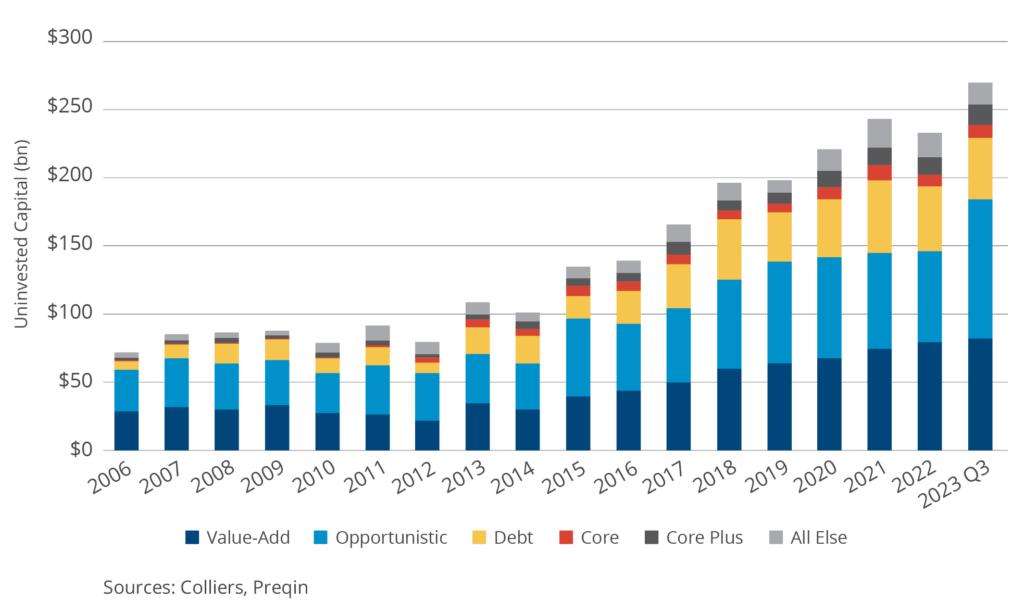

- Investors are sitting on more uninvested capital than ever before.

- A total of $270.6 billion targeting North American real estate was available at the end of Q3.

- Opportunistic capital leads the way, with more than $100 billion available. This figure totals more than all real estate strategies in 2014.

- This record amount is even more impressive given the sales volumes of 2021 and 2022.

- The cash haul could help put a floor on future distressed sales as investors chase opportunities.

With commercial real estate investors waiting to deploy $270.6 billion, per Preqin, more cash than ever is available to spend. Opportunistic, value-add, and debt strategies have the most capital overall. That is nothing new, as these strategies have accounted for roughly 84% of funds since 2010. Opportunistic strategies have more than $100 billion, the first time any single target allocation has crossed that threshold. Could this support a price floor in the case of distress? With so much money chasing these deals, someone is likely to bite. This scenario won’t play out in every situation, and some asset values will be significantly adjusted. We are beginning to see this capital put to work higher in the debt stack, where investors can get equity-like returns in a debt position. Cash buyers stand to benefit from the dislocation in the market now and into the future.

Upcoming loan maturities have been a hot topic among the capital markets community, and rightfully so. Lenders are starting to see assets come back, or they are opening the door to short sales and loan sales. The amount of parked capital available offers a ray of hope and stands as one of the brighter spots in the market today. The biggest challenge is likely meeting IRR hurdles. Given the cost of debt, some of this capital will be stuck, as unlevered returns typically cannot meet targets alone. Overall, investors are well positioned to capitalize on the types of deals that will need capital and the opportunities that will likely present themselves.

Aaron Jodka

Aaron Jodka