“Receivership” is an ominous word; “distressed” isn’t much better. Aside from ‘bad”, what does that really mean? Today, most have firsthand experience with how the pandemic transformed remote work from a perk to an amenity. Combined with the financial stress many businesses and landlords experienced during the same period, the budgets for many assets look very different than they did a few years ago. Since most commercial properties are mortgaged, reduced income has a knock-on effect that puts several financial instruments at risk.

To keep the situation in focus as it develops, it’s important to understand how the lifecycle of distressed assets differs from profitable properties. Property deal structures can vary significantly, but the basic principle of distress means they all have a few things in common: for whatever reason, cash flow or expenses at a property have changed and it can no longer generate the income necessary to support the costs associated with owning and operating it. Depending on how significant that problem is, lenders may get involved and could go as far as initiating receivership proceedings in court.

I’m not distressed, you’re distressed

Distressed properties aren’t technically in any kind of trouble. If stakeholders can continue to pay bills out of their own accounts, the discussion becomes semantic. They can, effectively, buy time to revise their plans. Others – often smaller investors and single private owners – require the building’s cash flow to meet all its financial obligations. Early conversations with lenders and property managers can help manage the situation, but loans nearing the end of their terms (due to the large sums of money involved, loans at the end of their terms typically still have a significant principle obligation) pose a more severe challenge. If stakeholders cannot devise a plan to return to profitability and the market value of the building is less than the amount owed, lenders have a fiduciary responsibility to act and protect their own interests. Whether lenders and borrowers come together to create workouts that give them a new lease on life or they initiate receivership proceedings depends on a lot of variables, but it boils down to whether the lender believes the asset’s performance can change.

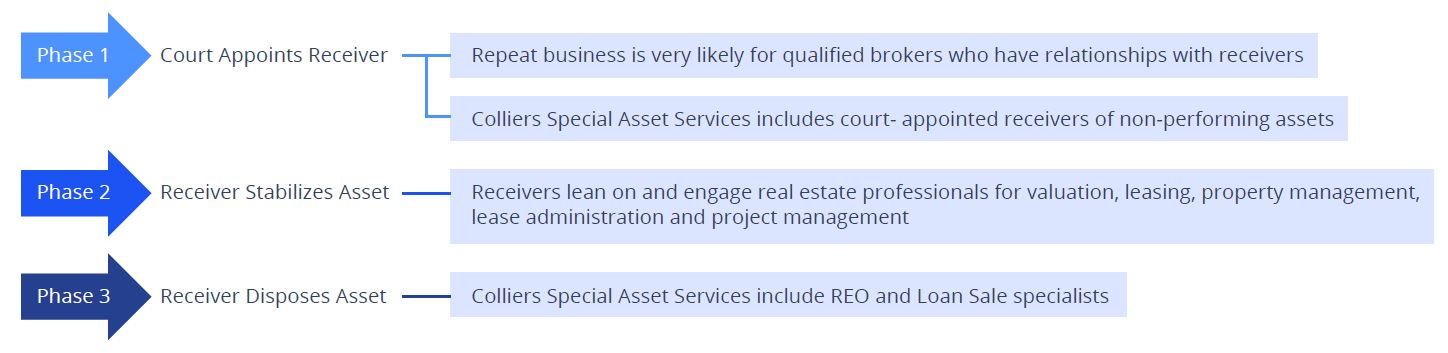

When lenders see no recourse, they may petition the courts for relief, filing a motion to appoint a receiver. In their view, the distress and lack of prospect for improvement force intervention. Once on the docket, the situation becomes complex, as a court appointed Receiver takes legal possession of the property along with all duties and responsibilities for preserving assets and cash flow. Receivers file monthly reports with the court and have the latitude to hire property management, leasing and sales agents. Importantly, if this designee assists in restoring a satisfactory financial position, he or she may discharge the proceedings. For lenders, the appointment of a receiver may be a highly desirable outcome versus auction or sale.

When lenders see no recourse, they may petition the courts for relief, filing a motion to appoint a receiver. In their view, the distress and lack of prospect for improvement force intervention. Once on the docket, the situation becomes complex, as a court appointed Receiver takes legal possession of the property along with all duties and responsibilities for preserving assets and cash flow. Receivers file monthly reports with the court and have the latitude to hire property management, leasing and sales agents. Importantly, if this designee assists in restoring a satisfactory financial position, he or she may discharge the proceedings. For lenders, the appointment of a receiver may be a highly desirable outcome versus auction or sale.

Cash flow problems can seem like a catastrophe-in-wait, but often it’s still very possible to stop the bleeding without extreme measures. This is when an experienced management team shines as it’s time to look at leases, build a detailed picture of commitments and recoverable expenses, evaluate service contracts and analyze utility costs. Requiring extensive knowledge of best practices and benchmarking, this process is as much about knowing where to look as it is about adding machines. The pairing of distressed properties and property management is so effective that many senior managers are also court appointed receivers, so consulting with an operations expert from outset is often the best chance of recovery. The same person, or one with the same objective, may end up taking the same steps later as Receiver.

Unfortunately, some stakeholders are surprised when late payment notices start arriving. To avoid that, start here: do you know if assets you’re involved with are going to struggle, or if they are facing financial difficulty today? If you don’t, get involved. Spend some time with bank statements and talk to the accountants that manage them. What you’re looking for is no more complicated than what schools taught in home economics: is there enough money to cover expenses without worrying about when payments and invoices are delivered? Waiting for tenant payments to post before paying essential services invoices is a big red flag. Late mortgage payments are even worse; if it happens enough, the loan holder can assert authority to take control of finances and ensure they are paid first. That may not be a death knell from a financier relationship standpoint, but it will make workouts and future projects more difficult.

Rough seas ahead

The remote work exodus shrunk the tenant market, with even those electing to keep in-person workplaces reducing their footprints, lowering rent rates and, for some properties, pushing cash flow beneath the threshold necessary to pay receivable accounts. Accordingly, the appraised value of many buildings fell overnight. Nearly $1.2 trillion commercial mortgages expire in 2024 and 2025, according to Guggenheim Investments and the Mortgage Bankers Association. Not all of those will show up in court, or even experience operating hiccups. However, those that are finding themselves in distress have precious little time to correct course.

That sounds dire and for some, it will be. However, the industry is not staring down an inevitable catastrophe, leaving everyone wondering how many life rafts the government will float. The financial picture of a property is not solely controlled by whimsical market forces. Cutting expenses, creating new revenue streams, identifying new uses, and even capital investments can all change the financial picture of a property, making it more attractive to buyers and easier to underwrite. Lenders are also not without their own tools to mitigate damage; many understand that a significant amount of value can be recovered over time. In the most extreme cases, government agencies serve as a backstops to prevent failures from cascading over from one lender to another. Still, those that heed these warning signs and act to protect their investments will be in a much more favorable position.

If you only remember one word about what to do with commercial properties in a challenging environment, it should be “experience.” The less time properties spend weighing down investors, the better it is for all parties. That means it isn’t the time to experiment with a new strategy, spend money speculatively, or learn to navigate murky waters alone. Management firms with personnel that are already approved Receivers hold distinct advantages because they have demonstrated they can safeguard value. More than just box-checkers, they have the knowledge to chart a clear path forward and the resources to quickly make progress.

Courts are typically slow-moving and the number of properties demanding their attention will not decrease in the foreseeable future. So what can property stakeholders do today, short of rolling up their sleeves and printing ledgers, to stave off distress? Call the property manager and start asking questions: what kind of cost cutting is possible; what’s the building’s current financial picture; what kind of things are tenants saying; do you have receivership experience? If the answers aren’t satisfactory, it may be time to interview replacements. Distressed properties and court receiverships are fraught with hidden risk and a competent advisor is invaluable.

If the answer is not that the local team has routine contact with colleagues that are on court receiver lists, then consider surveying options. At Colliers, a senior Managing Director oversees the process with a communication line directly to an experienced Receiver. He or she goes in to each assignment with an outline of common problems and how to solve them, guidance on what to examine, and a resource with access to the entire property management national leadership team.

Third parties that are trusted, known quantities and deliver on commitments are valuable partners. To learn more about how Colliers considers the complete picture of a property, develops plans that meet your budgetary limitations, and can effectively manage the entire distress cycle, please contact Steven J. Smith, Regional Managing Director [email hyperlink]. Steven is Colliers’ property management receivership specialist and is able to provide details regarding processes and availability.

Andrew Steele

Andrew Steele

Nicole Larson

Nicole Larson