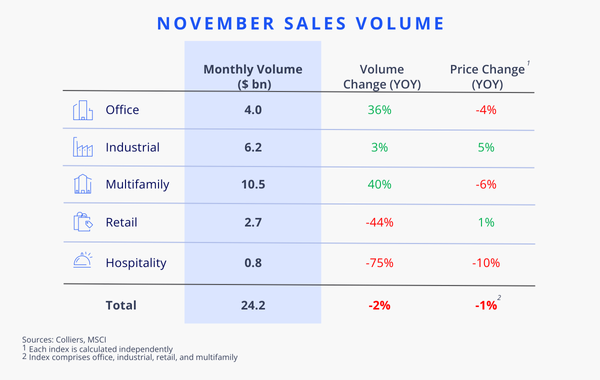

- Although monthly volume was down 2% compared to last November, year-to-date volume is up 2%.

- Deal velocity remains muted, a trend the market has yet to overcome.

- Office and multifamily lead in overall volume growth.

- Once again, multifamily topped $10 billion in monthly volume.

- Stabilizing market conditions are setting the stage for a more robust 2025.

Aaron Jodka

Aaron Jodka

Deal velocity remains muted, a trend the market has yet to overcome. However, stabilizing market conditions are setting the stage for a more robust 2025.

Office

With $4 billion in sales, office has seen among the strongest year-over-year increase in activity of all asset classes, up 36%. As with other asset classes, the number of deals remains constrained.

In November, multiple deals above $100 million closed, including the $255 million sale of 799 Broadway in Manhattan. Savanna acquired the 182,000 SF building for $1,400/SF. Additionally, Los Angeles County completed its acquisition of the Gas Company Tower at 555 West 5th Street for $200 million, or $152/SF.

Industrial

Industrial volume rose 3% compared to last November, with more properties traded in the month than in October, contrary to the overall market trend.

In one of the month’s highlights, Peakstone Realty Trust acquired a $490 million industrial outdoor storage portfolio from Alterra Property Group and JP Morgan Asset Management. Meanwhile, EQT Exeter remained active, scooping up a 31-property portfolio from Raith Capital Partners and Equity Industrial Partners.

Multifamily

Multifamily continued its streak of year-over-year volume gains, marking six consecutive months of growth. In each of those months, volume topped $10 billion.

Two major acquisitions drove November volume. Standard Communities acquired a 6,000-unit affordable housing portfolio spanning Arizona, California, Colorado, and Texas for $1 billion. Meanwhile, Brookfield Asset Management purchased an 8-property, 4,143-unit portfolio from BREIT for $845 million. The properties are spread across Arizona, Ohio, Nevada, and North Carolina.

Retail

Retail has yet to show a meaningful rebound in activity. Following a modest monthly gain in October, volume has once again fallen below last year’s levels, with only 232 properties trading in November.

Lightstone Group bought The Outlet Collection Seattle in Auburn, WA, for $82 million, or $88/SF. The new owners plan to invest another $10 million into the property. In Matthews, NC, Windsor Square sold to Hackney Real Estate Partners for $70.1 million, or $106/SF, while Vanderbilt University acquired the Park Place Shopping Center in Nashville for $66.9 million, or $1,115/SF.

Hospitality

Hospitality sales took a step back in November, falling below $1 billion in volume for the first time since April 2023. Unlike recent months, there was no major resort trade to help prop up activity.

Prospect Ridge acquired the 228-room Holiday Inn Express in Manhattan’s Chelsea neighborhood for $59.8 million, or $262,412/key. Additionally, the Crowne Plaza North Augusta in North Augusta, SC, traded for $37 million, or $205,556/key. Flacks Group acquired the property from Ackerman & Co. and Greenstone Properties.