Hotel Spending is Back

- Hotel sales were among the strongest on record in 2021.

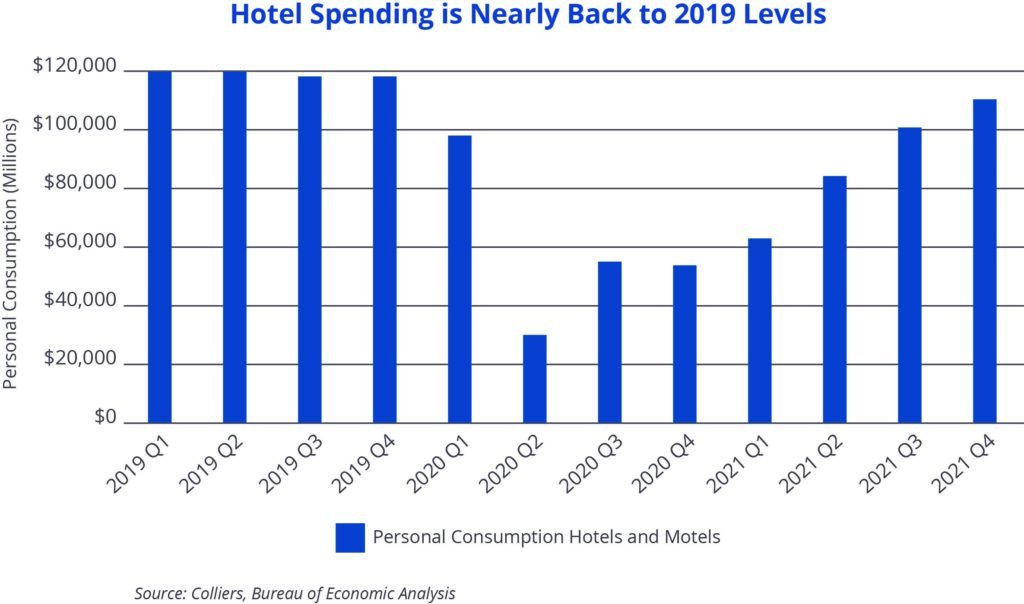

- Hotel travel spending is back – to just 6% below 2019 levels.

- Coastal markets have attracted some of the strongest sales growth and hotel revenue performance.

- Room rates have soared, particularly in the luxury space, driving RevPAR and sales topping a million dollars per room.

- As business and international travel picks up, hotel revenue performance will only strengthen.

Hotel investment has been on a tear. Total sales volume in 2021 was the third strongest on record, topped only by sales in 2007 and 2015. The $44.5 billion in hotel sales last year added up to the strongest year-over-year sales growth for all asset types, up 238%. And no wonder: consumer spending on hotels is back in a big way.

The Bureau of Economic Analysis reported that personal consumption spending on hotels and motels nearly matched 2019 year-end figures. That is remarkable given the relative lack of business travel. In comparison, air transportation and amusement park, campground, and other recreational spending remains well below 2019 figures. Leisure travelers are particularly focused on trips along the coasts, which mainly benefits Florida, and more broadly, the Southeast.

In fact, sales in Orlando, Miami, Tampa, and Fort Lauderdale ranked these cities among the top 25 most active hotel markets for sales volume. Sales growth in each year-over-year was well above the national average. Miami, for example, has one of the few airports in the country that had stronger domestic airport travel counts in 2021 than in 2019.

Investors are banking on further recovery, especially in the luxury space. We have seen multiple million-dollar-plus per room sales prices in recent months, from coast to coast. RevPAR has grown more from rates (ADR) than occupancy, outside of extended-stay hotels, where occupancy has been tremendously stable. In leisure destination markets such as Fort Lauderdale, Miami, Myrtle Beach, Palm Beach, and Tampa, 12-month ADR at year-end 2021 grew above year-end 2019 levels. Myrtle Beach was tops in this group, with room rates 25% above 2019 levels, per STR data.

This growth is translating into ever-higher sales prices. Our teams are selling assets for well above recent appraisals and in fact, above 2019 appraisals. Markets from Cape Cod to Jekyll Island to the Florida Keys have all generated strong RevPAR gains and high ADRs. The big-spending traveler is back, and that is great news for continued hotel performance and investment opportunities.

Download the report.

Aaron Jodka

Aaron Jodka