- The Mortgage Bankers Association estimates $4.47 trillion of commercial real estate loans are on lenders’ books.

- Roughly 60% of these loans are due by 2027.

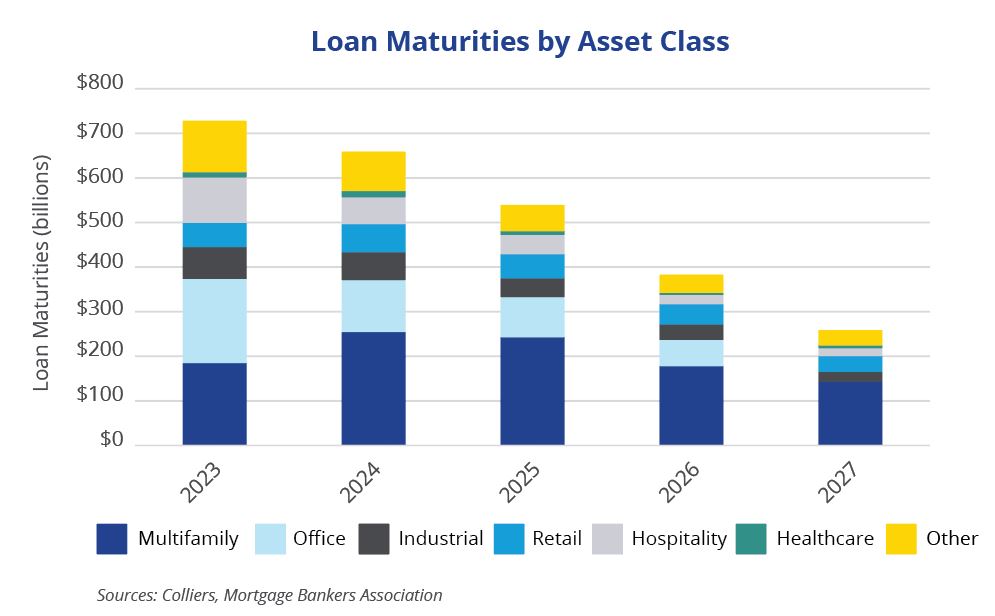

- Multifamily has the largest share of maturities over this period, topping $1 trillion.

- Nearly half of all loan maturities are on bank balance sheets through 2027.

- More than $700 billion in loan maturities is coming due this year, with multifamily and office facing the largest share.

There is a wave of maturities coming. The Mortgage Bankers Association (MBA) estimates $2.6 trillion of loan maturities through 2027. Multifamily accounts for 38% of those loans. Overall, multifamily loan maturities (with any maturity date) amount to $1.98 trillion per the MBA’s data estimates. In the near term, the asset classes facing the most significant maturity wall are hospitality and office. Between 2023 and 2024, 54% of hospitality loans are expected to mature, while 40.9% of office loans will. More than half of these loans are estimated to be on bank balance sheets.

On the surface, this looks problematic. However, banks and other lenders are willing to renew or extend loans as long as they meet coverage ratios. Borrowers who had interest rate swaps are well in the money on them and able to work with lenders on rate buydowns. Ultimately, this will buy time, smooth out maturities, and push some loans into the future. Interest rates or Federal Reserve support are not expected to be anything akin to the post-Global Financial Crisis. Debt is available, despite the recent volatility in the banking sector. Banks are currently challenged by a lack of loan churn. Borrowers are not refinancing out of loans early, as they had been in recent years, keeping loans on banks’ books.

The middle markets are still active, particularly between banks with longstanding relationships with borrowers. Life companies are fighting to win deals and need to put capital to work. Generally, the large loan space is more restrained. Local and regional banks are not stepping in and filling this void. Risks of execution increase as more banks participate. Today, the certainty of a close is imperative to borrowers.

Aaron Jodka

Aaron Jodka

Nicole Larson

Nicole Larson