 SF or larger.

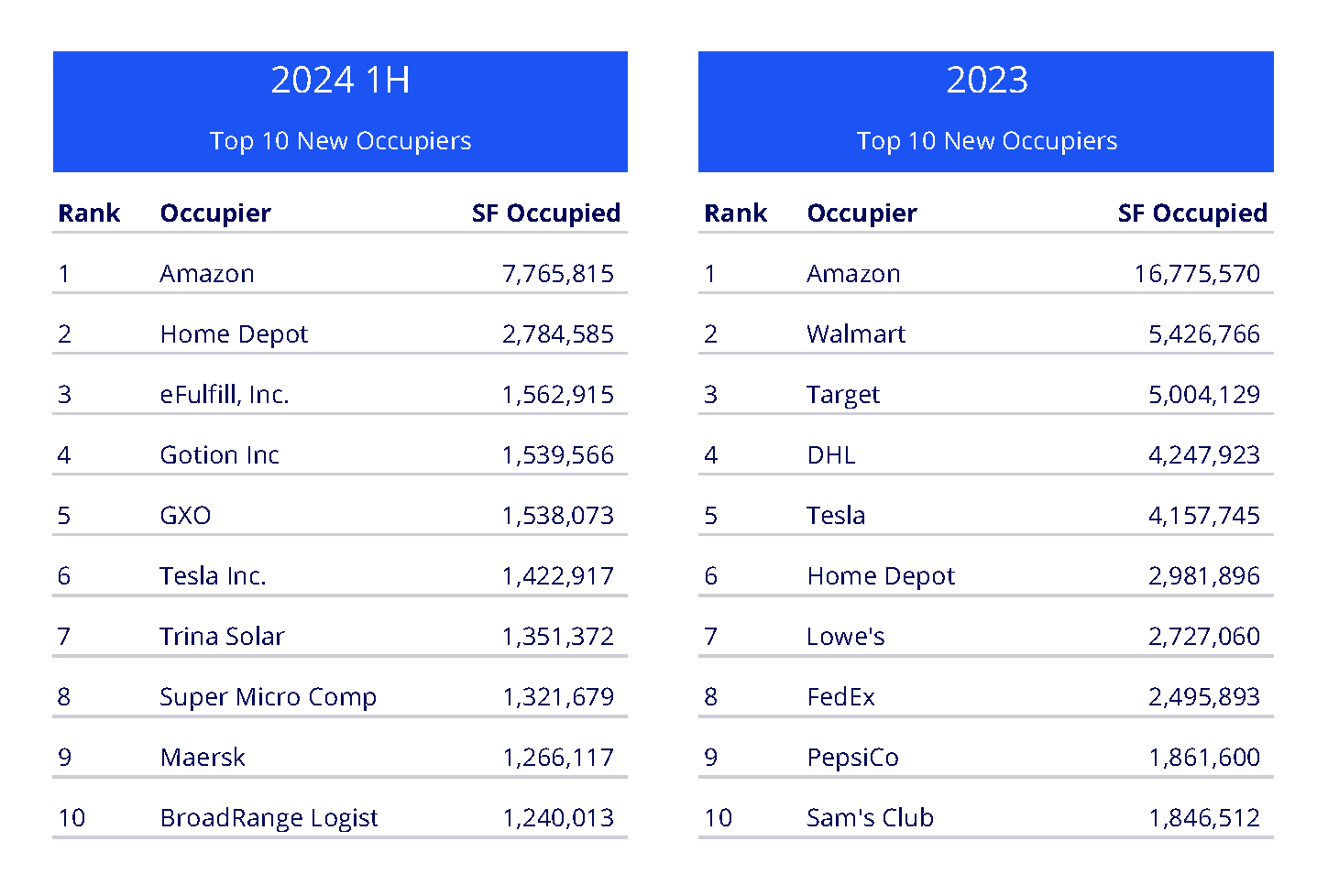

Consistent with the past several years, Amazon was the largest new occupier during the first half of 2024, taking 7.8 million SF. As Amazon takes occupancy of its recently leased facilities during the second half of the year, this figure will grow further. Home Depot was the second largest new occupier, taking 2.8 million SF year-to-date, although the home improvement retailer recently put a couple large facilities greater than 1 million SF up for sublease.

The increase in new bulk occupancies witnessed during the first half of 2024 is good news for the industrial market following a slow 2023. While demand is not expected to return to the record levels witnessed during 2021 and 2022, a gradual increase to near pre-pandemic levels is forecast. The quickly retreating construction pipeline will result in equilibrium returning more quickly than it would during a more prolonged cycle, ushering in the next growth cycle for the U.S. industrial market more quickly than most expect.

Craig Hurvitz

Craig Hurvitz

Vytas Norusis

Vytas Norusis

Justin Smutko

Justin Smutko

Aaron Jodka

Aaron Jodka