- CMBS delinquency rates increased in three consecutive months to close out 2022.

- Overall rates are low, at 3.04% per Trepp. The all-time high was 10.34% in 2012.

- Retail and multifamily have been driving increasing delinquency rates in recent months.

- Overall securitizations were down 34% in 2022, sinking to the lowest level since 2018, per Green Street.

- Expectations are for a continued pullback in issuance in 2023 and increasing delinquency rates.

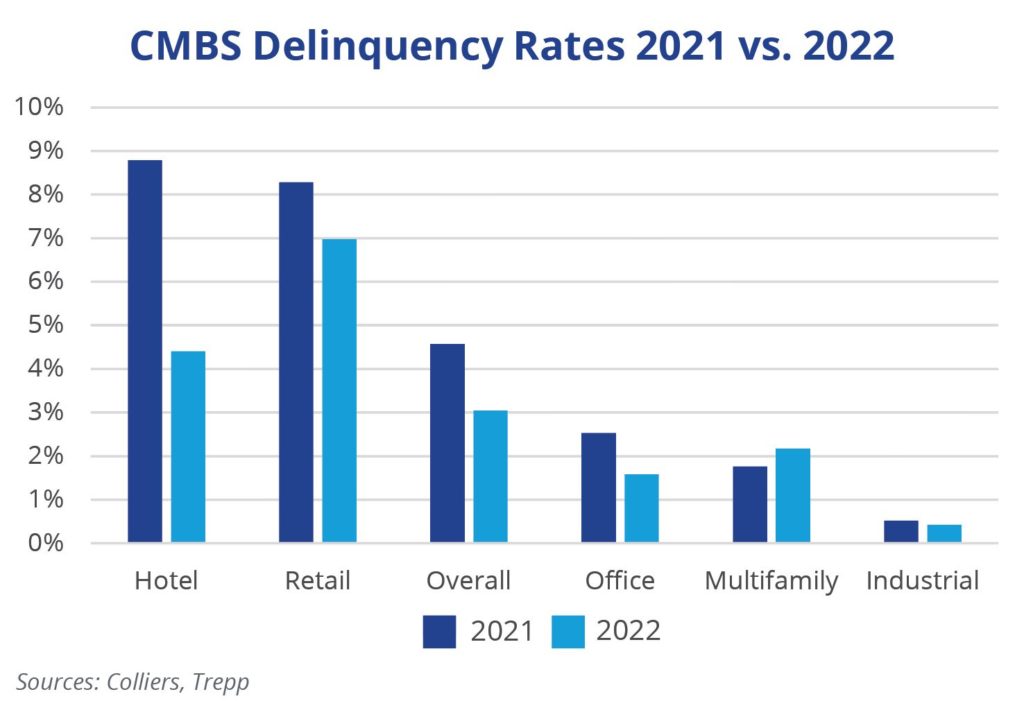

Investors are closely watching CMBS delinquency rates and watchlists. They expect distress to emerge as higher borrowing costs pinch current owners looking to refinance and create investment opportunities. At the end of 2022, CMBS delinquency rates remained low, just north of 3% per Trepp, and lower than the 4.57% reading at year-end 2021. However, they increased each month of Q4, with multifamily and retail acting as the driving forces. Retail has had the highest delinquency rate of all asset classes since March 2022. Multifamily delinquencies more than doubled since October, hitting 2.17% at year-end. This figure is above both industrial and office.

Office is expected to post higher delinquency rates in 2023 as properties struggle with occupancy challenges, slower occupier decision-making, and valuation pressure. Meanwhile, securitization issuance is facing headwinds. Securitizations fell 34.4% in 2022, hitting the lowest level since 2018, per Green Street’s Commercial Mortgage Alert databases. CMBS was down 36.5%, while CRE collateralized loan obligation offerings dropped 33.3%. A consensus has formed that issuance will be even lighter in 2023, further stressing owners and assets that need refinancing, particularly on the office side. Large office loans are regularly securitized, and with more concerns forming around that asset class, less debt liquidity will weigh on both office assets and issuance. Rescue capital is circling, and equity investors are deploying debt capital with equity-like returns.

The year begins in a very different state than it did in 2022. Optimism has been replaced with caution, and overall investment liquidity has been reduced. Still, cash-rich investors will be able to pounce on opportunities as they emerge. Meanwhile, institutional investors are acquiring certain CMBS tranches/issuance at attractive rates, feeling that the risk/return of existing loans is more appealing than new equity investment today.

Aaron Jodka

Aaron Jodka

Nicole Larson

Nicole Larson