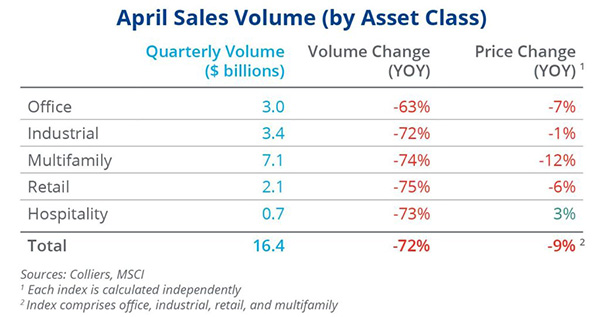

- At $16.4 billion, April sales volume was the weakest since April/May of 2020.

- Overall volume is down 72% from year-ago levels. However, April 2022 marked the strongest April ever.

- The RCA CPPI National All-Property Index continues to show a pricing reset at an increasing rate.

- All asset classes, save for hospitality, have posted declines on an annual basis.

- Multifamily volume, still the strongest asset class, is returning to a more normalized share of total volume at 34% year-to-date.

Office

Office volume totaling $3 billion is the weakest monthly showing since April 2010. That said, CBD volume topped $1 billion after three straight months of failing to cross that threshold.

The most significant deals of the month included the $530.9 million sale of Liberty Crossing I and II in McLean, VA. The United States purchased these assets, which house intelligence agencies. In addition, Mack-Cali sold Harborside 1, 2, and 3 in Jersey City, NJ, for $420 million. The largest single-asset transaction was the recapitalization of 15 Necco Street, Boston, an under-construction life sciences building valued at $1,061 per square foot.

Industrial

Industrial sales activity has slowed, with no major portfolio activity in April. Overall volume of $3.4 billion is reminiscent of April and May 2020 levels.

The largest sale of the month was the 350,000-square-foot Terminal Logistics Center in Queens, NY. A joint venture of Goldman Sachs and Triangle Equities acquired the property for $136 million, or $389 per square foot. Other major deals took place in Glendale, AZ, Las Vegas, NV, and Kentucky.

Multifamily

Multifamily volume of $7.1 billion is similar to 2013 levels. This asset class accounted for more than 40% of all volume in 2021 and 2022 but has reverted to more normalized, pre-pandemic levels of 34%.

The month’s largest deal was the Greystone and Harmony Housing sale of an 89-property affordable housing portfolio to a Michaels Organization, Goldman Sachs, and Community Development Trust joint venture for $1.2 billion. Other large deals took place in Boston and New York.

Retail

Retail activity equaling $2.1 billion is akin to April through August 2020 levels. There were no major portfolios or entity-level transactions to propel sales volume.

Tighter financing generally limited large-scale transactions, with the largest deals coming in at $71 million. These included The Shops at Wiregrass in Wesley Chapel, FL, a 474,000-square-foot lifestyle center, and Riverhead Center in Riverhead, NY, a 350,000-square-foot power center. Other sizable deals were in U.S. growth corridors such as Virginia, Georgia, and Florida.

Hospitality

Hospitality investment sales volume failed to top $1 billion in the month for the first time since 2020. A lack of portfolio deals put a lid on sales volume.

The largest deal of the month was the 575-room JW Marriott Starr Pass Resort and Spa in Tucson, AZ. Fortress sold the property to SW Value Partners for $110 million, or $191,300 per key. The 147-room Williamsburg Hotel in Brooklyn, NY, traded to Quadrum Global for $96 million, or $653,000 per key. The investment management and advisory group plans to rename the property. All other reported sales were sub-$30 million in April.

Aaron Jodka

Aaron Jodka

Nicole Larson

Nicole Larson