- After a fantastic 2021, REIT performance in 2022 was one of the most challenging since 1972.

- The Nareit All Equity REITs total return was -24.9%, weaker than the Dow Jones drop of 19.4%.

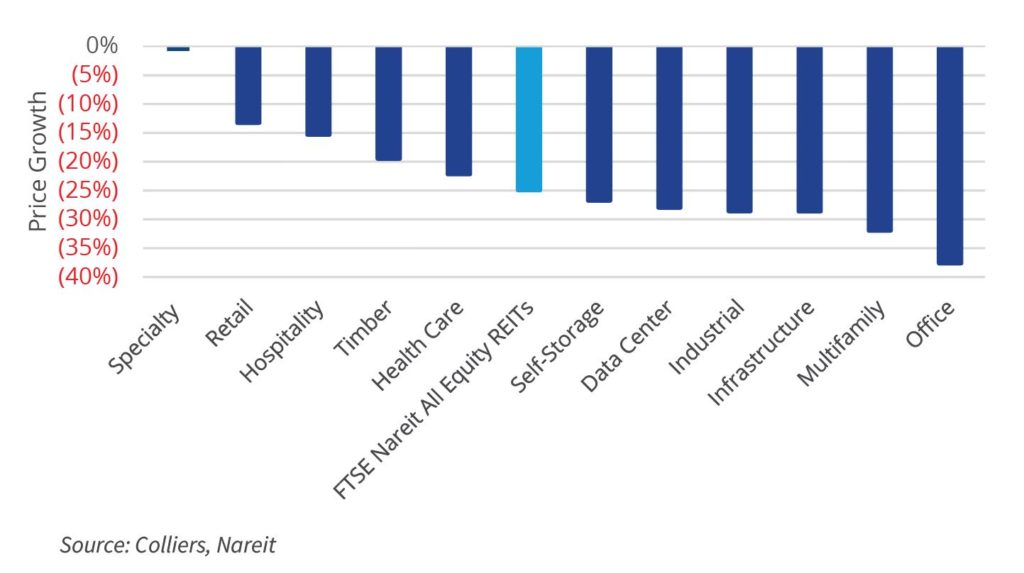

- Office faced the most significant declines, down 37.6% on the year. Multifamily wasn’t far behind at -32.0%.

- No sectors were positive, though specialty, which includes casinos and movie theaters, were mostly flat.

- Attractive REIT valuations could yield privatization plays in 2023.

It was a tough year for REIT performance in 2022. After a tremendous 2021, the market reversed course, with total returns down 24.9%. This marks just the third time in Nareit’s history, dating back to 1972, that the overall index declined by more than 20%. Note that this includes dividends, so REIT performance was far weaker than the Dow’s 19.4% decline. No sector posted gains, though specialty REITs, including casinos, movie theaters, and assets that don’t fit neatly in another category, were mostly flat on the year. Retail and hospitality posted the best relative performance of the major asset classes, down 13.3% and 15.3%, respectively. At the opposite end of the spectrum, office was down 37.6%, multifamily fell 32.0%, and industrial declined 28.6%.

It has been a volatile ride for REITs in recent years. That yo-yo effect continued into the start of 2023. January was a strong month for REIT performance, with total returns up 10.3%. After the beating that REITs took in 2022, valuations are looking attractive in many instances. Market caps for individual REITs are well below asset values, suggesting that privatization plays could be in the offing. Debt financing is a challenge, so these deals would likely come from cash-rich private equity or sovereign wealth funds. This would go a long way toward boosting investment sales volumes, which are expected to be limited in the first half of the year.

Aaron Jodka

Aaron Jodka