- The slowdown in investment is starting to show in transactional data.

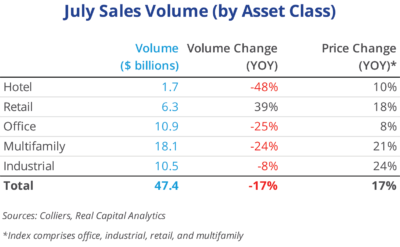

- Aggregate sales volume in July of $47.4 billion was down 17% from one year ago.

- Retail is the only asset class with year-over-year gains, up 39%.

- Hotel has seen the biggest declines, down 48%, followed by office (-25%) and multifamily (-24%).

- Sales, however, are still above the 2015-19 July average of $36.9 billion.

Office

Office volume of $10.9 billion fell 25% from last July, which, outside of December 2021, was the strongest month of sales post-pandemic. That factor makes monthly comparisons seem more extreme. The average monthly volume from 2015–19, $11.8 billion, is a better benchmark. Office price growth of 8.2% over the past year is the slowest in all asset classes. Cap rates have yet to show upward pressure in transactional data. In the largest deal of the month, Apple acquired an eight-property portfolio in San Diego for $445 million, or $545 per square foot. Other top deals took place in Atlanta, Houston, Chicago, and Manhattan.

Industrial

Industrial sales volume fell 8% from last year and 34% month-to-month to $10.5 billion. However, this is well ahead of pre-pandemic-era average monthly volume of $7.2 billion between 2015–19. Price growth leads all asset classes at 24.4% over the past year. Cap rates are showing upward movement, with the trailing three-month rate 30 basis points higher in recent months. The largest deal of the month was Pontegadea, the family office of Amancio Ortega, acquiring a six-property portfolio of single-tenant assets in multiple states for $567.2 million. This demonstrates the continued attractiveness of industrial to international capital sources and high-net-worth individuals.

Multifamily

A lack of portfolio sales caused multifamily volume to slump 24% year-over-year. Pricing is still up 20.9% over the past year, but this growth is slowing. Total volume of $18.1 billion continues to lead all asset classes. Putting this in context, from 2015–19 monthly volume averaged $14 billion, so the market is still highly liquid. Transactional cap rates are showing signs of leveling off, but have yet to move upward. The largest deal of the month was A&E Real Estate acquiring 160 Riverside Boulevard in Manhattan for $415 million, or $912,000 per unit. Other large single-property deals topping $200 million took place in San Jose; Elmsford, NY; Anaheim; Kirkland, WA; and Los Angeles.

Retail

Retail leads all property types in year-over-year volume growth, up 39% from last July. Overall volume of $6.3 billion is in line with pre-pandemic monthly levels from 2015–19, and pricing is up 17.7% over the past year. Transactional cap rates have not yet moved up; in fact, this is the only property type with continued cap rate compression. The largest deal of the month was DRA Advisors and KPR’s joint venture acquisition of a 33-property portfolio of grocery-anchored centers for $879 million. Numerous deals topped $100 million in the month, including the largest single-property transaction, RPT Realty’s purchase of Mary Brickell Village in Miami for $216 million, or $400 per square foot.

Hotel

Hotel volume has always been choppy, though July’s total of $1.7 billion is a down month. Volume is off 48% from a year ago, the biggest difference among all asset classes. Pricing is up 10.1% over the past year, however, and transactional cap rates have stabilized. From 2015–19, monthly sales averaged $3.3 billion. No portfolios were driving volume; the largest deal was the Hyatt Regency La Jolla, sold for $227.3 million to IQHQ, a life sciences developer that has been buying up properties nearby. Nashville continues to attract strong investment activity, this time with Pyramid Hotel Group acquiring the 255-room Cambria Hotel Nashville Downtown for $109.5 million, or $429,000 per room.

Download the report.

Aaron Jodka

Aaron Jodka