Spec suites, spaces built out by the landlord on a speculative basis, have been around for decades. Typically under 10,000 square feet, these move-in-ready suites appeal to many tenants who don’t want or know how to handle the logistics of getting office space ready to occupy. Spec suites attract tenants who lease space infrequently and want to avoid the significant timeline and process for building it out, shrinking the time a company’s operations are affected by a move. The disruption to the office market during and after the COVID-19 pandemic, has, of course, impacted spec suites, prompting Colliers to look more deeply into how tenants and owners approach these suites today in three markets: Charlotte, Miami, and Nashville.

Current Owner Sentiment

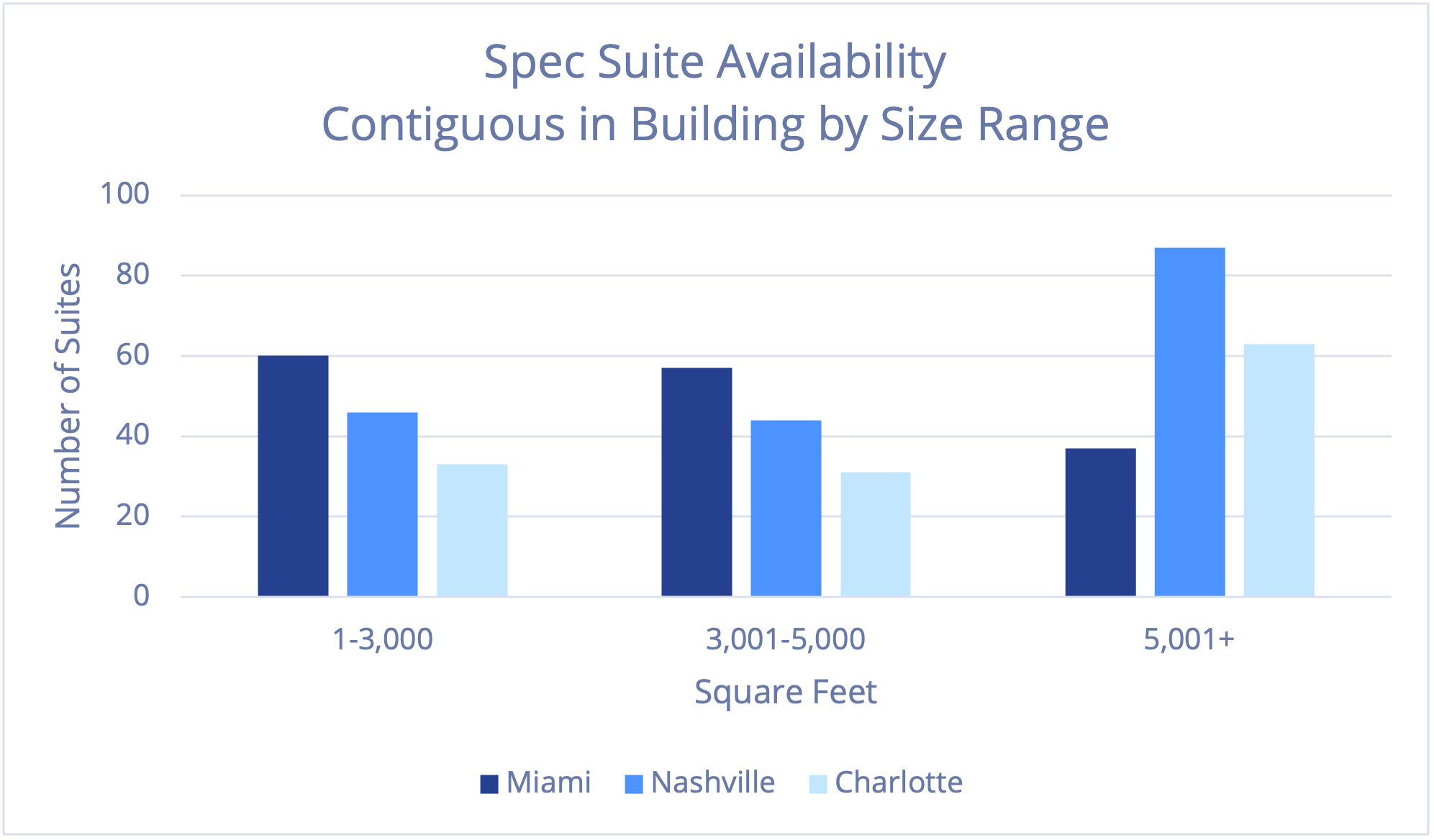

For most property owners, spec suites are not a new phenomenon. Today’s market requires education and confidence in the market’s health to justify the capital investment in these suites. Construction costs and labor pricing are high, making some owners hesitant to invest in new space without a committed tenant. Short-term forecasts do not assume a drop in construction pricing. Understanding current availability across all size ranges helps owners understand the competition and expected lease-up timeframe. Most owners succeed with spec suites when they can offer different sizes to fit the needs of various companies.

The Additional Value to Property Owners

Most buildings can command higher rent than usual for spec suites, with a 5%–10% rent premium in Miami and Nashville. Most are unfurnished, providing flexibility for prospective tenants without the need to remove unwanted furniture. Owners are typically unwilling to pay extra removal costs.

In Nashville, owners have also successfully signed new leases in other parts of their building using spec suites as real-time examples of buildout potential. Tenants can physically see the buildout as described and decide on any additional enhancements and expenses. Spec suites used as showrooms allow owners to differentiate their properties to attract tenants.

The Suite Spot

Spec suites tend to be smaller, usually between 1,500 SF and 10,000 SF. Post-COVID, suites in the 3,000 SF–6,000 SF range have attracted the most tenants in Nashville, while in Miami, the most successful suites are in the 1,500 SF–4,000 SF range. Attracting smaller tenants who do not typically commit to long-term deals, these leases are ordinarily three to five years. Trophy space, given the cost of construction, requires a minimum five-year term in Charlotte, Miami, and Nashville.

What has changed in demand post-COVID?

- Charlotte: Suites are being built without offices along the window glass line, and the number of private offices is limited to keep costs low.

- Miami: There is increased demand from new-to-market tenants due to low sublease availability and fully occupied coworking space.

- Nashville: Space layout is becoming more traditional, shifting away from open floor plans. Offices are being built along window lines, some with the flexibility to double as meeting or huddle rooms.

These examples show that spec suites will continue to attract tenants in every market nationwide. Their flexibility and lower move-in stress are crucial to tenants who need to be operational quickly with limited business disruption.

Marianne Skorupski

Marianne Skorupski Michael Lirtzman

Michael Lirtzman Kevin Gonzalez

Kevin Gonzalez Kim Kendall

Kim Kendall Ashley Harrison

Ashley Harrison

Marc Shandler

Marc Shandler Josh Cramer

Josh Cramer

Jesse Tollison

Jesse Tollison

Katie Watts

Katie Watts