- Affordable housing investment has set a record pace through mid-year.

- Potentially rising income tax rates will make it even more attractive.

- The incentives for owning affordable housing differ from those for multifamily properties, so it’s important to understand its nuances.

- Since capital is shifting from other asset classes to this space due to its stability and predictable cash flow, cap rates are compressing.

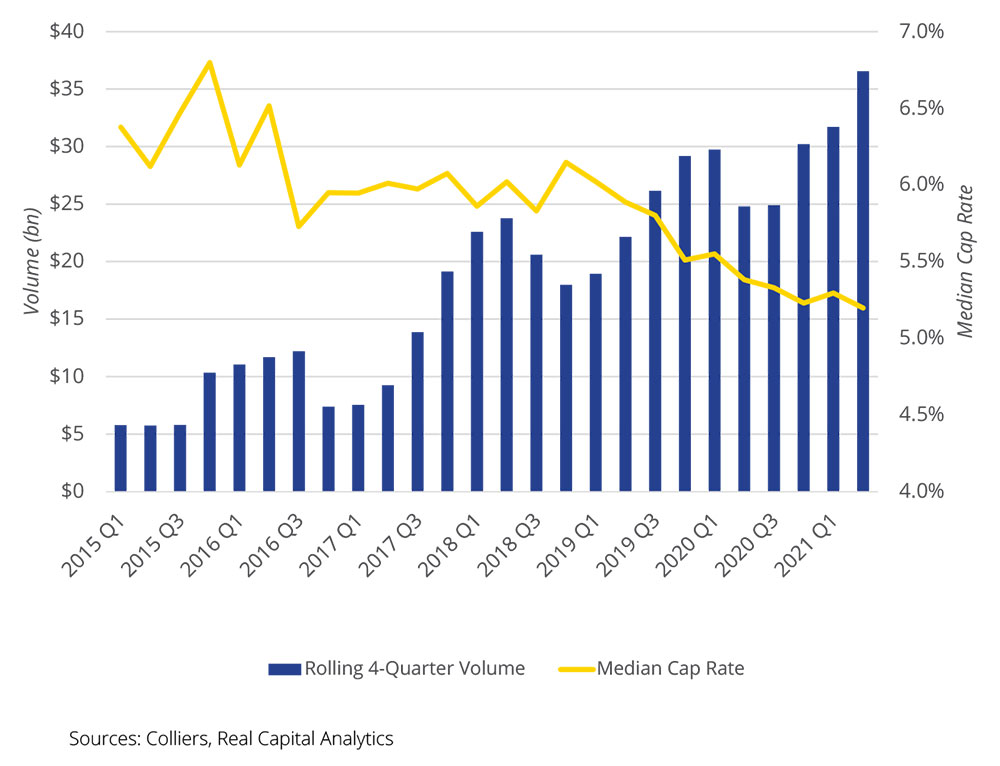

The affordable housing sector has bucked the trend of other asset types — total sales volume was higher in 2020 than in 2019 and has hit a record-setting pace through the first half of the year, per data from Real Capital Analytics. Cap rates continue to compress, and institutional investors have been net buyers since 2018, through 2021 year-to-date. Investors witnessed the stability of the asset type throughout the pandemic, when the collective fear of move-outs and higher vacancies didn’t materialize. Given this stability, the sector is attracting owners from across asset types.

But it’s important to note that affordable housing is more complicated to invest in than standard multifamily. The incentives are different, including numerous rules and regulations, tax credits, clawbacks, and deal-specific clauses and nuances. Expertise in understanding the ins and outs of this space is essential.

There are numerous ways to structure a ground-up deal, whether it is a 4% bond deal (less government equity provided for a deal), a 9% deal (higher equity, but a competitive process to land funding), or differing general partner/limited partner agreements. After certain qualifying locational criteria are met, tax credits are provided for 10 years. After year 15, deals are often re-syndicated (the process is redone by acquiring new tax credits), to update the properties. Throughout this process the owners earn various fees (developer fees, management fees, maintenance fees, etc.), some clearly codified in the tax code and others not.

With a pivot of capital, increased focus on ESG, and a dire need for affordable housing throughout the country, this space will be front and center for many investors. The largest players, according to Affordable Housing Finance, include LDG Development, The NRP Group, Dominium, Johnathan Rose Cos., and Pennrose. With the potential for rising tax rates, low-income housing tax credit (LIHTC) deals will become even more appealing.

Aaron Jodka

Aaron Jodka

Nicole Larson

Nicole Larson