- Economic data continues to paint differing pictures of current conditions.

- There remains a wide divergence in expectations from leading economists and real estate investors.

- PREA’s latest Consensus Forecast Survey shows an expectation for negative total returns across asset classes for the NCREIF Property Index (NPI).

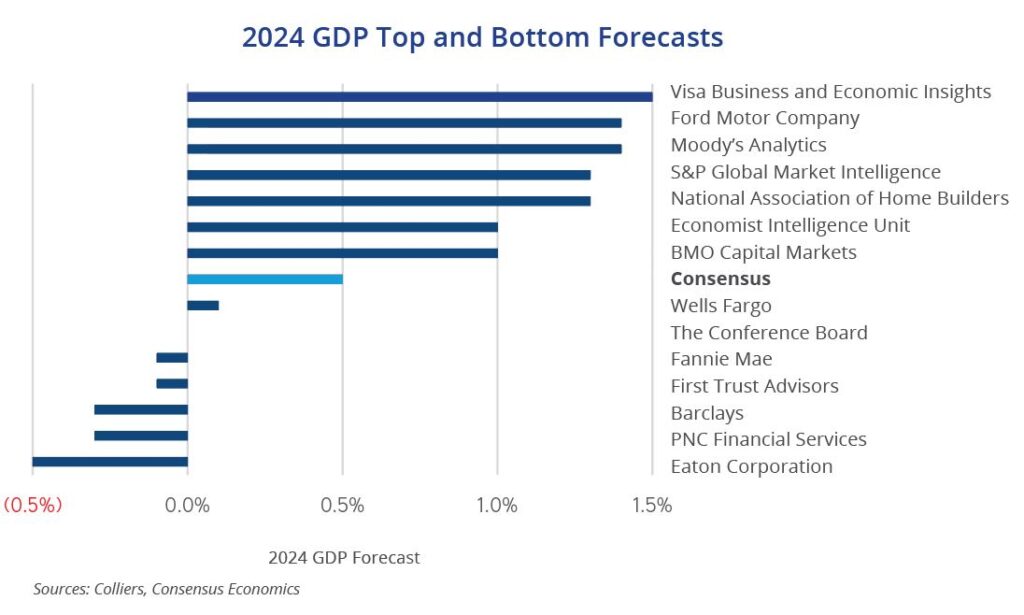

- Consensus Economics’ latest poll of leading economists and forecasters shows a lack of clarity on GDP growth.

- Investors who can pick their spots and sift through the noise stand to benefit.

It’s a tricky time to be an economist, armchair or otherwise. Data is all over the place, complicating the near-term outlook. Job growth has been surprisingly robust while manufacturing activity has been falling steadily for months. The yield curve has been strongly inverted for some time. A case can be made for either continued economic growth or an impending recession, further complicating real estate investing.

PREA’s latest Consensus Forecast Survey, based on respondents’ expectations of NCREIF’s Property Index, broadly and at the asset class level, shows a wide range of outcomes. In 2023, for example, the average total appreciation return forecast (asset value change) is down 11.3%, with a median of 11.5%. The low end of the scale is a decline of 5.2%, and the high end a drop of 21.2%. Office and industrial have the widest ranges, from −9% to −35.7% and −0.9% to −20%, respectively. Values should begin to rebound in 2024, with office lagging.

Meanwhile, there remains a lack of consistency in Consensus Economics’ latest report on the outlook for GDP growth. Forecasts range from Eaton Corporation’s contraction of 0.5% to Visa Business and Economic Insights’ expected growth of 1.5% in 2024. The median forecast is for growth of 0.5%, a slight downgrade from last month’s forecast, though expectations for 2023 have been raised.

Generally speaking, a recession has detrimental effects on markets. However, understanding the underlying fundamentals between asset classes, supply and demand drivers within local markets, and historical performance and volatility can aid investors in constructing portfolios. Some markets will face notable adjustments, while others will likely skate through relatively unscathed.

Aaron Jodka

Aaron Jodka