- Sales volumes are down 72%, on average, over the past year through April.

- Unsurprisingly, lenders are putting out less capital.

- Given the concentration risks to commercial real estate construction loans, many banks will essentially be out of the market.

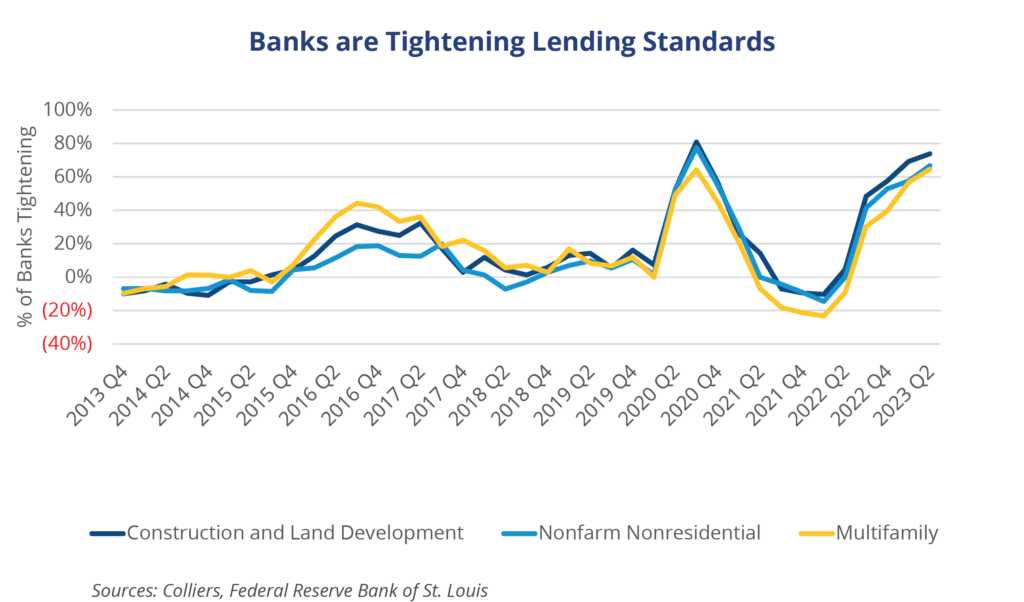

- The Fed’s latest lending survey shows a high share of lenders have tightened standards, making it more difficult for borrowers to refinance or secure a new loan.

- Potential regulation seeking additional capital requirements for banks may only exacerbate this challenge.

Securing financing is more challenging today. Not only has the cost to borrowers increased, but there is also less appetite in the market overall. Lenders are seeking lower loan-to-value ratios. Recourse is becoming part of the conversation again due to various factors. These include the instability in the banking industry beginning in March, a lack of loan churn (elective refinancing has dried up), and increased capital requirements. Through May, CMBS issuance declined 75% from the same period last year, while the number of deals dropped 66%, per Trepp. The Fed’s latest lender survey shows a clear upward trajectory of tightening lending standards. The net percentage of lenders doing so rose to 73.8% for construction and land development, 66.7% for nonfarm nonresidential deals (commercial), and 64.5% for multifamily. These are the highest levels seen since the third quarter of 2020 amid the pandemic.

Increased regulation is a liquidity risk. Many banks are sitting with commercial real estate and construction loan exposure in excess of 300% of Tier 1 capital, a level often seen as a tipping point in regulatory analysis. This is true in the case of both small banks, or those with less than $10 billion in assets, as well as larger ones. Smaller banks, however, have a higher concentration risk above 300% than larger banks, which have more diversified portfolios. Banks with higher exposures are more likely to reduce their lending. As noted in a previous Quick Hits, trillions in impending loan maturities are coming. Banks hold more than 60% of those outstanding loans, which need to be worked out one way or another. This could provide opportunities for the myriad debt funds out there, as well as equity capital shifting to debt strategies.

Aaron Jodka

Aaron Jodka

Nicole Larson

Nicole Larson