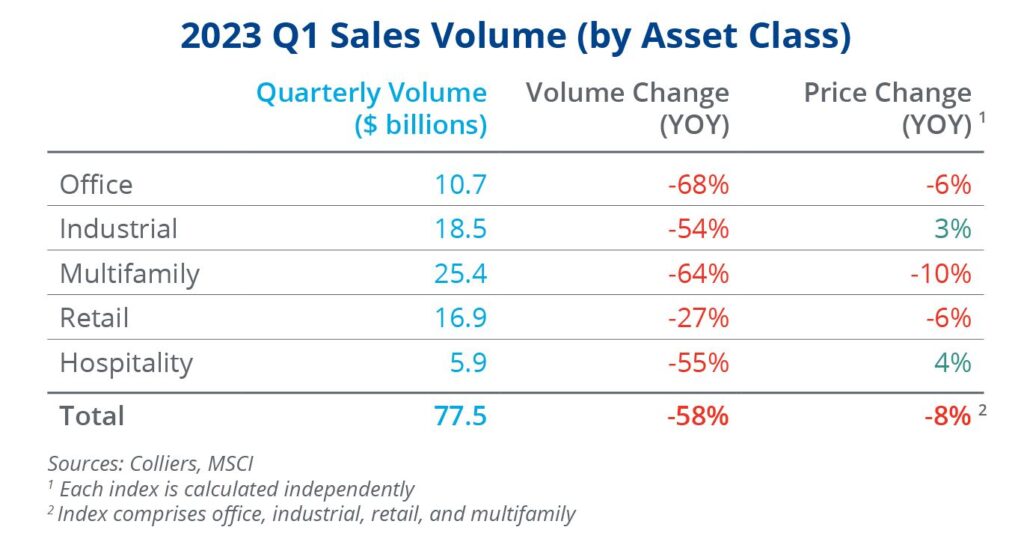

- Investment volume is down 58% from last year, hitting the lowest number since 2013 Q1.

- Office volume decreased the most, 68% below 2022 Q1.

- Pricing is falling across most asset classes. Hospitality is up 0.3%, and industrial is flat, the only asset classes not to decline quarter-over-quarter.

- Multifamily has faced the largest price drops.

- Price discovery remains a challenge.

First quarter volume slumped to $77.5 billion, the slowest start to the year since 2013. Prices are falling across most asset classes, with multifamily showing the most substantial adjustment, per MSCI. Banking volatility during the quarter will likely weigh on early Q2 volume. Inflation figures continue to show signs of cooling, though they remain above the Fed’s target. Meanwhile, the forward curve suggests that rates will fall from current levels in the quarters ahead, supporting investment sales activity.

Office

Office volume of $10.7 billion was the lowest Q1 total since 2010. Overall, volume is down 68% from year-ago levels, the most significant decline of all asset classes. Pricing is also falling, at an annualized rate of 11.4%, per MSCI. CBD volume is particularly weak, down 78% year-over-year, while just $2.6 billion traded in the quarter, the lowest since 2010 Q1. There have only been five quarters dating back to 2001 with lower CBD activity, all taking place during the Global Financial Crisis.

Industrial

Industrial is holding up better than most asset classes. Pricing is up year-over-year by 3.3% and held during Q1. Overall, volume totaling $18.5 billion is 54% lower than the start of 2022 but remains above the 2015-2019 average. Of all asset classes, industrial can make a case for a reversion to the mean. Investors can still underwrite rent growth and mark-to-market upside on transactions. In addition, cap rates remain disparate, offering intriguing value opportunities for buyers.

Multifamily

Multifamily is facing the most considerable pricing adjustment of all asset classes. MSCI reports pricing is down 10.3% year-over-year. However, looking at near-term movement, prices are down 23.1% on an annualized basis, using Q1 as a barometer. This drop is creating interesting buying opportunities. MSCI reports that cap rates have converged across garden and mid- and high-rise properties. Historically, garden units price at a higher cap rate. This trend suggests that either higher density assets are a value, or garden properties can expect further cap rate expansion.

Retail

Retail volume totaling $16.9 billion was down just 27% from last year. This figure is inflated due to the large STORE Capital privatization. Single asset sales are down 45%, a better indicator of overall market activity. MSCI shows pricing down 5.8% from one year ago. Similar to other asset classes, the decline is accelerating, and annualizing Q1 declines indicate a 14.3% pricing adjustment. Of all retail subsets, grocery posted the most sizable volume decline, down 67%. Given current cap rate levels, grocery looks to be a value play.

Hospitality

Hospitality volume is down 55% year-over-year. However, Q1 last year was one of the strongest starts to the year ever, so volume declines look worse than they actually are. When using 2015-2019 as a benchmark, volume is down 37%. Pricing grew the most in this asset class, with MSCI reporting gains of 4.3% over the past year. However, growth is cooling, as Q1 price movement suggests a modest 1.3% annualized gain. Hospitality is the only asset class that can boast this.

Aaron Jodka

Aaron Jodka

Baily Datres

Baily Datres Mike Otillio

Mike Otillio

Jesse Tollison

Jesse Tollison

Patrich Jett

Patrich Jett