- The Fed is nearing an end to increasing interest rates.

- This is leading to more stability in borrowing costs.

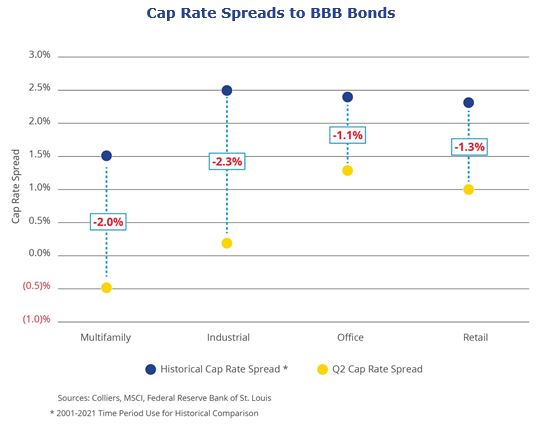

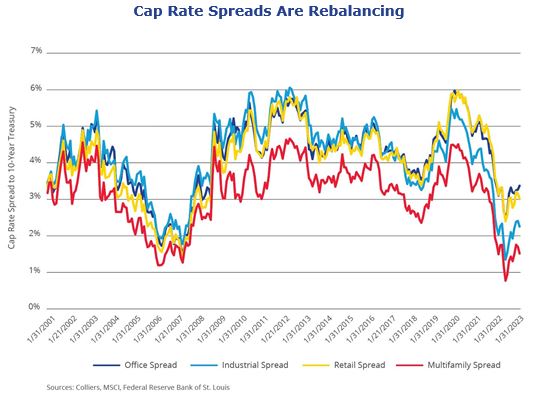

- Tight cap rate spreads to both 10-Year Treasuries and BBB bonds remain, though adjusted from the lows in late 2022.

- Industrial maintains the widest cap rate gap to BBB bonds, at 2.3 percentage points lower than historical spreads.

- BBB bonds are well above 10-Year Treasuries, suggesting that a return to more normal levels would help to normalize cap rate spreads.

Cap rate spreads to bonds, whether to 10-Year Treasuries or BBB notes, remain small by historical standards. However, they have rebounded from the lows of late 2022 when quickly rising interest rates caused bond rates to increase while sales data was slower to show cap rate movement. In October 2022, spreads were negative for industrial and multifamily and all but evaporated in office and retail. All asset classes’ spreads to BBB bonds were well below their normal levels at the end of Q2, and industrial and multifamily, unsurprisingly, were the lowest of all.

Where do we go from here? The forward curve for the 10-Year Treasury doesn’t show a lot of downward movement; what does, however, is the Secured Overnight Financing Rate (SOFR). If that key swap and rate index decreases, it can be argued that cap rates then don’t have to rise further. MSCI is likely to show some more cap rate movement due to the lagging effect of transactional data. In fact, listings are picking up as sellers have come around to the market’s current pricing environment.

The spread between the 10-Year Treasury and BBB bonds at the end of Q2, 2.0 percentage points, was wider than the historical average comparable spread of 1.8 percentage points between 2001 and 2021. It is not uncommon for this rate to be closer to 1–1.5 percentage points, which suggests that a return to normal — lower BBB bonds, in this case — would support more normal cap rate spreads.

Aaron Jodka

Aaron Jodka