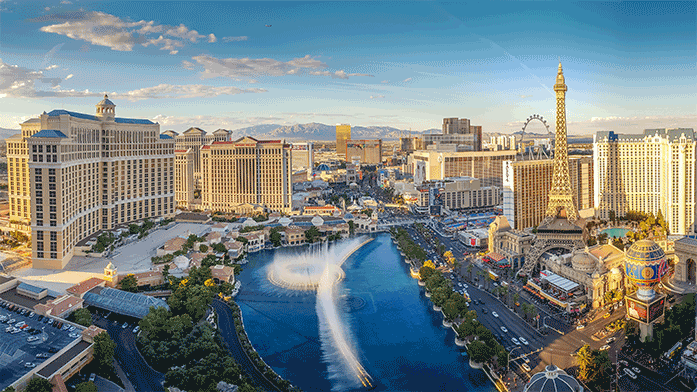

ULI’s Fall Meeting took place October 28-30 in Las Vegas. Here are 10 observations from the Emerging Trends in Real Estate session.

- Debt will be more readily available in 2025 relative to 2024. However, it will still be undersupplied based on market needs.

- Industrial ranks as the top asset class for investment.

- The top five markets for international migration are Florida, California, Texas, New York, and Massachusetts. Immigration will be needed to drive future population and working-age growth.

- Core capital has returned, actively looking at deals and speaking to sponsors and fundraisers.

- Dallas ranks as the top market to watch, followed by Miami and Houston. Boston remains the only market in the top 10 that would be considered a supply-constrained or “core” market. Manhattan ranked #11.

- Business travel is exceeding leisure travel. This trend could shift performance metrics across markets and brands.

- The U.S. consumer remains resilient, supporting overall GDP growth, as well as the retail asset class.

- There remains a wide gap between the cost of homeownership and renting, supporting a positive outlook for continued strength in multifamily absorption.

- Office has become deeply discounted, presenting investors with opportunities to find

diamonds in the rough. - Senior housing, build-to-rent, temperature-controlled industrial, life sciences, student housing, and data centers are all popular among investors.

Aaron Jodka

Aaron Jodka

Anjee Solanki

Anjee Solanki