- BBB bond rates have risen in recent months, causing cap rate spreads to narrow.

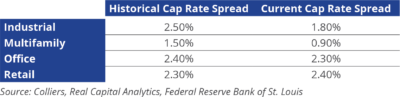

- Historically, cap rates have been about 2.4 percentage points higher than BBB bond rates for office, industrial, and retail. Multifamily has been lower at 1.5 percentage points.

- Spreads are in line with long-term trends in office and retail, and below trend for industrial and multifamily.

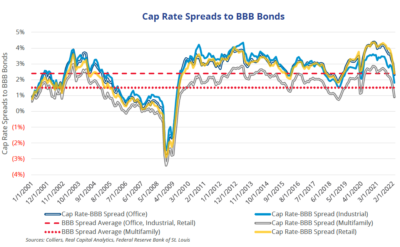

- Spreads were below trend as recently as 2018 and had multiple years in the mid-2000s where cap rate spreads were narrower than normal.

- Given real assets can have improvement in cash flow through improved occupancy and rental rates, the rising NOI environment suggests cap rates do not have to rise and can stay below trend.

Real estate investors have long used BBB bond rates as a point of comparison to cap rates. After all, the 10-year Treasury is considered a “risk-free” bond, while BBB bonds have inherent levels of risk, such as default, bankruptcy, etc. Since the beginning of 2022, BBB bond rates have moved from 2.7% and topped 4% in recent days. This has caused the spread between these bond rates and cap rates to narrow. In fact, across the major property types, this spread (cap rates less BBB bonds) is back in line with its long-term average for office and retail, while it is now slightly below in industrial and multifamily.

Since the Great Financial Crisis (GFC), cap rate spreads have generally been above their long-term trend. For office, industrial and retail, that spread has historically averaged between 2.3 and 2.5 percentage points (cap rates above BBB bonds). Multifamily trades at a tighter spread of 1.5 percentage points. For some short periods in 2018 and early 2019, these spreads dipped slightly below their long-term average (the COVID-19 disruption, too, caused volatility in the series).

Below average spreads can be unusual for extended periods of time. From mid-2005 up until the GFC, real estate traded at spreads below their long-term trend to BBB bonds. Once the GFC occurred and BBB bond rates blew out, spreads even turned negative for a short time. Real estate’s solid fundamentals, particularly on the industrial and multifamily side, stand in stark contrast to BBB bonds. A bond is a bond, and while they trade on the open market causing price movement, the coupon is a fixed rate. Improving occupancies and rents have and continue to fuel strong NOI growth. Retail’s recovery has begun, while office has also stabilized. This suggests that real estate can, and rationally should, act differently than BBB bonds in a rising interest rate environment. Add in real estate’s ability to hedge against inflation (for the same reasons mentioned above, rising rents and NOI), and there’s further support for movement to below trend spreads. Fear not: Cap rates can hold or continue to compress.

Download the report.

Aaron Jodka

Aaron Jodka

Nicole Larson

Nicole Larson