- Private-label CMBS issuance has made a strong rebound in 2024.

- After posting the weakest year since 2011, 2024 CMBS issuance is due to top the 2013-2021 average of $84.2 billion.

- Single-borrower deals have been the most popular, accounting for 64% of volume through Q3.

- Early indications show strong deal flow in October, with an additional $12.6 billion in launched or pending deals.

- At its current pace, CMBS issuance this year may top $100 billion, a level last reached in 2007 and 2021.

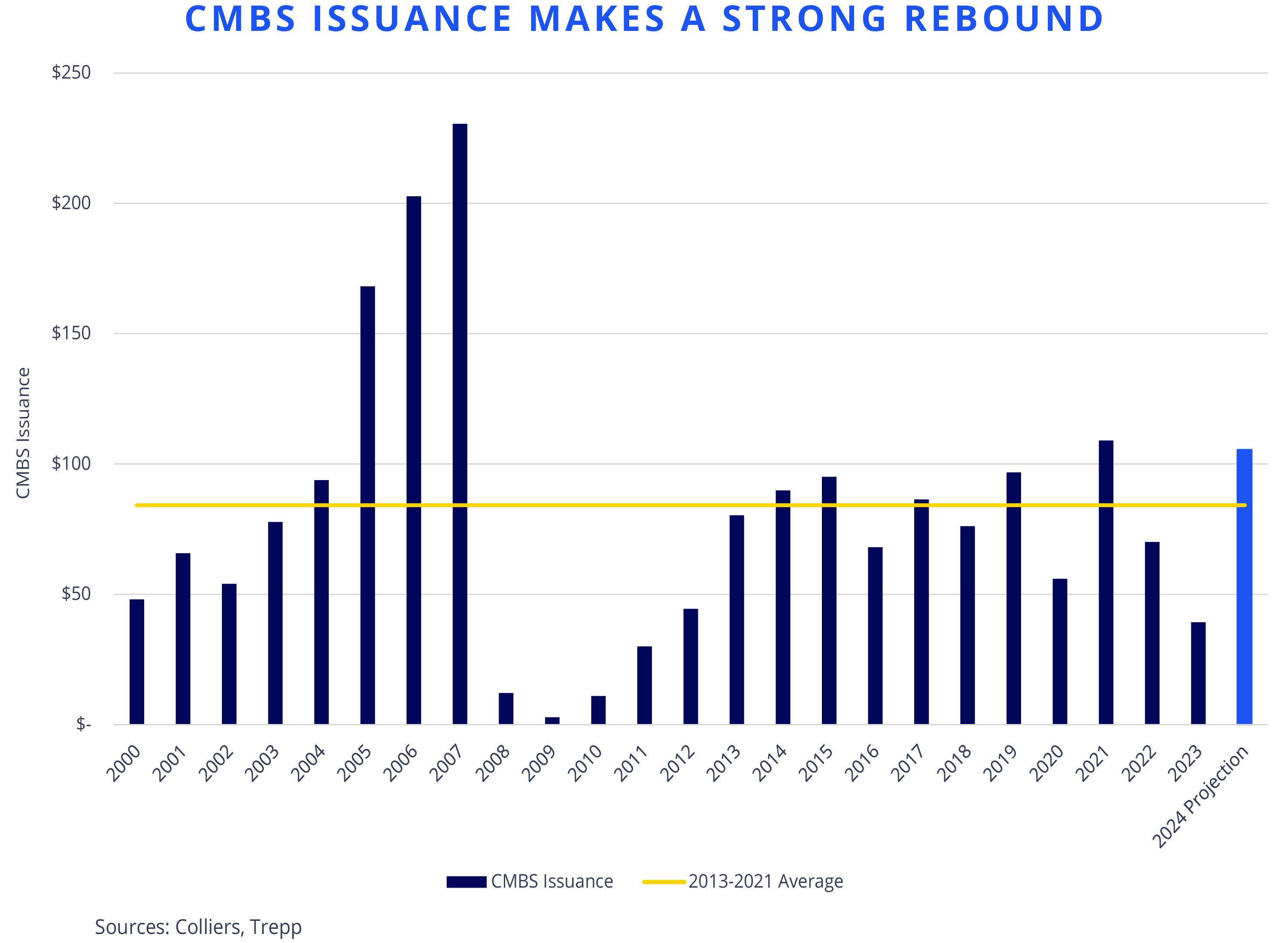

While not discounting the challenges borrowers face in finding new loans or refinancing their existing ones, a bright spot has emerged in the lending environment: private-label CMBS. That said, we are a long way from the heyday of 2005-2007 when annual issuance soared to $230.5 billion. In the pre-interest-rate cycle between 2013-2021, CMBS averaged $84.2 billion per year. Unsurprisingly, in the following years, issuance pulled back. However, in a reversal seen through Q3, the market is well on its way to exceeding the post-GFC average.

At its current pace, this year’s total CMBS issuance could top $100 billion, a feat only matched once since 2007.

Volume in the first half of this year surpassed the total for 2023. Momentum accelerated in Q3 with an additional $28 billion in issuance, a trend that looks to continue into Q4. At the start of October, launched and pending deals totaled an additional $12.6 billion. If the current pace continues, this year’s total CMBS issuance could top $100 billion, a feat only matched once since 2007. CMBS has been a successful financing avenue for single-borrower deals, with 64% of issuance through Q3 allocated to this group. Deals above $1 billion have largely been single-asset transactions. However, as the year has progressed, conduit deals are becoming more commonplace, indicating better overall liquidity for the market.

With a falling interest rate environment at hand and a banking industry still hesitant or unable to lend, the CMBS market is poised for continued market focus and debt execution for cash-flowing assets.

Colliers Insights Team

Colliers Insights Team

Marianne Skorupski

Marianne Skorupski

Steig Seaward

Steig Seaward