Industrial real estate has once again led the pack in the Urban Land Institute’s annual investor survey. As reported in the 2016 Emerging Trends in Real Estate, industrial not only ranked as the top sector for both investment prospects and development prospects for the second year in a row, it also posted its highest score since 2004.

Plus: The Fed should rip off the band-aid already! | World’s busiest ports

Why the strong interest in warehouses and industrial property? And why are offices and especially retail centers lagging? Certainly investors have been attracted by the sector’s strong property fundamentals—occupancy rates and rents are now above pre-recession peaks—which have pushed industrial to the top property returns. But what has driven the strong property performance, and why more than offices and retail? Answers to these questions reflect nothing less than fundamental changes in how we work and shop. Though many factors contribute, the essence of the transformation can be demonstrated in just three charts.

Also: Workplace wellness makes for healthy business | The different types of commercial real estate leases

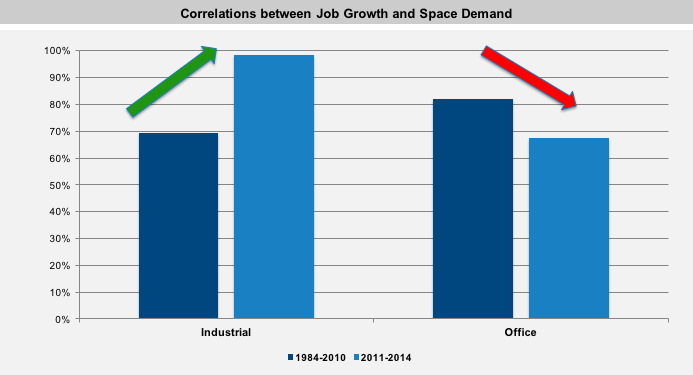

First, consider the relationship between job growth and property space demand. Jobs are the single most important driver of real estate occupancy, but as shown in this first chart, that connection is growing for industrial space and falling for office space.

In the 25+ years prior to 2011, there was a 70 percent correlation between overall job growth in our economy and industrial space demand nationally. Thus, a 10 percent gain in jobs would be associated with a 7 percent increase in industrial demand. In the past four years, however, that link has jumped to virtually 100 percent—meaning almost a 1:1 percentage correlation between job growth and industrial space demand. Over the same time, however, the correlation between job growth and office space demand has declined from over 80 percent between 1984 and 2010, down to less than 70 percent since then.

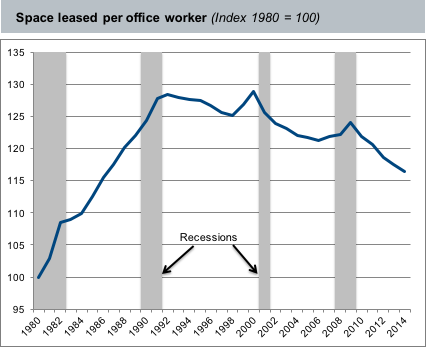

The declining demand for office space relative to economic growth at first might seem counterintuitive. Isn’t the U.S. economy becoming more “white-collar,” at the expense of manufacturing and other “blue-collar” jobs? Yes, but office-based firms are also becoming much more efficient in their use of space. In the second chart we track the amount of office space leased per office worker, which has been declining since about 1990. The ratio rose during the last two recessions, as firms could not shed space as fast as they let go workers. But during the subsequent recoveries, firms didn’t lease much additional space once they began hiring again. In fact, we’re adding only about half as much space per new worker in this recovery than is typical. Firms are organizing their offices more efficiently and allocating less space to their workers, reflecting both new, more collaborative ways of working as well as firms’ greater attention to profitability. Technology improvements have also enabled more workers to take advantage of telecommuting, further reducing office space needs—at least in the traditional “workplace.”

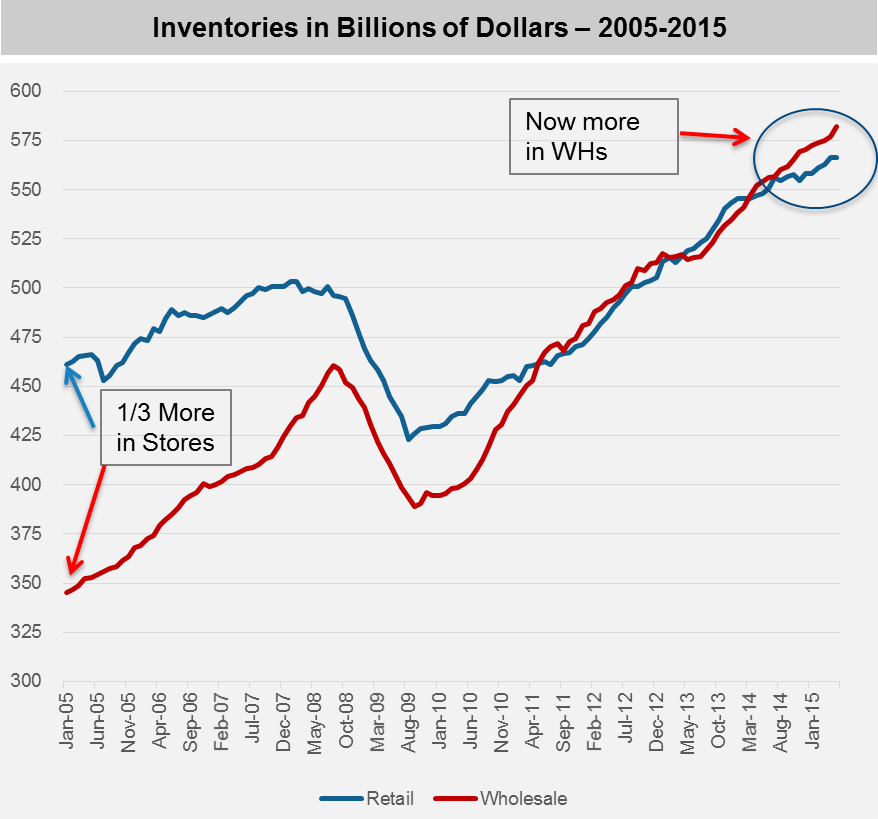

And what accounts for the relative rise industrial space demand? In a word: e-commerce, which is fundamentally changing logistics and the way we move goods from manufacturer to the consumer. As shown in the final chart: As recently as only a decade ago, retailers used to store one-third more inventory in the backrooms of their stores than did merchant wholesalers in their warehouses. Now more goods are stored in warehouses.

Retailers stock less product in their stores and sell more product from their warehouses via the e-commerce divisions of traditional brick-and-mortar retailers and pure-play online retailers. In sum, fewer goods are shipped to physical stores. Thus, the value of goods stored with wholesalers rose about three times as much as the growth in retail inventories over the past decade. Of course, rising international trade and the housing market recovery are also important factors in the warehouse revival. But the move toward e-commerce—and consumer expectations for next day and even same-day delivery—go a long way toward explaining why the industrial sector has been so strong.

Some analysts expect to see the pendulum swing back a bit for office space leasing, as at least some workers rebel against ever-smaller cubicles and open spaces. But the trend toward more efficient space use for offices seems enduring, while the move to e-commerce at the expense of brick-and-mortar stores continues to gain momentum. Thus, expect to see leasing in the industrial sector outpace both offices and retail space. Who knows? Maybe these trends will be enough to make the industrial property sector sexy at last.

Colliers Insights Team

Colliers Insights Team

Craig Hurvitz

Craig Hurvitz

Raul Saavedra

Raul Saavedra

Greg Gosselin

Greg Gosselin