- Medical office building (MOB) vacancy fell 10 basis points in 2021, while Office vacancy rose 160 basis points.

- An increase in absorption and slowing deliveries drove the improvement in fundamentals.

- Average net asking rents rose 1.7% in 2021, to a new high of $22.61 per square foot.

- 50.4 million square feet of MOB space is underway across the country, 70% of which is off-campus.

- Investment sales set records in 2021, and 2022 started with a splash with Healthcare Realty Trust and Healthcare Trust of America announcing a merger valued at $18 billion.

The MOB market continues to show its resiliency. Fundamentals improved over 2021, with rising absorption, falling vacancies, and rising rents. Nearly 20 million square feet of new space delivered in the year, with another 26.1 million square feet started. A total of 50.4 million square feet are underway. MOB construction remains concentrated in off-campus facilities that provide readily accessible locations and out-patient clinics to accommodate the shift away from in-patient hospital care. Off-campus properties — which tend to be smaller than new on-campus facilities — account for almost 70% of projects underway.

There are currently 1,092 healthcare real estate projects under construction, 389 of which are hospital developments. Most current hospital developments involve expansion or replacement of existing facilities; new facilities comprise only 25% of projects. The five states with the most MOB square footage under construction are California, Florida, Texas, New York, and Ohio. The same five states also top the list of hospital construction activity. Houston leads the country in total square footage underway (2.4 million square feet) followed by Chicago and New York (1.7 million square feet). Orlando, with 1.6 million square feet underway, leads the nation in development as a percentage of inventory at 13.7%. The national average is 3.3%.

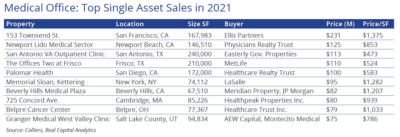

With such strong performance, investors have taken notice. A total of $17.4 billion traded in 2021, the highest on record. Medical real estate is no longer perceived as a niche asset class. Average MOB cap rates stood at 6.1%, 20 basis points lower than at Q4 2020 and the lowest among the seven property types that comprise the medical real estate universe. Sub 4% cap rates have been recorded for prime MOB trades. The MOB buyer profile is heavily dominated by the Investor/Private group, which accounted for 67% of MOB sales volume in 2021. REITs follow next with a 24% share and the total is rounded out by Hospital & Health Systems (7%) and Providers (2%).

The trend of increasing allocations to MOB and healthcare shows no signs of slowing in 2022. In February, Healthcare Realty Trust and Healthcare Trust of America announced a merger valued at $18 billion. The merger will create one of the largest pure-play medical office REITs in the market, comprised of over 700 properties totaling 44 million square feet.

Download the report.

Aaron Jodka

Aaron Jodka

Nicole Larson

Nicole Larson