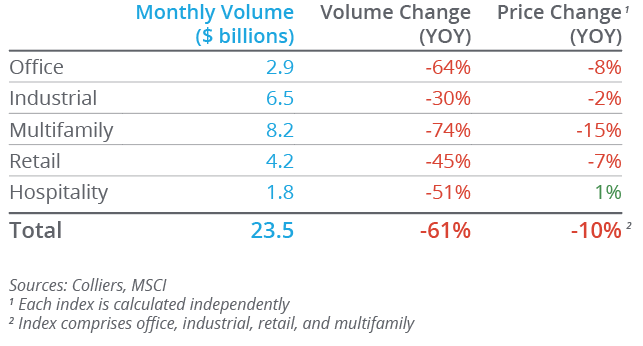

- Unsurprisingly, year-over-year comparisons were weak in August, with volume down 61%.

- On the bright side, volume was up 20% month-over-month after a sizeable June to July drop-off.

- Deals above $100 million are becoming more scarce, though numerous multifamily trades topped that mark in August.

- Sale-leaseback activity is gaining traction, providing additional liquidity in the industrial and retail asset classes.

- At its September meeting, the Fed’s announcement to hold rates and broadcast fewer reductions in 2024 may get some sellers off the sidelines.

Office

Investors poured $2.9 billion into the office market in August, a slight uptick from July’s lows. Of all the asset classes, office remains the most out of favor.

Deals north of $100 million are becoming less common. Three sales in August topped that total, led by the 400,000-square-foot Medtronic Campus in Lafayette, CO, for $188 million, or $465 per square foot. This property is newly built, with a lease running through August 2043. In addition, the 220,000-square-foot Pen Factory in Santa Monica, CA, traded for $166 million, or $754 per square foot.

Industrial

Industrial volume totaling $6.5 billion was up 21% month-over-month. Compared to last year’s sales, volume is off just 30%.

The month’s largest deal was the $1 billion portfolio sale to Westcore Properties from BentallGreenOak and MEPT. The 3.5 million-square-foot portfolio in the Inland Empire marks one of the few $1 billion deals in 2023. Also, Big Lots! sold its Apple Valley, CA, distribution center and 14 retail properties to Blue Owl Capital in a sale-leaseback.

Multifamily

Multifamily volume expanded 21% compared to July, with $8.2 billion trading in August. It continues to lead all asset classes in volume.

Multiple trades topped $100 million in August, revealing continued liquidity in the multifamily market. The largest deal was a six-property portfolio in Massachusetts, where Bridge Investment Group acquired 1,722 units from Harbor Group International for $372 million. Other large trades took place in New York; Chicago; Phoenix; Bethesda, MD; Duluth, GA; Redmond, WA; and Ashburn, VA.

Retail

Retail volume grew the most of any asset class in August, up 36% compared to July. With $4.2 billion traded, it marks one of the year’s strongest months.

Regency Centers closed on its acquisition of Urstadt Biddle Properties, bringing 72 properties to its portfolio. The 5.3 million square feet of retail space in the Tri-State region was valued at $1.4 billion. Also trading in the month was the 545,000-square-foot Stonebridge at Potomac Town Center in Woodbridge, VA. Kimco acquired the asset for $172.5 million, or $316 per square foot. No other deals topped $100 million.

Hospitality

Hospitality volume increased 15% month-over-month to $1.8 billion. Volume has trended around $2 billion per month this year.

In one of the larger single-asset hospitality trades in recent months, QIA acquired the 631-room Park Lane Hotel in New York City from a joint venture for $622.9 million, or nearly $1 million per key. Also topping $100 million in the city, the leasehold of Gramercy Park, which sold to MCR for $179.8 million, or nearly $1 million per key. Recent changes to short-term rentals in New York have resulted in a pop to RevPAR.

Aaron Jodka

Aaron Jodka

Nicole Larson

Nicole Larson