Cross-Border Investment is Shifting

- Cross-border investment surged in 2021, nearly doubling 2020 levels.

- International capital represented 8.5% of all sales, in line with 2019 levels.

- Foreign capital has made its way outside of the major core coastal cities.

- Industrial is now the largest target for international capital with multifamily ranking second.

- The expected recovery of CBD office should lure capital back to that sector in the years ahead.

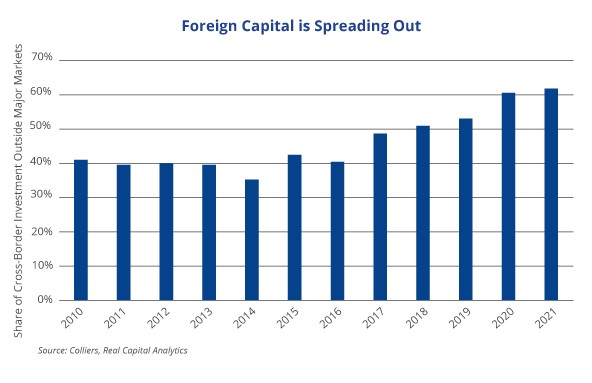

Cross-border capital flows recovered strongly in 2021 to a share of total investment volume in line with 2019 levels, though still well below peak levels of 2015–2017. More notable is the shift in international capital flows: The adage that foreign capital doesn’t take connecting flights no longer applies. Last year, 62% of cross-border investment was outside the major markets (though Boston and Manhattan ranked in the top three overall). That is significantly higher than recent averages of 40% of such investment in non-major markets from 2011–2017.

There are multiple reasons for this shift outside of major markets (Boston, Chicago, Los Angeles, New York, San Francisco, and Washington, D.C.). CBD office sales volume, historically the driving force for international capital investment, has been relatively constrained over the past 24 months. On the other hand, multifamily and industrial volume has surged all over the U.S. Industrial received the largest amount of capital in 2021, followed by multifamily. As major portfolios traded throughout the country, cross-border capital has followed. The rapid growth in e-commerce is market-agnostic, since demand has surged across the country, driving the need for industrial and warehouse space. Migration patterns have long favored the Southeast and Southwest, which have attracted heavy concentrations of multifamily investment.

This added liquidity is great news for rapidly growing Southeast and Southwest markets. Atlanta, Phoenix, and Dallas all ranked within the top five for total foreign investment. Canadian capital sources dominated in each of these markets, along with a higher-than-average share of Middle Eastern capital. However, European capital (the only net seller year-over-year) was limited in these markets. Portfolio allocations are shifting as investors recognize the growth opportunities in these demographically outperforming markets.

Download the report.

Colliers Insights Team

Colliers Insights Team

Nicole Larson

Nicole Larson

Steig Seaward

Steig Seaward