- Meaningful declines in sales volume are now apparent in reported transaction data.

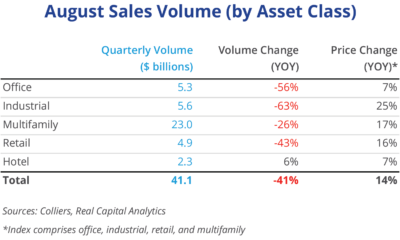

- Overall deal counts are down by half, with volume off 41% year-over-year.

- Industrial volume is down 63% from last August, with office (-56%), retail (-43%), and multifamily (-26%) also showing declines. Hotel is up 6%.

- Transactional data is a lagging indicator — prices are falling as non-cash buyers cannot pay 2021 prices with 2022’s borrowing costs.

- Those with a longer view can acquire assets with less competition than seen in years.

Office

Deals are harder to get done. At $5.3 billion, August’s monthly activity is the lowest since September 2020. Volume is off 56% year-over-year and a similar amount month-over-month. Reported cap rates are holding steady, but on the ground that is not the case. Griffin Capital sold a majority interest in a $1.1 billion portfolio of suburban assets throughout the country to Workplace Property Trust and GIC, driving about 20% of monthly sales volume. The largest single transaction was Piedmont’s acquisition of 1180 Peachtree in Atlanta for $472 million, or $705 per square foot.

Industrial

Industrial sales volume posted the largest decline in all asset classes in August. Buyers are finding accretive financing difficult, as borrowing costs are above cap rates for many deals. Monthly sales volume of $5.6 billion is down 63% from last August and 61% from July 2022. A lack of portfolio sales also held back the industrial market. The largest reported sale was of an underway 1.9-million-square-foot asset in Fairmont Mills, SC (between Greenville and Spartanburg), for $185 million, or $97 per square foot. It is preleased to Hart Consumer Products.

Multifamily

Multifamily volume in August suggests that the market is stronger than it really is. At $23 billion, volume is down 26% year-over-year but rose month-over-month by 14% due to the privatization of American Campus Communities. Single-asset sales were down 49% in the month. Price growth is cooling, and RCA’s CPPI price index showed only a 0.1% monthly gain in August. Since national cap rates are below current borrowing costs, multifamily faces headwinds. The largest individual asset sale of the month was Hines’ purchase of the 2021-built Life Time Coral Gables in Coral Gables, FL, for $429.4 million, or $867,500 per unit.

Retail

Sales are falling on the retail side. Volume of $4.9 billion was down 43% from last year and 25% month-over-month. To be fair, last August included the Kimco/Weingarten merger, so a volume drop was not unexpected, market conditions aside. Cap rates are higher in this asset class, but as pressure mounts on other property sectors, adjustments are expected here as well. The highlight of the month was Unibail-Rodamco-Westfield (URW) selling the Westfield Santa Anita for $537.5 million, or $365 per square foot, the largest single-asset retail trade in years. URW is unwinding its U.S. portfolio.

Hotel

Hotel is the lone asset class with annual sales gains in August, up 6% from one year ago. With $2.3 billion in volume, sales are up 20% month-over-month. However, one portfolio trade drove about 20% of overall sales. Monthly sales numbers are low relative to pre-pandemic figures. Yields on hotels are the highest for the major asset types, which has insulated the market somewhat from rising borrowing costs. In the largest deal of the month, BREIT acquired a six-property portfolio from Hersha for $435.9 million.

Download the report.

Aaron Jodka

Aaron Jodka

Nicole Larson

Nicole Larson