- Life sciences IPO activity cooled in 2022 after a blockbuster 2021.

- Companies are extending their runway by spending more conservatively.

- Silicon Valley Bank’s collapse will cause volatility in the industry in the near term.

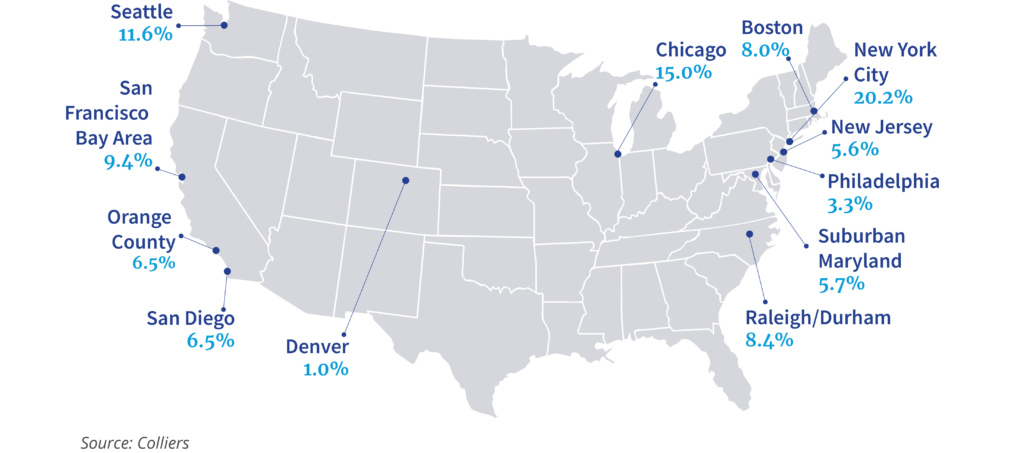

- Vacancies rose in several key markets in 2022 as new deliveries became available.

- The industry’s fundamental drivers remain in place with an aging population, continued need for medical treatment, and new scientific discoveries.

- Life sciences assets are seen as a strong alternative investment class and are capturing office allocations as a result.

The recent collapse of Silicon Valley Bank is reverberating throughout the life sciences. SVB was a significant funding source for the industry, and its receivership and subsequent breakup are causing companies, founders, and VCs to rethink their banking relationships and find new partners and letters of credit. This scenario is still playing out and will likely cause additional volatility in market activity in the near term.

In 2022, general investor sentiment across asset classes and industries shifted to a risk-off mindset that affected venture capital (VC) funding and the IPO market. While over 100 companies went public in 2021, only 23 did so the following year, less than the number offered in Q1 of 2021. In addition, many of 2021’s IPOs ended 2022 trading well below their launch price.

VC investors remain sitting on large sums of uninvested capital, which will keep life sciences companies going. Young biotech and life sciences companies are spending more conservatively to extend their runway between funding rounds. This trend is causing slower leasing in many markets, and vacancies increased year-over-year. Still, context is important here. Some markets, such as Boston, operated with a 1% vacancy rate in 2021, which was unsustainable, discouraging business growth and stifling innovation. Occupiers are welcoming a more normalized vacancy rate, finding wider availability of ground-up purpose-built product and conversion and sublease space on the market.

The tremendous investment in life sciences in recent years comes with a need for the talent so critical to this industry. Other fast-growing sectors can hire recent college grads en masse, but the expertise needed in life sciences takes time to acquire. Additional training programs at colleges and universities, international migration, and recruiting are helping fill some of these talent gaps. However, holders of advanced degrees, particularly PhDs, are truly driving scientific breakthroughs.

What hasn’t changed are the underlying fundamentals of the life sciences industry. As the U.S. population ages, there is an increasing need for medical care and discovery. However, the life sciences industry is inherently volatile: breakthroughs take time and substantial capital investment and are, in and of themselves, uncertain. Nevertheless, life sciences remains the top alternative asset class, attracting pension funds and other institutional investors. This trend is boosting its liquidity, despite an overall slowdown. Continued office-to-lab or cGMP conversions are expected as the office market rebalances.

Today’s Quick Hits is based on our recently released Life Sciences report. In it, we explore the top major and emerging life sciences markets across the U.S. To read more, please click the link below.

Aaron Jodka

Aaron Jodka

Charles Dilks

Charles Dilks Victoria Abbasi

Victoria Abbasi Miles Rodnan

Miles Rodnan

Sheena Gohil

Sheena Gohil Bob Shanahan

Bob Shanahan

Anjee Solanki

Anjee Solanki